ChopChop hopes to make a dent, and more

By Karamjit Singh February 22, 2013

- Digital loyalty card to help merchants build relationship with customers

- Looking to enhance the product across different platforms, including POS

HAVING too much time can be both a good and bad thing. It depends on what one does with it. For Aaron Hee, the 18 months he was down with a medical condition from early 2010 afforded the accounting graduate time to reflect on life and then to challenge himself to live a life of purpose.

It was his year of discovery.

That sense of purpose, he realized, would not be attained by building a safe career in the corporate world. He needed to do more.

“I wanted to make a dent in the universe,” is how he describes his motivation to become an entrepreneur.

But first he made a dent in his parents’ savings. Having studied overseas on a scholarship, he needed to repay the bond he was breaking.

“I told my mum I needed to raise some money to repay my bond. She asked me how I was going to do that and I asked if she and dad could help,” he says.

And that was that. Most entrepreneurs start their journey by raising money from friends and family to fuel the early days of the dream, but Hee used the money to repay his scholarship.

But at least he knew by then, circa June 2011, what it was he wanted to do. Together with his friends from university, Aven Cheong and Jermaine Cheah, both technical co-founders, the trio decided that their path to opportunity lay in helping merchants to retain customers with the mobile phone as the tool to enable this. ChopChop was born.

“It is a simple idea,” admits Hee. But nonetheless, a powerful value proposition to merchants, most of whom will admit that they have no clue who their customers are, and even worse, who their best customers are and how to build a relationship with them.

ChopChop’s own challenge was that none of the young trio had any retail experience. But they were inspired by a digital loyalty start-up in the United States, getpunchd.com, which was acquired by Google in lightning speed, within four months.

“Actually they were acquired on the very day that we were brainstorming about what to do next and we kind of said, ‘Hey, that’s an interesting space to get into’,” Hee recalls.

For a month prior to that brainstorm, the trio thought they were already on to their big idea, social payments for merchants, but came up against Bank Negara Malaysia regulations.

For a month prior to that brainstorm, the trio thought they were already on to their big idea, social payments for merchants, but came up against Bank Negara Malaysia regulations.

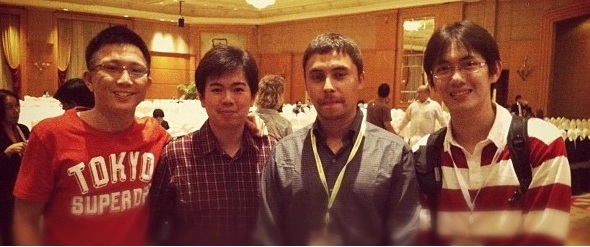

“We had not quite factored that in,” admits Hee (pic, far left, and his team posing with YouTube co-founder Jawed Karim, second from right).

But having just put themselves into the entrepreneurship game, they were undeterred and started looking for something else they could add value to. It just happened to be on the day Google made its acquisition, July 11, 2011.

The change in direction was actually not that dramatic as they were still in the merchant space, just not looking at payments anymore. Being in the loyalty space also made sense as Hee notes that most merchants simply don’t know how to rise above the noise and get into the subconscious of customers to hopefully be a top-of-mind choice when the customer thinks of buying something that the merchant happens to be offering.

“There are just too many channels out there, especially in social media, and most merchants and brands just don’t know how to best direct their marketing efforts.

“And that is where ChopChop comes in with our digital wallet, which is a combination of voucher, coupon and pre-paid card,” says Hee, who is the salesman in the team, though he prefers to call himself the ‘Hustler,’ which means working hard and being relentless in making the sale.

ChopChop now has around 100 merchants and brands that are either trying out the service or already paying for it. Not sharing how many are paying customers, Hee says the target is to get 50% of the base to start paying RM149 (US$48) per month.

To be sure, this is not an easy space to be in. There are more established companies operating out of Singapore playing in the same space which have market traction with regional retail brands.

So how will the bootstrapped trio show investors (they are looking to raise funds now) that they have the product and the execution ability to compete and win the trust of merchants?

To Hee, this is just part of the challenge of being an entrepreneur. “We have to show them market traction, rising revenue, technical capability to improve our product and convince them that we can execute on the game plan,” he says.

As for now, in terms of product, they are working on strengthening the core technology and enhancing the all important user experience. They are also moving into native platforms in the coming months.

“We are currently working with a POS (point-of-sales) vendor to integrate our product. The QR codes will be printed onto the receipt and this will make it easier for customers to get their virtual chops anytime so long as the receipt is with them -- instead of the current method where chops have to be collected at the point of transaction.

“As for the merchants, this will ease their operations as they don't have to attend anymore to physically awarding the chops,” he says.

“Like it or not, as much as we are in a different game, we always get compared with the group-buying and digital vouchering players. But our partner merchants understand our value proposition and the quality of customer service and interaction that we deliver.

By focusing intensely on creating sustainable value mixed with perseverance and luck, we hope to make a difference,” he adds.

The challenge is to convince investors now.

For more technology news and the latest updates, follow @dnewsasia on Twitter or Like us on Facebook.