Malaysia’s real-time payments transactions surge by 864% in 2020: ACI Worldwide

By Digital News Asia April 16, 2021

- Malaysia recorded more than 69 million real-time payments in 2020

- Is third-fastest growing country in terms of RTP, with CAGR of 83.9%

MORE than 68 million real-time payments transactions were processed in Malaysia in 2020 – a surge of 864% compared to the 7 million of 2019, according to a new global report from real-time payments company ACI Worldwide and data analytics and consulting firm GlobalData.

MORE than 68 million real-time payments transactions were processed in Malaysia in 2020 – a surge of 864% compared to the 7 million of 2019, according to a new global report from real-time payments company ACI Worldwide and data analytics and consulting firm GlobalData.

The report, the second instalment of “Prime-Time for Real-Time” (first launched in 2020), analyses global real-time, account-to-account payment volumes and forecasts across 48 global markets. It projects a Compound Annual Growth Rate (CAGR) for real-time payments of 83.91% in Malaysia from 2020 to 2025.

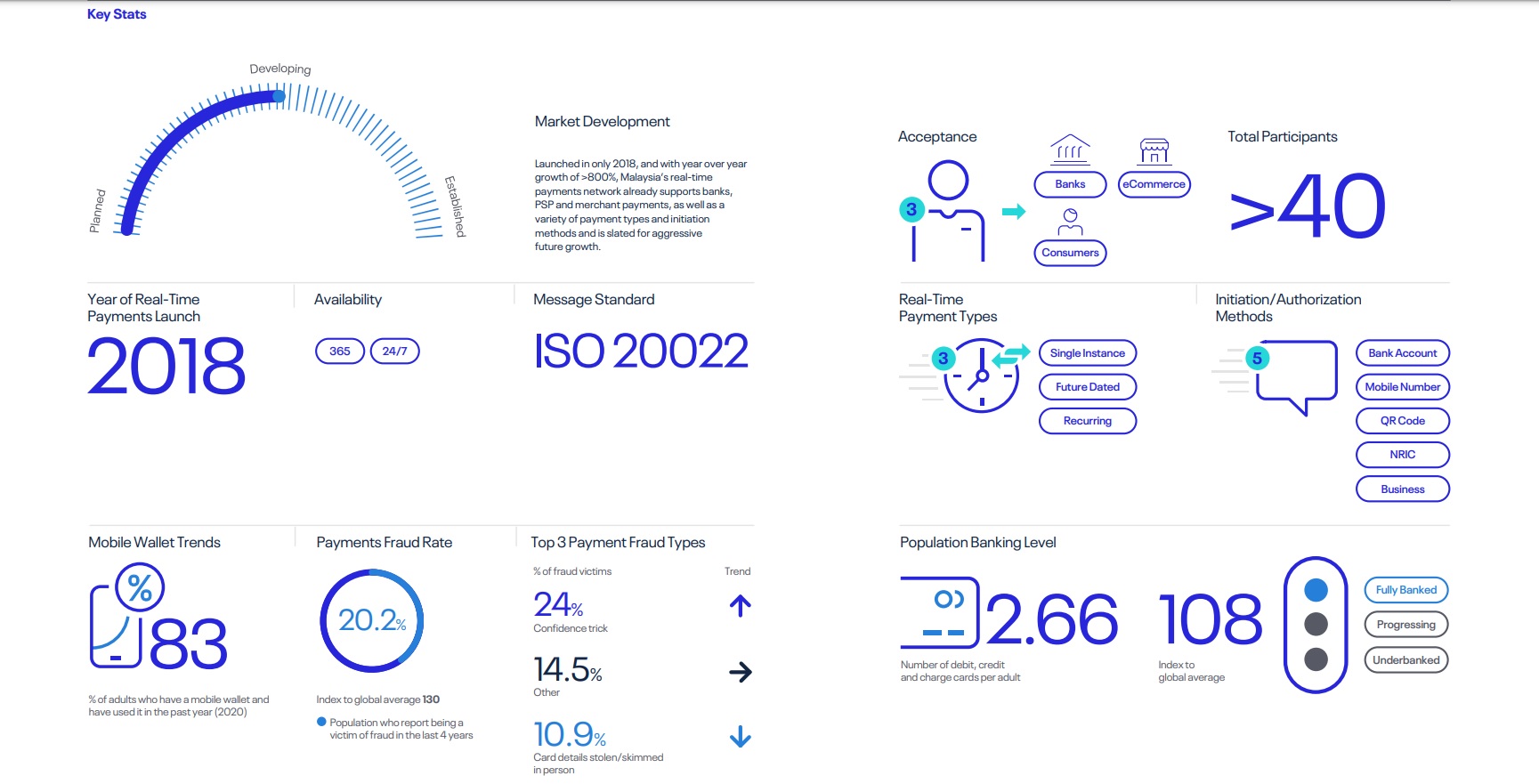

According to the report, although Malaysia’s real-time payments network is less than two years old, it already boasts a robust infrastructure and numerous supporting banks, PSPs and merchants.

DuitNow, which enables users to transfer funds instantly with a mobile number or national ID, was launched in 2018 by the national payments network and central infrastructure provider, Payments Network Malaysia (PayNet), in collaboration with ACI Worldwide.

DuitNow, which enables users to transfer funds instantly with a mobile number or national ID, was launched in 2018 by the national payments network and central infrastructure provider, Payments Network Malaysia (PayNet), in collaboration with ACI Worldwide.

The surge is driven largely by the Covid-19 pandemic and the resulting shift in payment preferences and consumer lifestyle. According to the report, mobile wallet transaction volume rose 171% in 2020 in Malaysia.

Interestingly, the report found that countries like Brazil, Mexico and Malaysia, where many people historically relied on cash, are now some of the fastest adopters of mobile wallets.

“The pandemic has cast the spotlight on the importance of digital payments and robust payment infrastructures, condensing a decade of anticipated innovation into one year and creating human behavioural changes that will not reverse as we emerge from the crisis,” Jeremy Wilmot, chief product officer of ACI Worldwide (pic, left), commented in a statement.

“The pandemic has cast the spotlight on the importance of digital payments and robust payment infrastructures, condensing a decade of anticipated innovation into one year and creating human behavioural changes that will not reverse as we emerge from the crisis,” Jeremy Wilmot, chief product officer of ACI Worldwide (pic, left), commented in a statement.

“Countries with a robust digital payments infrastructure already in place have coped better than those without when it comes to containing the economic impact of the pandemic. Real-time payments have enabled governments, working jointly with financial institutions, to accelerate much-needed disbursements and economic stimulus payments to their citizens. They have also enabled real-time liquidity to businesses that had to adapt to disrupted supply chains.”

Notable trends

Samuel Murrant, lead analyst, Payments, GlobalData, said that real-time payments are still in a nascent stage worldwide, with focus largely placed on P2P payments in many countries. The Covid-19 pandemic, however, has provided an opportunity to accelerate the growth path for these instruments.

“As consumers become used to the speed of real-time settlement for P2P payments, they will naturally move to using them for e-commerce over the relatively slower and less convenient process of using cards online. From there, there is potential to move into in-store payments, once enough consumers recognise real-time payment brands and the user base is high enough to deliver sufficient value to merchants,” Murrant explained.

The report added that the total number of real-time transactions in Malaysia is expected to grow to 1.45 billion b6 2025. The real-time share of Malaysian electronic transactions in 2020 was 1.9%, up from 0.2% in 2019. It is predicted to be 16.5% by 2025

Additionally, the value of real-time transactions in Malaysia was up by 908% from 2019, rising from US$550 million to US$5.55bn. The expected CAGR by 2025 is 96.04%, the report noted.

At the same time, mobile wallet transaction volume rose 171% in 2020 in Malaysia.

This places Malaysia as among the fastest growing countries in terms of real-time payments. The top spot goes to Croatia, with an expected CAGR of 374.4% between 2020 and 2025. This is followed by Colombia (112.7%), Malaysia (83.9%), Peru (74.4%) and Finland (71.4 %).

India is the country with the highest number of real-time transactions in 2020, with 25.5 billion transactions. This is followed by China (15.7 billion) and South Korea (6.0 billion). Thailand takes fourth place with 5.2 billion transactions.

Total number of real-time transactions in 2020 were 70.3 billion, up 41% from 50.0 billion in 2019.

Related Stories :