Regulators need to look at impact of digital content, streaming

By Gabey Goh April 29, 2015

- Regulations in Singapore restraining local players from engaging and competing

- Content consumption patterns shifting away from TV and PCs to mobile

SINGAPORE’S regulators need to look at the impact of digital content and what it means for television in the country, especially with regards to domestic players, according to Keith Budge, Ooyala Inc vice president of Asia Pacific and Japan.

“The reality is that by some estimates, there are some 200,000 people watching Netflix via VPN (virtual private network) services. People are going to watch what they want and will do what they need to, to get access to that content.

“But the regulatory environment in Singapore is actually restraining local players from engaging and competing in this market.

“I don’t know the answer to this, but I do know that this is a challenge that regulators need to grapple with as the media industry continues its shift,” he told Digital News Asia (DNA) in Singapore.

Founded in 2007, Ooyala provides online video technology products and services, and counts brands such as the Times of India, Disney, News Corp, ESPN, NBC Universal, Bloomberg Television, and the Telegraph Media Group as customers.

In 2014, it was acquired by Australian telecommunications company Telstra for US$270 million. It claims 135 million unique users in 240 countries.

Budge said that one of the issues surrounding content is that it is either something you own or have to buy the rights to it for distribution.

“If you own it, you can do anything with it, but if you have to buy the rights to it, you have to go to the studios or content owners to get the right to stream content.

“The old content contracts don’t include the rights to stream, so a lot of the shift happening in the industry is not just around technology but around streaming rights,” he said.

Budge noted that the bigger content players have already started moving into the streaming space. For example, HBO announced last year that it would be launching its own streaming-only service, with more studios expressing similar intentions.

The service, HBO Now, was launched in early April in time for the new season of popular series Game of Thrones.

“So instead of just making content available through cable operators in various markets, they are making it available directly available to consumers,” Budge said.

It is not just established players that are venturing into the content streaming space, with startups such as Catch Group’s iflix and Singtel’s Hooq entering into the mix, joining slightly older players such as Malaysian media giant Media Prima’s tonton.

“While cable television is regulated in-country with a certain number of licences granted by regulators … you can’t really regulate online streaming the same way,” said Budge.

“So you’re seeing all these new content startups coming up that are crossing borders and regulatory barriers, on the way to creating a whole new business,” he said.

Budge said that Media Prima is an Ooyala customer, and his company recently helped tonton migrate to a more robust technology platform to deliver its content.

“tonton is a really interesting company as it has really attractive content in terms of local original creations. Everyone likes really big global content like Game of Thrones, but what really wins is sports and local content,” he argued.

Show me the money

Despite being an industry in flux, the fact remains that people need to make money out of providing video content.

Despite being an industry in flux, the fact remains that people need to make money out of providing video content.

“Unless you’re a government service, in which case that’s not an issue. But the big issue is around how content players can provide good service and make money doing so,” said Budge (pic).

“The dynamics around doing that either via subscriptions or advertising hinges on understanding users. If you’re providing video content, you need to provide users with the content they want and recommend them the content they’d most likely want.

“The common trend is around ‘how do we best understand our users and what they want’ and by doing that, we can then provide them the content they want and somehow make money doing so via fees or advertising revenue,” he added.

The beauty of digital delivery is the ability to tap into a more granular level of analytics to understand individual users across an array of endpoint devices, in contrast to the traditional model of leveraging a single television screen to market to an entire household.

But even with the availability of good analytics, Budge noted that the challenge becomes data protection, privacy and management, with the need to maintain confidentiality, as well as having systems in place that would both enable insight but is compliant with local regulations.

“This is part of our job as the platform provider,” he said.

Ooyala recently released the latest version of its video analytics platform – Ooyala IQ – which provides the ability to analyse video performance and audience behaviour, including multi-dimensional filtering by device, operating system, browser, country, state, player, and traffic source.

The analytics engine is intended to maximise video monetisation across all screens through real-time actionable insights that help providers better understand and target audiences, based on actual usage patterns, the company said.

It was designed with an open framework, allowing for deeper integration of many business-critical data types, whether from Ooyala or from the broader media ecosystem, that can be used to maximise performance, engagement and revenue, Ooyala claimed.

These include ad performance and ‘viewability’ metrics, as well as quality of service metrics used to gauge the overall health of video streams, it added.

The answer is mobile

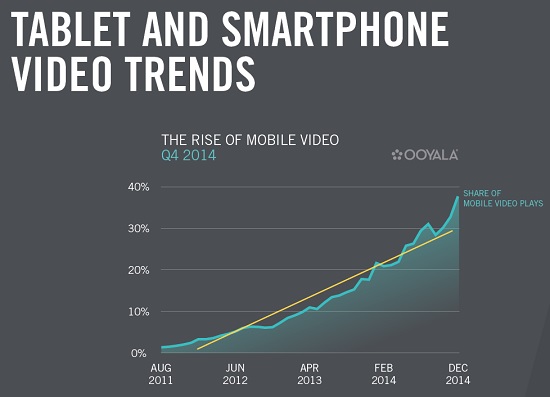

The company’s Global Video Index Q4 2014 report certainly highlights the continuing shift of content consumption patterns away from televisions and PCs to mobile devices and tablets – and the urgency for content providers to remonetise their delivery channels.

According to its findings, video views on smartphones and tablets now make up 30% of all video plays, a 200% increase from the same period in 2013.

News and sports videos are the most popular types for mobile viewing, with sporting events in July, August, and September such as the World Cup, Wimbledon, Tour de France, British Open, US PGA Championship, US Open Tennis, and the Ryder Cup, giving mobile video traffic an extra boost.

Other findings from the report include:

- Tablet users watched long-form video for 70% of the time they spent viewing on their device. That’s more than for any other device.

- Tablets also lead in the percentage of time spent watching content from 30-60 minutes long.

- PCs led all devices in the number of ad impressions for broadcasters and publishers, followed by mobile phones. In this category, mobile phones continue to gain ground and take share from PCs.

- PCs had the highest fill rates of all devices across all segments measured, reaching 80% for broadcasters and 69% for publishers.

- Broadcasters see the highest rate of ad completions (87%), followed by publishers (71%).

- Tablets have the highest ad completion rates for broadcasters, followed by PCs and mobile phones.

To read the full report [PDF], click here.

Related Stories:

Media habits: Enter the binge-watching Malaysians

TM unfazed by increasing VOD competition

Patrick Grove’s South-East Asian gamble on VOD

Singtel, Sony Pictures and Warner Bros to roll out Netflix-type service

Illegal Game of Thrones downloads a major driver of increasing piracy

For more technology news and the latest updates, follow us on Twitter, LinkedIn or Like us on Facebook.