Internet content providers powering network capex growth: Ovum

By Digital News Asia February 11, 2015

- Communications service providers likely to keep capex flat for next few years

- Internet content providers recording much stronger revenue growth

THE communications industry capex is shifting rapidly to favour Internet content providers (ICPs) such as Google, Apple and Facebook as traditional telcos tighten their capex (capital expenditure) budgets in the face of weak revenues, according to global analyst firm Ovum.

According to a new forecast from Ovum, ICP capex grew from US$23 billion in 2008 to US$46 billion in 2013, and it will grow well over the US$100 billion mark by 2019.

ICPs are starting to spend heavily on their networks, particularly on data centres and cloud infrastructure. Telcos, or communications service providers (CSPs), are likely to keep capex largely flat over the next several years, from the approximate 2014 level of US$340 billion. That’s partly because revenue growth for the CSPs is hovering at around 2% per year, limiting their network investment options.

Ovum principal analyst and report author Matt Walker (pic) notes that ICPs are recording much stronger revenue growth, and some – notably Google – spend more of their revenues on capex than typical large CSPs.

Ovum principal analyst and report author Matt Walker (pic) notes that ICPs are recording much stronger revenue growth, and some – notably Google – spend more of their revenues on capex than typical large CSPs.

“Ubiquitous broadband and user-friendly fixed and mobile access devices have changed the telecomms industry dramatically. Enormous new value is being created by the new business models, apps and service platforms now available to end users, many enabled by ICPs,” he said in a statement.

However, Walker notes, this transition is not easy for many industry players, especially large CSPs, forcing them to tightly control network spending. To compete with the adjacent market ICPs, they need to explore partnerships, leverage start-ups and ecosystems for innovation, consider a broader range of suppliers, and look realistically at what mergers and acquisitions could accomplish to improve their strategic positioning.

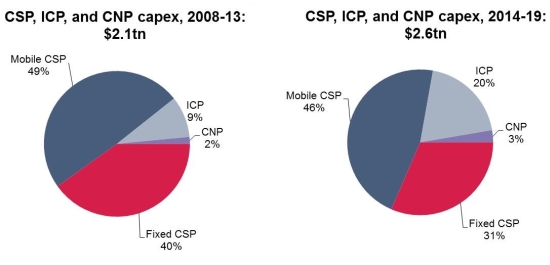

Even as ICP capex spikes, CSPs will dominate network infrastructure markets for many years to come. By 2019, fixed and mobile CSPs will still account for 29% and 44%, respectively, of total communications provider capex, while ICPs will likely reach 24% of total capex.

Carrier-neutral providers (CNPs), mainly tower and data center specialist providers such as Crown Castle and Equinix, will chip in another 3%. While small spenders, CNPs are playing a crucial role in the overall functioning of the world’s networks, Walker said.

CSPs are raising cash by spinning off tower assets to cell tower CNPs, for instance, and relying more on these specialists for incremental tower coverage. Data centre-focused CNPs are also carving out a strong niche, providing multitenant data center space to CSPs, ICPs, and enterprises.

Figure 1 compares these four provider types’ capex shares for the past six years (2008–13) and for the 2014–19 forecast period.

Like companies in other network industries, CSPs have to spend heavily on their networks for both growth and basic maintenance. Upgrading networks with new technology to support a lower cost base, new features or better performance will continue to be part of CSPs' annual planning. A tight revenue climate puts a ceiling on capex growth, but capex levels will remain high.

Walker concluded, “CSPs that fail to maintain their networks, upgrade to meet the competition, and deploy new services will simply fail in the marketplace.”

Related Stories:

Level playing field needed for govt cloud procurement: Ovum

Social messaging apps will cost operators US$32.6bil: Ovum

80% of BYOD use goes unmanaged, says Ovum

For more technology news and the latest updates, follow us on Twitter, LinkedIn or Like us on Facebook.