NTT: Malaysia as data center hub has all the ingredients bar connectivity costs

By Dzof Azmi June 15, 2021

- Factors considered by key players – reliability, quality, diversity, price

- NTT Ltd expects their 5th data center to be 40% full by June 2021

"I think Malaysian data centers are already the cheapest in the region," pointed out Henrick Choo (pic below), CEO of NTT Ltd Malaysia. "(But) I think we lose out a bit when it comes to international connectivity."

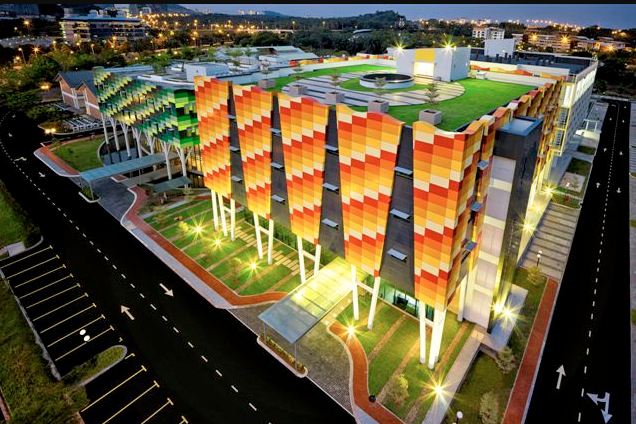

Choo was speaking in conjunction with the launch of Cyberjaya 5 (CBJ5) last February, NTT Ltd's fifth data center in Malaysia. NTT in Malaysia has been successfully operating the Cyberjaya campus data centre for over 24 years, and the new block adds more than a hundred thousand square feet to their complex.

Choo was speaking in conjunction with the launch of Cyberjaya 5 (CBJ5) last February, NTT Ltd's fifth data center in Malaysia. NTT in Malaysia has been successfully operating the Cyberjaya campus data centre for over 24 years, and the new block adds more than a hundred thousand square feet to their complex.

Despite the cost advantage Malaysia offers, Singapore is still considered the place to go to for hyperscalers and high-end enterprises. "I think one of the key drivers is connectivity which is very, very cheap in Singapore," explained Choo, pointing out that all the subsea Internet cables in the region run through Singapore.

In fact, Malaysia's location can be advantageous if properly utilised. "Malaysia is centrally located, so we have a good chance of success if we do it right," he said. "Whether Thailand needs to reach Singapore, or Indonesia needs to connect to China, they need to go through us."

Meanwhile, he says other companies look to other countries for different advantages, for example to Indonesia to exploit their large market size, and they may amend their strategy over time.

"If you observe the hyperscalar movement, they move to Singapore first, then they move to Indonesia before coming here and then move to Thailand," he said.

Government push to attract cloud providers

NTT Ltd's decision to construct additional capacity was not taken lightly. Choo said that the decision to invest in the new block was made 18 months ago, while the 10 acre site was purchased 24 months ago.

CBJ5 spans 107,000 square feet and is designed for a critical IT load of 6.5MW (approximately 4,000 households worth of electricity).

NTT Ltd made a point to say that the data centre complies with the Risk Management in Technology (RMiT) guidelines set by Bank Negara Malaysia. "RMIT is pushing banks to move to higher quality data centers. We see a lot of requests, a lot of demand from that perspective," said Choo.

"We also foresee strong demand from the (Malaysian) government pushing for hyperscalers to come to Malaysia," he continued, referring to Malaysia's MyDigital target to get between RM12 billion and RM15 billion worth of investment by cloud service providers over the next five years. The government is playing its part as a cloud user by shifting towards a cloud first approach and going paperless while setting a specific target of achieving 80% cloud storage by end 2022.

However, despite NTT’s strong data centre presence in Malaysia the company was not picked by the Malaysian government to be one of the four anchor cloud service providers to the government where, specifically, conditional permission was given to four CSP (content service providers) – Microsoft Corp, Google Inc, Amazon Inc and Telekom Malaysia Bhd – to build and manage hyper-scale data centres and cloud services in the country.

Important element for a nation's infrastructure

All countries in the region will continue to try and offer the best in terms of data centres to attract FDI. "The reliability, the quality, the diversity, the price are all important to the big players," said Choo.

Arguably now there is a window of opportunity because the Singaporean stopped the construction of new data centres. "But I heard they are going to open up again by the end of this year," shared Choo.

However, Choo quickly added that a vibrant data centre ecosystem helps local players as well, especially with the pandemic accelerating demand and overall digital transformation.

"Data centers will be one of the important elements for infrastructure, and we foresee that with the launch of the CBJ5 the uptick rates will be actually quite promising," said Choo.

The hope is that they will be able to fill up to 40 percent of the data floor by June - a mere four months after opening of the new block. Choo was happy to encourage interested customers to reach out to them to better understand what they have to offer. "We understand there's no one size fits all," he said, "That's why we design bespoke solutions that tailor to our client's organization's goals and requirements."

- With Malaysia a strategic hub for its submarine cables, NTT launches fifth data centre in Cyberjaya

- Industry players want a piece of the MyDigital data centre pie

- NTT Ltd to build 5th data centre in Malaysia to support digital ecosystem