Auto industry needs to get with online program: Accenture

By Digital News Asia January 10, 2013

- In Malaysia, car buyers visit an average of 11 different websites prior to making the purchase

- Lack of integrated digital marketing in auto industry, which is lagging behind other retail sectors

CONSUMERS say they are turning to a variety of online and offline services to help them make their car-buying decisions because industry websites do not satisfy their needs, a new global survey by Accenture reveals.

CONSUMERS say they are turning to a variety of online and offline services to help them make their car-buying decisions because industry websites do not satisfy their needs, a new global survey by Accenture reveals.

The survey of 13,000 drivers in 11 countries – including 1,000 in Malaysia – found that consumers believe the car-buying process would be simpler and quicker if the content on auto industry websites was customized to be more relevant to their specific car-buying preferences.

It would also help if the industry adopted such online innovations as web chat and mobile-enabled websites, which are used widely in other retailing sectors, Accenture said in a statement.

Car buyers also continue to value traditional communications – a test drive and negotiating with a sales person – even after checking for information online.

Of the survey respondents who say they research their car purchases online before buying a vehicle, 78% visit at least six websites or more first, and 15% say they need to browse more than 20 websites to get the information they seek (click graphic to enlarge).

In Malaysia, car buyers visit an average of 11 different websites prior to making the purchase, with almost one in 10 buyers visiting over 21 different websites.

In addition, more car buyers review other consumer online feedback (81%), followed by Google ads (78%) rather than car makers’ websites (70%).

Accenture believes the findings demonstrate that there is a notable lack of integrated digital marketing in the auto industry, which is lagging behind other retail sectors, as 80% of Malaysians agree that car dealers have not exploited the full potential of online digital marketing such as videos.

“A consistent customer experience is vital to the online-offline sales process, an area in which the auto industry is notably lagging other sectors in the eyes of the consumer,” said Lee Won-Joon (pic), managing director of Products Operation at Accenture Asean.

“Consumers have made it clear that they want better online support, advice and personalization when buying a car with consistent handoffs to the dealer when they are ready to visit the showroom.

“At a time when digital marketers are utilizing algorithms to predict what online visitors want to know, automakers should be better able to shape web content that is more user-centric,” he added.

According to the survey, customer experience and engagement are vital to satisfying increasing customer expectations. Customers want better online support, advice and personalization, as more Malaysian drivers want intuitive customization (80%), easier and clearer pricing (88%), and easier configuration/ tailored offers (77%).

Drivers in Malaysia would also like to see the following information available online: Special offers (80%), after sales extras (78%), part exchange upgrades (77%), and special maintenance offers (72%).

“In our experience, car buyers are open to post-sales activities such as loyalty program memberships and enrollment in maintenance plans,” said Terence Foo (pic), managing director, Automotive Industry, Accenture Malaysia.

“In our experience, car buyers are open to post-sales activities such as loyalty program memberships and enrollment in maintenance plans,” said Terence Foo (pic), managing director, Automotive Industry, Accenture Malaysia.

“Success with these programs can be enhanced through the use of customized landing pages that are based on customer demographics, personal preferences and previous interactions. However, our research shows that consumers believe the auto industry has a way to go to enhance digital marketing,” he said.

Digital marketing key

According to the survey, 83% of Malaysian car owners (80% globally) said that the use of digital marketing will increase in the next three years. Accenture believes that putting digital marketing to better use could yield an increase in topline sales for the automotive sector of one to two percent.

The study polled consumers in both developed and emerging markets. In each of these markets, the level of digital penetration has created an appetite among buyers for using digital channels, illustrating how important it is for auto makers and dealers to tap into the power of mobile devices and the Internet, Accenture said.

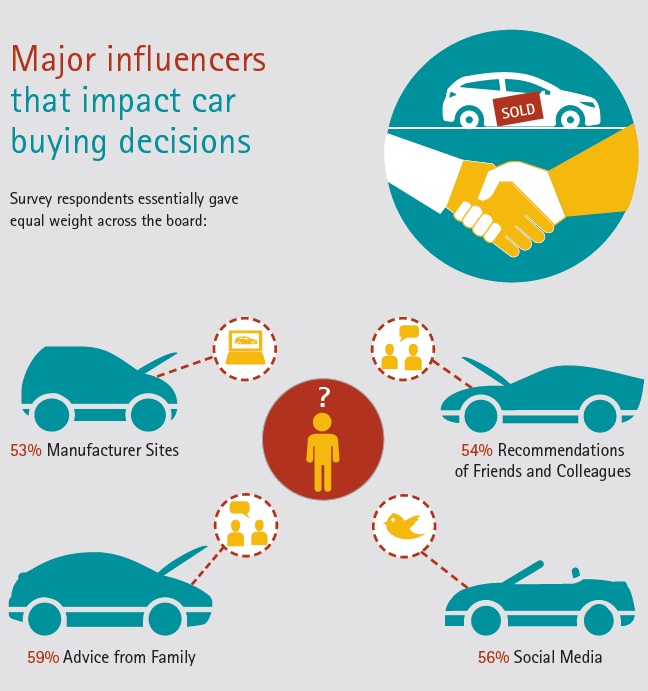

In terms of the major influencers that impact their car-buying decisions, what is most revealing about the Malaysian marketplace is the high number of influencers impacting the decision maker on the car purchase, with half of the respondents citing numerous factors including advice from friends and family (53%), social media (59%) and offline information reviews (60%).

“The wide range of influencers with no discernible ‘leader’ demonstrates the extent to which consumers are constantly assessing their car purchases,” Foo said.

“Consumers are in a constant state of purchase evaluation, which is changing the traditional boundaries of marketing and customer loyalty. Through the sophisticated use of digital technology, automakers and dealers could better interact with their customers and have a stronger online influence in the buying process.”

Other findings:

-

Only 14% of Malaysians, compared to 29% globally, would be willing to skip the dealer contact, with 57% fairly willing

- 7 out of 10 Malaysian car buyers would be fairly willing to skip dealer contact if fully dedicated information via a website or call center was available.

- 58% of Malaysian car buyers are interested in chatting with dealers online in order to make the purchase process easier, as compared to 81% in Germany and 59% in India.

- Half of all current drivers (compared to 34% overall) would consider car buying, financial and whole transaction online.

- 65% would possibly undertake the purchase process online (as compared to 96% in South Korea) and only 6% would dismiss it immediately.

-

83% of Malaysian car owners (80% globally) said that the use of digital marketing will increase in the next 3 years.

- 61% agree they can see themselves buying a car direct online without visiting a dealership.

Related Stories:

Paul Tan: From personal adversity to professional triumph

iCar Asia acquires another auto website

Catcha Media subsidiary, iCar, lists on ASX

For more technology news and the latest updates, follow @dnewsasia on Twitter or Like us on Facebook.