Telco battleground: Can Maxis claim the crown in 2017?

By Sharmila Ganapathy-Wallace October 27, 2017

- Digi gained a lead over Maxis for overall subscriber base and prepaid subscribers

- TM could roll out prepaid packages in the near future, disrupting the landscape

THE telecommunication landscape in Malaysia is undoubtedly super-competitive, with the major players having to grapple with narrowing margins and a declining mobile subscriber base.

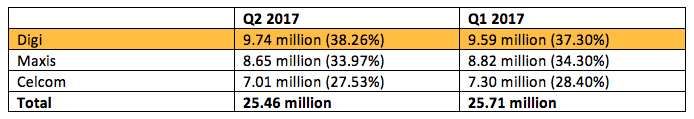

Therefore, the Big Three (Digi.Com Bhd, Maxis Bhd and Celcom Axiata Bhd) continued to battle it out in the second quarter of 2017 (Q2), with Digi emerging the winner in terms of overall subscriber base and market share (see Table 1).

Digi successfully beat Q1 market leader Maxis in Q2 with 37.78% of market share and 12.03 million subscribers, versus Maxis’ 34.68% market share.

During the April to June 2017 period, Digi was the only one to gain subscribers over the previous quarter, while Maxis lost 150,000 subscribers and Celcom lost 320,000 subscribers.

Overall subscriber base and market share

Table 1: Overall subscriber base and market share

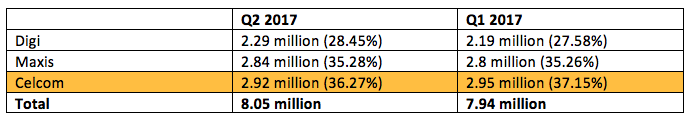

Prepaid subscriber base and market share

Digi also beat Maxis in terms of prepaid subscriber base and market share during Q2 (see Table 2), where it was the only telco among the three to gain prepaid subscribers. Compare this to Maxis, which lost 170,000 prepaid subscribers during the period, while Celcom lost 290,000 prepaid subscribers.

Table 2: Prepaid subscriber base and market share

Postpaid subscriber base and market share

The data in Table 3 shows that Digi added 100,000 postpaid subscribers in Q2, followed by Maxis which added 40,000 postpaid subscribers.

Although Celcom emerged the winner in the postpaid segment with 36.27% market share, it lost 30,000 postpaid subscribers during the period.

Table 3: Postpaid subscriber base and market share

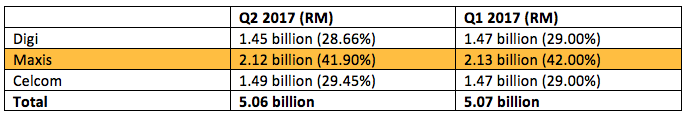

Service revenue and market share

In terms of service revenue, Maxis was the obvious leader at RM2.12 billion in Q2, although it must be noted that it, along with Digi and Celcom, suffered a decline in service revenue over the previous quarter.

This was unlike the previous quarter, where Maxis saw an increase in service revenue compared to Q4 2016. (Note: Service revenue is revenue that excludes the money it gets from the sale of mobile devices.)

Table 4: Service revenue and market share

Prepaid revenue and market share

All three telcos suffered a decline in prepaid revenue in Q2, although Maxis managed to retain its leading position in this respect, clocking in RM984 million during the quarter.

Digi meanwhile, held the second spot in terms of prepaid revenue, just as it did in the first quarter of this year.

Table 5: Prepaid revenue and market share

Postpaid revenue and market share

As is evident from the table below, Maxis maintained its leadership in terms of postpaid revenue, although it suffered a minor decline in postpaid revenue, which is what also happened in Q1, compared to the previous quarter.

Digi recorded the biggest gain in postpaid revenue, ringing in an additional RM16 million, while Celcom gained a marginal RM1.4 million in terms of postpaid revenue.

Table 6: Postpaid revenue and market share

Capital expenditure breakdown

From the table below, it appears that Maxis invested the least in terms of capital expenditure (capex) during the second quarter, with Celcom spending the most in terms of capex.

Telcos tend to spend the least during the first quarter, ramping up capex spending during the second to fourth quarters of the year.

As with the first quarter, the capex is expected to go into improving network quality and coverage, as well as improving IT systems.

Table 7: Capital expenditure breakdown

Looking ahead

In short, while Digi gained a lead over Maxis in terms of overall subscriber base and prepaid subscribers during the second quarter, it was still behind Maxis and Celcom in terms of postpaid subscriber base and service revenue during this period.

According to an analyst from a bank-backed brokerage, the year could end with Digi coming out top in terms of subscriber base.

“It depends on what perspective you are looking at, but it looks like the overall winner could be Maxis,” he says, adding that it may be a close tie between the two telcos for the overall top dog position.

He observes that the telco landscape will remain constant until year end, revolving around price competition, noting also that on the whole, players have been rolling out new packages at a slower speed.

He also says that Telekom Malaysia Bhd could roll out prepaid packages in the near future, which will likely disrupt the domestic telecommunications landscape.

AmBank Research senior vice-president of equity research Alex Goh tells Digital News Asia that in terms of total subscriber base, Digi could remain the winner, but it is a close tie between Maxis and Digi.

Commenting on the market outlook going forward, he notes that competition is affecting all the players.

“Maxis is leading in postpaid, with Digi still fighting for the postpaid segment while still trying to defend the prepaid segment. Celcom is somewhere in between.

“Maxis could emerge the overall postpaid leader with the highest ARPU [average revenue per user] in this segment as it is somewhat immunised from the competition because of its service and coverage, noted as the best amongst its peers,” he concludes.

Related stories:

Minimal financial impact on telcos from 700Mhz spectrum

Telco battleground Q1 2017: Return of the King

Celcom trying to create a startup culture to regain its mojo

For more technology news and the latest updates, follow us on Facebook,Twitter or LinkedIn.