yufin announces small merchant sign-ups in Philippines

By Digital News Asia June 28, 2022

- Helps SMEs manage cash, credit transactions via mobile devices

- Claimed that SMEs can can increase monthly profits by up to 50%

yufin, a merchant platform that enables underserved small medium enterprises (SMEs) in emerging markets to access the digital economy, announced it has signed over 2,500 merchant partners in Mindanao, Philippines since its launch in end-May this year.

yufin, a merchant platform that enables underserved small medium enterprises (SMEs) in emerging markets to access the digital economy, announced it has signed over 2,500 merchant partners in Mindanao, Philippines since its launch in end-May this year.

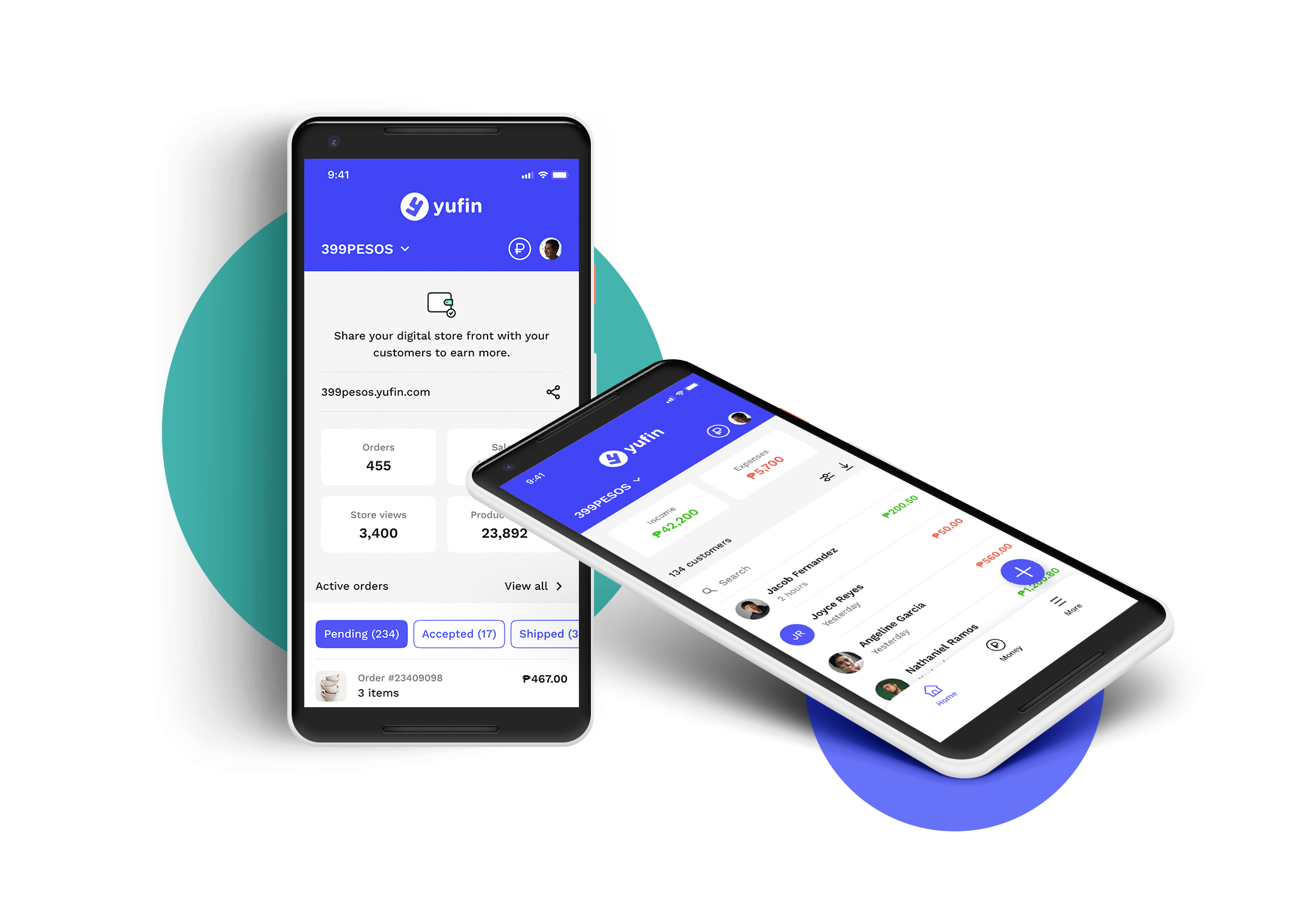

In a statement, the company said its easy-to-use yufin app helps SME merchants manage their cash and credit transactions over mobile phone and provides a technology platform for a suite of services to help millions grow their businesses.

SMEs such as sari-sari stores are often one-person enterprises operated by women, Yufin noted.

This makes up a significant proportion of consumption in the Philippines, the company said, adding that less than 20% of these SMEs have bank accounts while 80% have access to smartphones.

Shubhrendu Khoche, chief strategy and product officer at yufin, said small business entrepreneurs are at the heart of communities and distribution networks in the Philippines but they are often cash and paper-based and unbanked.

“This massively limits their potential to grow. The yufin app which is easy to use and available in Tagalog, Cebuano and English helps these micro-entrepreneurs manage their cash and credit transactions from the get-go as well as provides them a gateway to services that will help them grow their businesses,” he said.

The company said its yufin app enables merchants to accept digital payments, sell online on digital stores, order from business-to-business (B2B) marketplaces and access better loans.

Built by Miti Ventures, yufin has secured early-stage funding of approximately US$1 million (RM4.4 million) from angel and institutional investors.

“The company exists to help underserved small businesses grow bigger by saving them time, helping them get online, accept digital payments, sell more and get access to cheaper capital,” said Kurt Weiss, chief executive officer at yufin.

It is estimated that these small entrepreneurs can increase monthly profits by up to 50% within the first five years of using the platform, Weiss claimed.

“We are delighted by the initial response to yufin and to welcome our first 2,500 merchants to the yufin community.

“The potential to benefit millions of small and micro-entrepreneurs in the Philippines, and in other emerging markets in addition to raising income levels and increasing financial inclusion is huge,” he added.

Related Stories :