Can Intellectual Property be sexy, or relevant to all?

By Karamjit Singh May 12, 2015

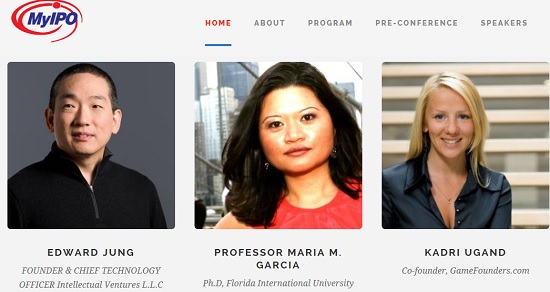

- MyIPO hosting Global Intellectual Property Valuation Conference in KL

- Asean focus, hopes to change mindset on IP

HAVING successfully held the inaugural Global Intellectual Property Valuation Conference (GIPVC) in 2013, the Intellectual Property Corporation of Malaysia (MyIPO) is again playing host to and organising the biennial conference.

GIPVC 2015, from June 8-10, aims to bring a more Asean (the Association of South-East Asian Nations) focus, with three key thrusts:

- Pivot towards a regional focus in support of Malaysia’s Asean chairmanship;

- Accelerate the ‘Ideas Economy’ by leveraging on ideas, innovation and creativity to drive economic growth and create significant technological advances for Asean; and

- Commercialise and capture the value of Intellectual Property (IP) as the new asset class – especially for industries that traditionally have not seen value in IP nor believe they have any form of IP.

It may be asking a lot from a three-day event, but that has not stopped MyIPO from throwing its energy behind the conference to try and make it as impactful as it can be.

For instance, GIPVC 2015 starts with a ‘by-invite only’ pre-conference on June 8 with ‘IP Clinics’ led by senior IP lawyers, a ‘Masterclass,’ and a policy roundtable with specific industry tracks among the highlights, including a session for the technology licensing offices (TLOs) of universities to help them sharpen their IP senses.

There will also be a session, IP Connect, for entrepreneurs and small companies to help them realise the potential IP that they may have and not even be aware of.

In a lead-up to the main event, MyIPO, together with Digital News Asia (DNA), is also having a panel session this Thursday (May 14) to discuss IP & Entrepreneurs: Getting It Right From the Start.

The session features Chris Leong of Soft Space International Sdn Bhd; Bobby Liu of Hub.IT; and Mohan Kodivel, an IP lawyer with Adasatra, who will share their thoughts. Readers can RSVP to attend.

The panel session will be from 3pm to 5pm, May 14 at MyIPO’s headquarters,12A, Menara UOA, Tower A, Bangsar, Kuala Lumpur.

Leveraging on Asean’s 600mil market

Leveraging on the lure of the 600-million population of the Asean market, GIPVC 2015 has already attracted a strong line-up of speakers from the United States, Europe and China.

The Bank of Beijing will be sharing its experience in using IP as a form of collateral for its customers – an area that Malaysia is also particularly keen to encourage its banking system to develop, in order to open up a new funding avenue for small and medium enterprises (SMEs).

“Meanwhile, both the United States and Europe already have very mature IP ecosystems and speakers from there would be able to share a lot of lessons, best practices and offer rich experiences that delegates to the conference will surely find useful,” said Samirah Muzaffar (pic), MyIPO’s consultant for IP markets and valuation.

“Meanwhile, both the United States and Europe already have very mature IP ecosystems and speakers from there would be able to share a lot of lessons, best practices and offer rich experiences that delegates to the conference will surely find useful,” said Samirah Muzaffar (pic), MyIPO’s consultant for IP markets and valuation.

The conference proper will see plenary sessions coupled with four breakout tracks with IP Monetisation sessions, an IP Monetisation Roadmap Launch, even an Asean Youth IP Event by StartupMalaysia.org, and a first-ever charity dinner.

The idea of the charity dinner is to open up the minds of guests that IP assets can be multifold, ranging from a unique dress design to shoes or smartphone cover, to unique fonts even.

“Everything you do actually has elements of IP rights,” said Samirah.

“We hope … to help participants identify what these IP rights can be, to capture them and then monetise them,” she added.

The added bonus through this exercise is any change in mindset that occurs among participants.

At the same time, MyIPO also plans to use the conference to share its experience in pushing various IP initiatives in Malaysia since mid-2012, especially in IP valuation.

In this particular area, Malaysia leads in South-East Asia with the initial IP valuation efforts being started even earlier, by national ICT custodian Multimedia Development Corporation (MDeC) in 2010.

Singapore launched its IP Hub blueprint in March 2013. By this time, Malaysia already had its IP Financing Scheme through Malaysia Debt Ventures (MDV), and MyIPO was pushing to develop more IP valuers and had kicked off efforts to promote an IP marketplace.

In fact, Samirah said she had accompanied MyIPO Director-General Shamsiah Kamaruddin to Singapore recently where they shared their experience with the head of the Intellectual Property Office of Singapore (IPOS).

Malaysia currently has around 20 examples of IP Valuation schemes – where corporates have gone through the IP Financing Scheme with MDV – while Singapore has just started its journey.

As a result of its track record, Malaysia has been elected to also chair the Asean IP Working Group on IP Valuation and Marketplace 2016-2020.

“That is a big role to play,” said Samirah, pointing out that Malaysia is co-chair with Singapore for IP Valuation while chairing the Marketplace working group on its own.

With the coming GIPVC 2015, MyIPO hopes to inject into all participants the belief that IP cuts across the board and affects everybody.

And, perhaps, an even bolder goal of the agency is that “we want to make IP sexy,” said Samirah.

Related Stories:

Public university R&D: ‘I could cry’

MyIPO: IP marketplace model needs private sector input

Budget 2013 boost for angels and IP monetization

For more technology news and the latest updates, follow us on Twitter, LinkedIn or Like us on Facebook.