APAC smartphone sales up 74%, Microsoft takes No 3 spot globally

By Digital News Asia August 21, 2013

- Worldwide smartphone sales reached 225 million units, up 46.5% from Q2 2012

- Samsung maintains No 1 position, Apple’s sales till grew by 10.2% from a year ago

ASIA Pacific, Latin America and Eastern Europe exhibited the highest smartphone growth rates of 74.1%, 55.7% and 31.6% respectively, as smartphone sales grew in all regions, according to Gartner Inc.

ASIA Pacific, Latin America and Eastern Europe exhibited the highest smartphone growth rates of 74.1%, 55.7% and 31.6% respectively, as smartphone sales grew in all regions, according to Gartner Inc.

Worldwide mobile phone sales to end users totaled 435 million units in the second quarter of 2013, an increase of 3.6% from the same period last year.

Worldwide smartphone sales to end users reached 225 million units, up 46.5% from the second quarter of 2012. Sales of feature phones to end users totaled 210 million units and declined 21% year-over-year.

“Smartphones accounted for 51.8% of mobile phone sales in the second quarter of 2013, resulting in smartphone sales surpassing feature phone sales for the first time,” said Anshul Gupta (pic), principal research analyst at Gartner.

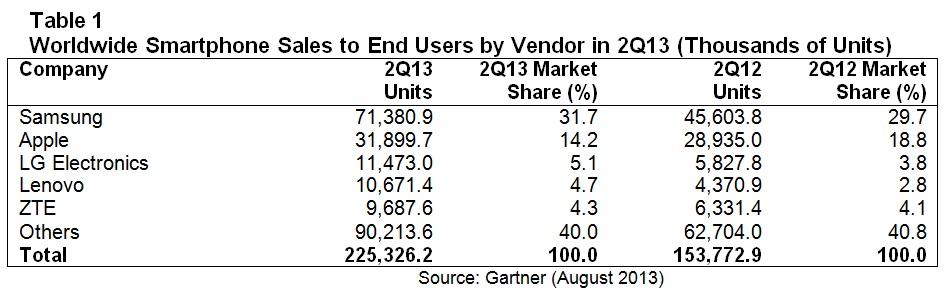

Samsung maintained the No 1 position in the global smartphone market, as its share of smartphone sales reached 31.7%, up from 29.7% in the second quarter of 2012 (see Table 1 below). Apple’s smartphone sales reached 32 million units in the second quarter of 2013, up 10.2% from a year ago.

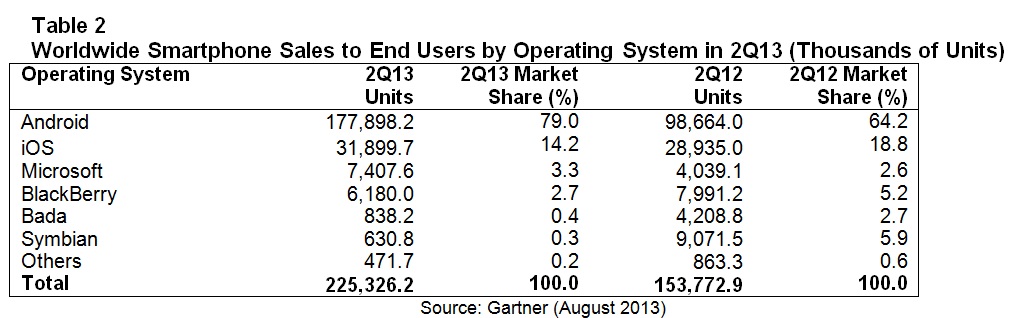

In the smartphone operating system (OS) market (see Table 2 below), Microsoft [with its Windows Phone 8 OS] took over BlackBerry for the first time, taking the No 3 spot with 3.3% market share in the second quarter of 2013.

“While Microsoft has managed to increase share and volume in the quarter, it should continue to focus on growing interest from app developers to help grow its appeal among users,” said Anshul.

Android continued to increase its lead, garnering 79% of the market in the second quarter.

Vendor perspectives

Samsung: Samsung remained in the No 1 position in the overall mobile phone market, with sales to end users growing 19% in the second quarter of 2013 (see Table 3 below).

“We see demand in the premium smartphone market come mainly from the lower end of this segment in the US$400-and-below average-selling-price mark,” said Anshul.

“It will be critical for Samsung to step up its game in the mid-tier and also be more aggressive in emerging markets. Innovation cannot be limited to the high end,” he added.

Nokia: Slowing demand of feature phone sales across many markets worldwide, and fierce competition in the smartphone segment, affected Nokia’s mobile phone sales in the second quarter of 2013.

Its mobile phone sales totaled 61 million units, down from 83 million units a year ago. Nokia’s Lumia sales grew 112.7% in the second quarter of 2013 thanks to its expanded portfolio, which now includes the Lumia 520 and Lumia 720.

“With the recent announcement of the Lumia 1020, Nokia has built a wide portfolio of devices at multiple price points, which should boost Lumia sales in the second half of 2013,” said Anshul.

“However, Nokia is facing tough competition from Android devices, especially from regional and Chinese manufacturers which are more aggressive in terms of price points,” he added.

Apple: While sales continued to grow, the company faced a significant drop in the average selling price of its smartphones. Despite the iPhone 5 being the most popular model, its average selling price declined to the lowest figure registered by Apple since the iPhone's launch in 2007.

The average selling price reduction is due to strong sales of the iPhone 4, which is sold at a strongly discounted price.

“While Apple’s average selling price demonstrates the need for a new flagship model, it is risky for Apple to introduce a new lower-priced model too,” said Anshul.

“Although the possible new lower-priced device may be priced similarly to the iPhone 4 at US$300 to US$400, the potential for cannibalisation will be much greater than what is seen today with the iPhone 4.

“Despite being seen as the less expensive sibling of the flagship product, it would represent a new device with the hype of the marketing associated with it,” he added.

Lenovo: Lenovo’s mobile phone sales grew 60.6% to reach 11 million units in the second quarter of 2013. Its quarter performance was bolstered by smartphone sales, which grew 144% year-over-year and helped it rise to the No 4 spot in the worldwide smartphone market for the first time.

Lenovo continues to rely heavily on its home market in China, which represents more than 95% of its sales. It remains challenging for Lenovo to expand outside China as it has to strengthen its direct channel as well as its relationships with communications service providers.

“With second quarter sales broadly on track, we see little need to adjust our expectations for worldwide mobile phone sales forecast to total 1.82 billion units this year,” said Anshul.

“Flagship devices brought to market in time for the holidays, and the continued price reduction of smartphones, will drive consumer adoption in the second half of the year,” he added.

Related Stories:

Mobile phone sales down 2.3% worldwide, smartphone sales up 42.7%

108mil+ phones sold in SEA, 42mil of them smartphones

BlackBerry finds comeback hard going

MDeC now aims ICON program at Windows Phone 8, with Nokia’s help

For more technology news and the latest updates, follow @dnewsasia on Twitter or Like us on Facebook.