Malaysia investors among most vulnerable in Asia: Manulife survey

By Digital News Asia September 3, 2014

- Review portfolio less frequently and invest in fewer financial products than Asian peers

- Low financial literacy, low online usage leave most reliant on family and friends’ advice

INVESTORS in Malaysia are among Asia’s most vulnerable in terms of their investment experience and the advice they draw on, according to the Manulife Investor Sentiment Index for the second quarter of 2014.

According to the survey’s findings, Malaysia investors have less investment experience given their lower investment ownership rates, and the fact that they review their portfolios less frequently and lack asset diversification, compared with other Asian markets, Manulife Holdings said in a statement.

On average, they own only two to three investment products, compared with five products on average for the other Asia investors surveyed, the Canadian-based financial services group said.

Malaysia investors review their portfolios less frequently than other investors in Asia, with only 7% reviewing them once per month compared with 20% region-wide, and only 15% reviewing them at least once every three months compared with 39% on average, according to the second quarter figures.

READ ALSO: Equity crowdfunding: The good, and not so good

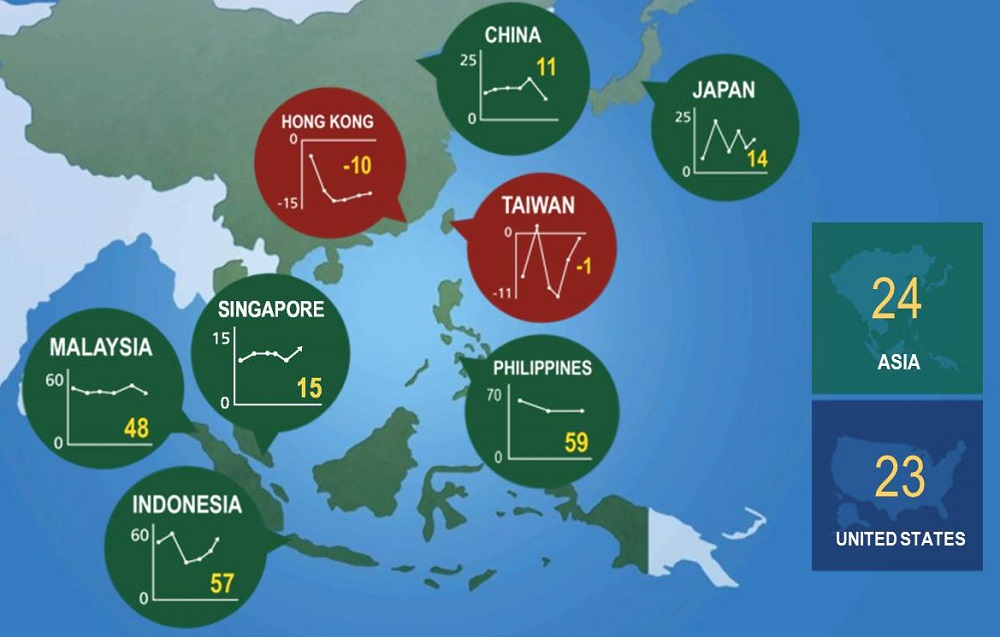

Manulife’s Investor Sentiment Index in Asia is a quarterly, proprietary survey measuring and tracking investors’ views across eight markets in the region on their attitudes towards key asset classes and related issues.

It is based on 500 online interviews in the Hong Kong, China, Taiwan, Japan, and Singapore markets. In Malaysia, Indonesia and the Philippines, it is conducted face-to-face.

Respondents are middle class to affluent investors, aged 25 years and above who are the primary decision maker of financial matters in the household and currently have investment products.

Advice from family and friends

Malaysia investors also show little inclination to address their shortage of experience by reference to more qualified sources of investment advice, Manulife Holdings said.

Only 8% of Malaysia investors use financial planners, against an Asian average of 25% and a US average of 50%.

Malaysia investors are also not taking advantage of online sources of investment information and advice. Only 9% rely on or refer to digital sources for financial planning, the lowest level in the survey, and well below the regional average of 31%.

Instead of using expert or online input to guide their investment decisions, Malaysia investors appear to rely overwhelmingly on family and friends, with 73% citing this as their source of investment advice, one of the highest levels in the region, compared with 44% in Hong Kong, 39% in Singapore, or 25% in Japan.

“Investors need to be prudent in their decisions and to heed the wisdom of others, but this is not what we are seeing in Malaysia,” said Mark O’Dell, group chief executive officer of Manulife Holdings.

“Malaysia investors seem not only to be most content to draw only on each other's advice and experience, but also fail to draw on more up-to-date and better qualified sources of investment insights when these are available.

“We can see the consequences in their relatively small average number of investment holdings, and in their infrequent portfolio reviews. These are habits that could easily be changed, but until they are, Malaysia investors remain vulnerable and highly exposed to market shifts and poor investment choices,” he claimed.

Low financial literacy; high self-confidence

Malaysia investors also exhibit a relatively low level of financial literacy, according to Manulife Holdings, which operates as John Hancock in the United States.

Only 2% of Malaysia investors answered all five questions taken from an international financial literacy benchmark quiz correctly, compared with 20% of Singapore investors and 11% of all investors surveyed.

The quiz was adapted from the Investor Education Foundation Financial Literacy Test, by the United States Financial Industry Regulatory Authority.

Moreover, Malaysia investors exhibit overconfidence in their own financial literacy, with one-in-five thinking their financial literacy is high. They also appear confident about their financial planning abilities, with 72% of the two-thirds who do not seek advice from industry staff saying they don’t seek professional advice simply because they “do not need it.”

However, their apparent self-confidence may not be as sure as it seems. The survey shows that of the two-thirds of those who don't seek professional advice, only 27% feel they can manage their own investments, compared with an average of 36% in China, 41% in Indonesia, and 53% in the Philippines.

They also seem to show some recognition of the limits of their financial knowledge, with nearly 70% saying they need more education on retirement planning.

“The views and habits of Malaysia investors, and their choices of both investment products and sources of investment advice, may be considered contradictory or puzzling – but luckily, improvements are readily made,” said O’Dell.

“Investors can easily increase their use of financial planners and online investment resources. They can also take the basic prudential step of diversifying their portfolios and reviewing them more often.

“All these options are simple common sense, but can deliver better performance straight away if implemented correctly,” he added.

Investor sentiment down

The research was drawn from the Manulife Investor Sentiment Index survey for Malaysia in the second quarter of 2014, which also showed that investor sentiment was weaker at +48 (down 10 from the first quarter), but in line with Malaysia investor sentiment throughout 2013 and still one of the most optimistic of all surveyed markets.

The Asia average during the second quarter was +24, unchanged on the quarter (see chart below).

“A decline in fixed income sentiment was the key factor that drove overall investor sentiment lower in Malaysia,” said Jason Chong, chief investment officer for Manulife Asset Management Services Bhd.

“Generally, the asset class is being undermined by anticipation of rising interest rates. This has led investors to reduce their exposure to fixed income in favour of equities, which are widely expected to benefit from the ongoing global economic recovery.

“While concerns of rising interest rates have been discounted by the market to some extent, the outlook for bonds is more likely to be driven by the quantum and speed of future rate increases.

“That being said, we still see opportunities to generate recurring income on corporate credit issuances of generally short duration. Thus, we believe that careful selection of investments based on in-depth credit research is the key to generating positive returns in this environment,” Chong added.

Related Stories:

Weak VC leadership letting Asean region down: Catcha chief

Malaysian business confidence back to post-election highs: ACCA

Disrupt: 'Taking money in Malaysia would've been a mistake'

MBAN hopes for mindset shift among angel investors

For more technology news and the latest updates, follow us on Twitter, LinkedIn or Like us on Facebook.