Proposed mega merger of equals between Axiata & Telenor could create KL headquartered global champion

By Digital News Asia May 6, 2019

- Preliminary shareholding before due diligence sees Telenor owning 56.5%, Axiata 43.5%

- Celcom & Digi merger will create largest telco in Malaysia with over 20mil subscribers

[Article updated including with new charts.]

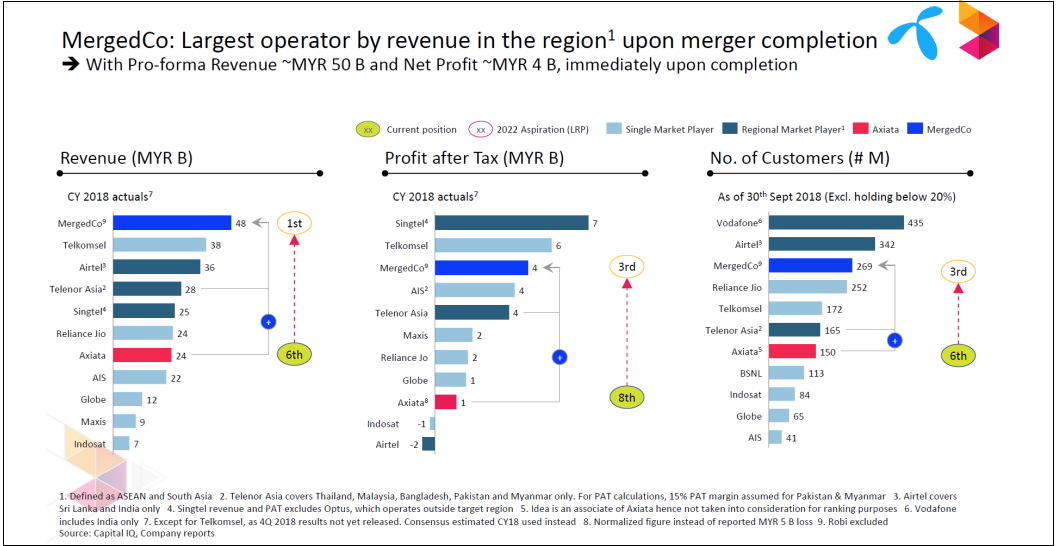

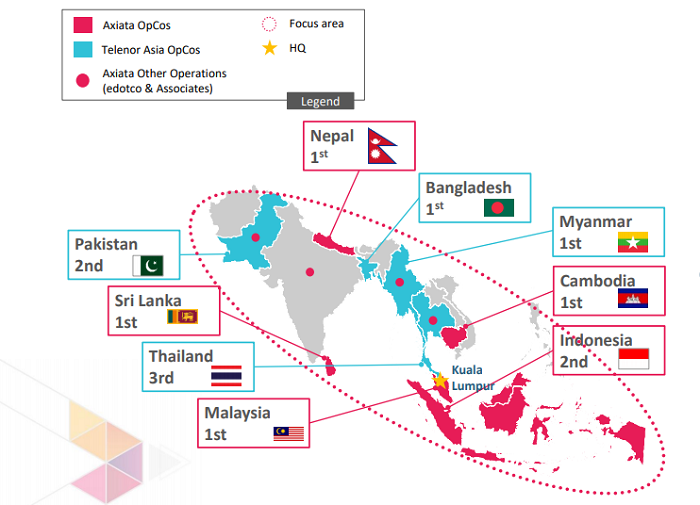

IN THE biggest news to hit the telco world in the past year, Malaysia-based Axiata Group Bhd and Norway-based Telenor ASA have announced that they are in discussions to establish a new merged global entity by combining Axiata and Telenor’s Asian operations within both their Asean and South Asia markets. If an agreement is reached, the merger will allow Axiata and Telenor to claim the number one positions in six out of the nine countries that they operate in.

The two telcos have also stated their stipulated intention to list the MergedCo on Bursa Malaysia and another major international exchange within the next few years.

The main shareholders of Axiata are national soveriegn fund, Khazanah Nasional Bhd, also the single largest shareholder with 37.16%, with Permodalan Nasional Bhd at 18.42%, and Employees Provident Fund with 16.16%, according to Axiata.

While there is no certainty the proposed discussions will result in any binding agreement or obligations on the two parties to proceed with any acquisition, merger or divestment, Axiata says it has opted for an early voluntary disclosure to provide transparency to its shareholders as discussions progress.

Those discussions involve several issues and matters that have yet to be determined and agreed upon, including due diligence involving several entities across nine countries.

Nonetheless, the potential of such a merger has Axiata’s senior brass clearly excited with Axiata president and group chief executive officer, Jamaludin Ibrahim, declaring: “We are on the verge of making new history! This proposed mega merger of equals would create a global champion, headquartered right here in Malaysia.”

Jamaludin adds that the merged company will actively support the Malaysian government’s aspirations to attract world-class organisations, and lead in fueling innovation and developing global talent in Malaysia.

“There is a lot of work ahead of us to conclude this deal, but I am excited as this merger would be unparalleled in the history of telecom in Asia and corporate Malaysia."

Telenore said in a statement, “By uniting two strong organizations with complementary footprints and a merger of equals spirit, there will be attractive opportunities to capture substantial synergies, preliminary estimated at around US$5 billion.”

Both telcos have a presence in Malaysia, Thailand, Myanmar, Bangladesh and Pakistan. In Bangaldesh, where Axiata has a stake in Robi Axiata Ltd, post merger, Robi will continue to be operated independently as it is unlikely it will receive regulatory approval for the merger where Telenor's GrameenPhone is the number one operator, and the merger of the two players will give them a combined 80% share of the market. Axiata also operates in five countries where Telenor is not present: India, Sri Lanka, Nepal, Cambodia and Indonesia. Post merger, in a chart provided to the media (see main chart above) the two telcos will be the top player in Malaysia, Nepal, Cambodia, Myanmar, Sri Lanka and Bangladesh. They will be the number two player in Indonesia and Pakistan and the third largest player in Thailand.

Globally, the telecommunications industry has seen significant shifts in terms of industry structure whereby, the distinction between fixed and wireless services is blurring towards convergence. At the same time, market competition continues to intensify beyond traditional players but also from strong internet-based services and content providers. Technology advancement and digital service adoption have surged exponentially, triggering robust opportunities but also complexities across the consumer, home, enterprise and Internet of Things (IoT) market segments.

In parallel, prices for products and services have steadily fallen in the past few years while capital expenditure especially on network, quality coverage and advanced technology continue to rise in an effort to meet the ever-increasing customer demand for data. In this highly competitive environment, to innovate, deliver affordable and competitive services as well as improve profitability, the ability to scale rapidly, deliver efficiencies and deploy global best practices become increasingly crucial.

The proposed merger aims to enable the new merged entity (MergedCo) to bring together Axiata and Telenor’s Asian operations unique combination of scale, competencies and vast experiences in leading and managing emerging and frontier markets. As a global champion, the MergedCo will include a Malaysian champion, a global TowerCo (the Axiata owned, edotco), and the largest innovation center in this region, all to be headquartered in Malaysia.

Among the key highlights from the proposed merger are:

Global champion

The international MergedCo on merger will have proforma revenue of more than US$12 billion (RM50 billion) and Earnings Before Interest, Taxes, Depreciation & Amortisation (Ebitda) of more than US$4.8 billion (RM20 billion) and controlled operating subsidiaries in nine countries with a combined total population of more than one billion people and 300 million customers. In an analysis by Reuters, assuming the newly listed entity were to trade at seven times projected EBITDA, a little higher than Telenor’s 6.5 times multiple as per Refinitiv data, the enterprise would be worth nearly US$39 billion (RM161.6 billion).

With its unique portfolio, the MergedCo will be one of the largest telecommunications groups in the region in terms of value, revenue and profit, and with a strengthened balance sheet to support aggressive growth and expansion in the Consumer, Home, Enterprise and IoT/Artificial Intelligence market segments.

Additionally, the portfolio of controlled teleco operations shall comprise six countries with number one positions, two countries with number two positions and one market with third position within their respective markets.

Separately, Robi Axiata Limited, a subsidiary of Axiata operating in Bangladesh shall continue to be managed independently by Axiata post completion of this proposed merger. In bringing together assets from both parties, the proposed merger has the potential to deliver up to around US$4.8 billion (RM20 billion) incremental value in synergies through consolidation of assets and organisations, economies of scale and scope, and complementary best practices of the Parties.

Malaysian champion

In addition to the pan-Asia presence, the proposed merger is intended to create a true Malaysian Champion by merging Celcom Axiata Bhd and Digi.Com Bhd, which will in turn become the largest mobile operator in Malaysia.

Global TowerCo

The proposed merger will also potentially lead to the formation of a global top five mobile infrastructure player, by combining edotco group sdn bhd, the existing Axiata TowerCo which is currently the 13th largest TowerCo globally, and Telenor’s Asian tower assets.

Innovation centre

Lastly, the opportunity will establish the largest innovation center in the region to include IoT and 5G, as well as a become a global talent hub.

While the shareholding will reflect the relative asset valuation, resulting in Telenor being the majority shareholder of the global MergedCo anticipated to own 56.5% and Axiata will own 43.5%, both parties acknowledging that this is preliminary subject to adjustments and due diligence. This proposed transaction will be based on the principle of merger of equals between Axiata and Telenor. The intention is to create a commercial Board governed company, combining the best-in-class talents, capabilities and culture of Axiata and Telenor in the MergedCo group.

Telenor and Axiata will work in good faith towards a binding agreement in relation to the proposed merger by end of quarter three, 2019 following the due diligence exercise. Should the parties agree to sign an agreement, the eventual transaction will be subject to approvals by shareholders and regulatory bodies, amongst others.

“With the dynamic combination of breadth, experience and knowledge of Asia’s two regional champions - Axiata and Telenor Asia – we bring the best of Asian and European cultures. Leveraging on the synergies of our combined assets, organisations, talents, best practices, scale and financial firepower, we would create the largest telecom operator in the region. Additionally, we would also intend to create the largest mobile operator in Malaysia, one of the largest TowerCos in the world and the largest Innovation Center in the Region,” says Jamaludin.

Morgan Stanley is acting as International Financial Advisor to Axiata on the proposed merger.

Related Stories :