Digital agenda driving closer CFO-CIO collaboration: EY

By Digital News Asia May 29, 2015

- 71% of CFOs report increased involvement in IT agenda in last 3yrs

- Emerging-market CFOs place greater emphasis on better data

THE relationship between the chief financial officer (CFO) and the chief information officer (CIO) is becoming closer and more collaborative, with the CFO playing a greater role in four vital IT-related activities, according to an EY global survey.

The survey covered 652 CFOs and a series of in-depth interviews with CFOs, CIOs and EY professionals, the consulting firm said in a statement.

The findings indicate that CFOs are increasingly involved in managing cybersecurity, establishing information management strategies and processes, transitioning to a digital IT function, and creating an analytics-driven organisation.

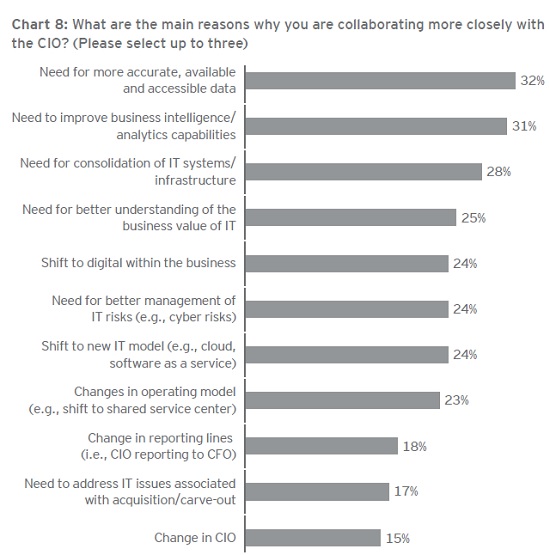

The need for better quality data and improved analytics capabilities is driving collaboration between finance executives and their IT-focused counterparts, EY said.

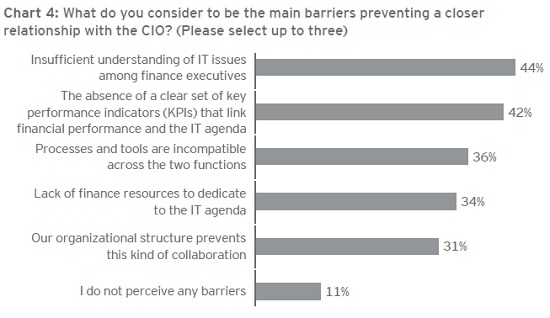

However, CFOs and finance executives state a lack of understanding of IT issues, and their prevailing view of IT as a cost centre, rather than as an asset, pose a significant challenge to the relationship.

CFOs also continue to struggle with balancing their responsibility to maintain cost discipline with more strategic ambitions, such as setting the agenda for change, EY added.

“In today’s digital economy, the financial well-being of an enterprise is dependent on the health of the CFO-CIO relationship,” said Sunny Chu, EY Asia Pacific advisory partner and analytics leader based in Singapore.

“In order to succeed, organisations must make bold technology investment decisions that are driven by corporate strategy, while managing a range of severe risks, such as cybersecurity and data privacy concerns.

“This mission-critical convergence of technology, investment strategy and risk has elevated the CFO-CIO relationship to new levels of importance,” he added.

Cybersecurity a top priority

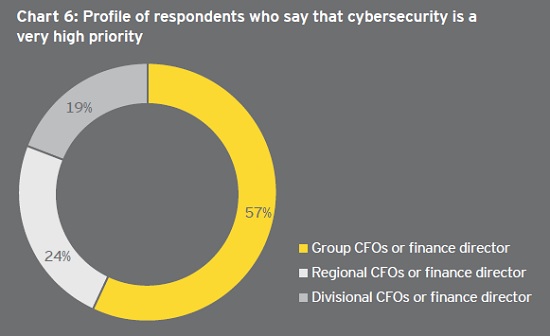

Two-thirds (66%) of the CFOs surveyed say managing cybersecurity is a high or very high priority. They are aware of the growing sophistication of attacks, and in many cases have already been victims.

“The more sophisticated attackers are looking at economic manipulation as an objective. This might involve trying to manipulate the company share price,” said EY global cybersecurity leader Ken Allan.

“Their aim may extend to devaluing the organisation to the extent that it can be acquired at a distressed price to capitalise on its recovery,” he added.

The EY survey also indicates that while most CFOs recognise the scale of the threat, they perceive that a lack of understanding of IT issues prevents them from recognising what a mature cybersecurity capability looks like, so they can invest in the right initiatives.

In fact, this lack of understanding was identified as the top obstacle to a closer working relationship with the CIO, with 44% of CFOs citing it as one of their top three barriers.

The tendency for CIOs to discuss cybersecurity issues in technical jargon, rather than business language, can also block fast decision-making and action.

However, effective cybersecurity management requires organisations to treat it as an enterprise risk management issue, rather than an IT one. Breaches are inevitable, and it is not possible to prevent every attack, or protect every asset.

Instead, the CFO should lead the board-level discussion to prioritise which assets are business-critical to protect. The CIO should take the lead in working out how to protect them, said EY.

“Cybersecurity preparation is all about understanding what the business is trying to protect. Some CFOs are trying to understand the technical detail when they shouldn’t be,” said Allan.

“CFOs should also ensure the whole organisation has a tested plan in place to ensure they are ready to respond when the inevitable breach occurs,” he added.

Analytics drives collaboration

CFOs recognise the need for improved analytics and data management capabilities to drive financial and strategic decision-making. It’s also the No 1 reason CFOs say they are working more closely with their CIO.

For now, though, the role that CFOs play is relatively limited, as only 53% say they make a significant contribution to determining where analytics can add most value to the organisation.

“There’s a huge opportunity for CFOs to be a champion for advancing the analytics agenda – not only within finance, but also, given how CFOs are involved in other parts of the organisation, for embedding it across the firm,” said EY global chief analytics officer Chris Mazzei.

Emerging market trends

The EY survey also revealed that similar to their global counterparts (61%), CFOs and CIOs in emerging markets report a closer relationship. 59% of emerging CFOs and 66% of Asia Pacific emerging market CFOs who responded to the survey stated an increase in collaboration.

While 71% emerging market CFOs (Asia Pacific emerging markets: 82%) have greater involvement in the IT function, the focus on cost and profitability still dominates.

Emerging market CFOs (68%) also shared similar sentiments with other CFOs towards cybersecurity, even as Asia Pacific emerging market CFOs placed relatively less importance in this.

Just over half (57%) of Asia Pacific emerging market CFOs consider cybersecurity and information risk management to be a high priority for their business.

At the same time, 55% of emerging market CFOs and 56% of Asia Pacific emerging market CFOs shared that determining the area where analytics provide greatest value-add to the business is a top priority.

“While the huge volume of data generated presents new opportunities, many organisations have yet been able to fully understand how they can take advantage of it to maximise business insights and returns,” said Chu.

“The need for better data and improving analytics capabilities for enhanced competitiveness are driving greater collaboration between CFOs and CIOs in emerging markets.

“However, while emerging market CFOs may experience fewer legacy system issues than those in developed markets, they face challenges that include silo processes and systems, weak governance, limited availability of data, and the variable quality of data.

“That could also explain why emerging-market CFOs place greater stress on getting better data than their developed-market peers,” he added.

Opportunity for growth

The report outlines how CFOs and CIOs can increase the effectiveness of their collaboration:

- Build finance leaders’ understanding of IT issues;

- Share responsibility for driving innovation through digital IT;

- Shift the IT operating model emphasis from capex to opex;

- Manage risk exposures of new digital technologies;

- Work as peers – despite a still-common reporting line of the CIO to the CFO;

- Make data a fourth pillar of the business, alongside people, process and technology; and

- Treat cyber-risk as part of enterprise risk management.

For more information, visit www.ey.com/cfoandcio.

Related Stories:

CFOs, finance teams failing at technology: ACCA report

CIOs: We’re being held back by other C-levels

CFO and CTO? It’s the CFTO next

CMOs: The CIO may be your best friend, says IDC

For more technology news and the latest updates, follow us on Twitter, LinkedIn or Like us on Facebook.