Winning and losing companies of the future: new IMD study

By Digital News Asia December 25, 2021

- To survive disruption is to pivot, draw on intel from unrelated sectors

- Financial firms that behave most like tech firms top sector ranking

Tesla, Lululemon, Mastercard, and Google topped the global rankings in their respective industries in the Future Readiness Indicator released last week, and a number of companies fared much worse than expected: Apple, IBM, Twitter, Spotify, HSBC, Audi, and Sony.

The Institute for Management Development's (IMD) Future Readiness Centre studied more than a decade of data (2010 to 2021) to rank publicly listed companies against their competitors by how future-ready they are for the post-pandemic economy and their likelihood of survival in a world of fast and frequent change. In simple terms, the Future Readiness Indicator measures the corporate world's resilience.

The Future Readiness Indicator analyses 86 highest-grossing companies in the four highest-revenue industries: Fashion & Retail, Automotive, Financial Services, and Technology. The US led the list with 40 companies. Next came China and Germany with seven each; France and Japan with six each; Switzerland and UK with four each; South Korea with 3; Sweden with 2; and Argentina, Canada, Italy, the Netherlands, Singapore, Spain, and Taiwan with one each.

The research reveals that companies that reoriented themselves to new trends before the pandemic outpaced their competitors. Covid-19 served as a dramatic test case, rewarding companies that built up their capabilities ahead of time and exposing the  institutional inertia of those that did not.

institutional inertia of those that did not.

“Our predictive analytics equips executives with intelligence to not just recover from the recent economic blow, but better respond to tomorrow's disruptions – like Omicron – with lessons on how not just to survive, but thrive, in the future” explains Professor Howard Yu (pic, left), author of the Future Readiness Indicator at IMD.

China beat the rest of Asia with most (7) companies in the global ranking with Geely (9th), BYD Company (13th), NIO (14th), Ping An (7th), Alibaba Group (8th), Tencent (11th), Xiaomi (14th). For South Korea, Hyundai ranks 5th, in the automotive vertical, just behind Ford, BMW, Toyota, and Tesla (#1). Kia ranked 16th out of 18 companies beating Audi and Renault. Samsung ranks 25th out of 29th companies in the Technology vertical. For Japan, Toyota (2nd), Honda (10th), Nissan (15th) ranked in Automotive, while Fast Retailing (14th) in Fashion & Retail, Nintendo(24th) and Sony (29th) in Technology rounded up its six companies. TSMC is the only Taiwanese company that made it into the ranking at 21st out of 29 companies in Technology, while for Singapore, DBS (17th) in Financial Services was its flag bearer.

On the US dominance of the rankings, Yu explains “The research shows that there is much convergence across industries, and that means the digital ecosystem and intellectual capital will matter a great deal from now on. By proximity, companies in the US get exposed to the Silicon Valley tech giants, and the vibrancy of VC capital and its sophistication also helps. Executives from corporate America are more aware of the need for change and are therefore closer to the talent pool. Because what we measure is a balanced composite score, you need to have a balanced portfolio from a strong financial balance sheet for substantial innovative momentum. From this regard, US companies overall remain highly competitive, which reflects in their dominance of the ranking results.”

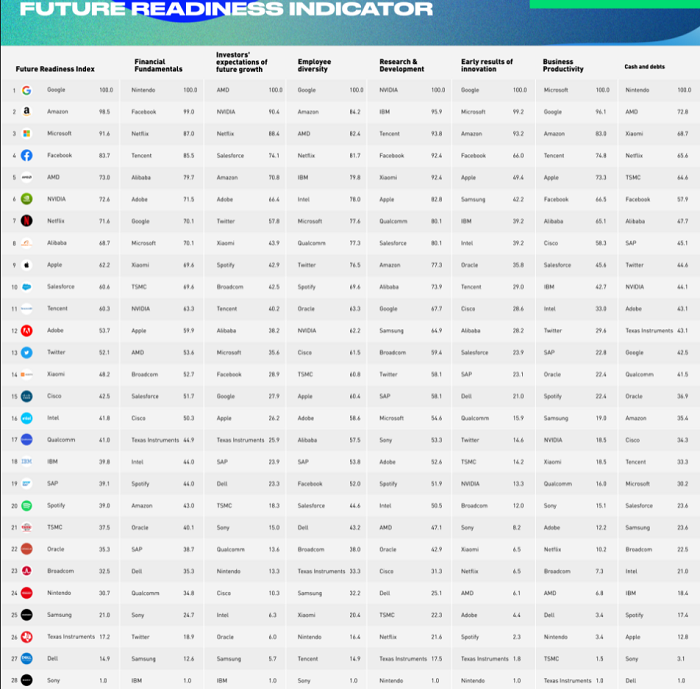

In the Technology sector, Google ranked the highest overall for future readiness, with Amazon coming second and Microsoft third. Sony ranked last out of 28 companies, and Dell ranked 27th.

Some other surprising positions in the list include Apple, which landed at 9th place, some way behind the top three and Facebook, AMD, NVIDIA, Netflix, and Alibaba (in places 4 through 8). Twitter was 13th, IBM 18th, Spotify 20th, and Nintendo and Samsung landed at 24th and 25th place out of 28 companies that made the list.

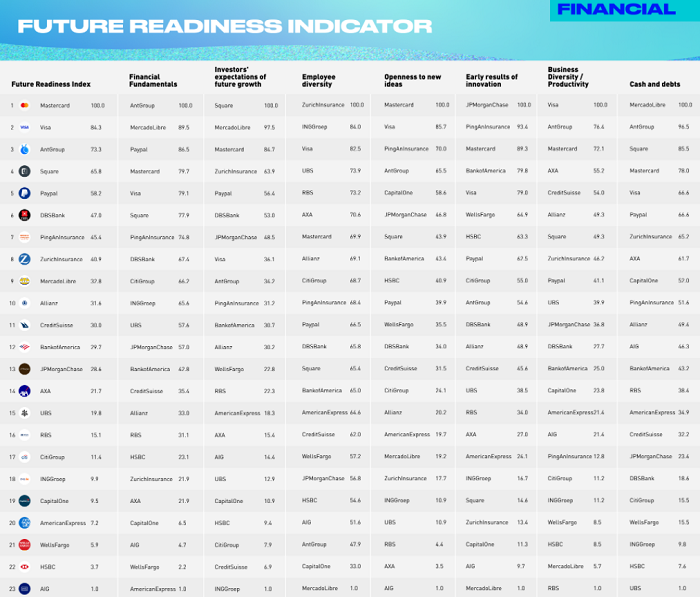

In the Finance sector, Mastercard scored the highest for future readiness, followed by Visa and Ant Group, whereas HSBC, Wells Fargo & Company, and American International Group ranked the worst overall, in places 21 through 23.

What’s more, American Express ranked 20th out of 23, Capital One 19th, CitiGroup 17th, and JP Morgan Chase & Company landed at 13th.

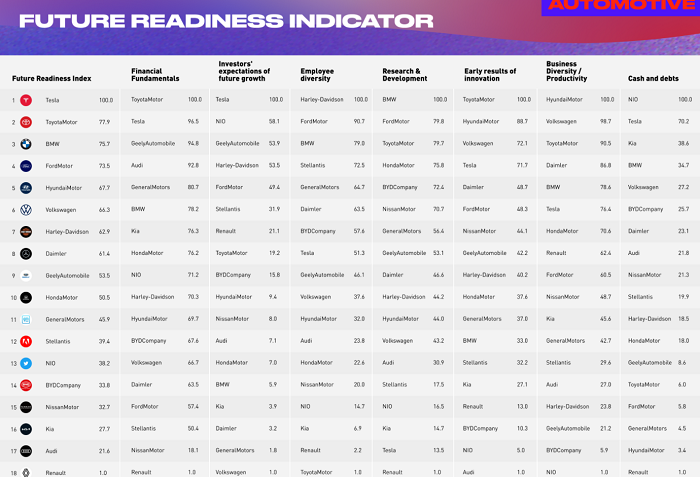

In the Automotive sector, Tesla ranked the highest overall for future readiness, Toyota ranked second, and BMW came in third. Kia, Audi, and Renault took the 16th through 18th spots.

Interestingly, however, Toyota, Renault, and even Tesla, to an extent, ranked surprisingly poorly on gender diversity, whereas Harley-Davidson and Ford Motor ranked highest on this specific metric.

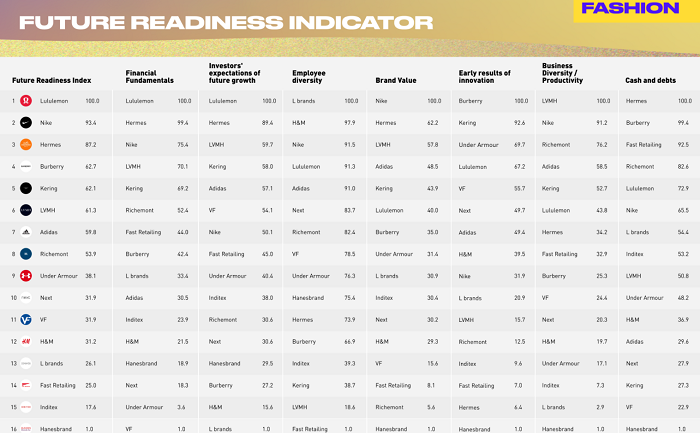

For Fashion and Retail, Lululemon ranked best overall, followed by Nike and then Hermes. Fast Retailing, Inditex, and Hanesbrands ranked the worst, in places 14 through 16.

Adidas ranked five places below Nike, at 7th out of 16. Under Armour was in 9th, and Next was in 10th.

The Indicator utilises rule-based, objective measurements to arrive at a composite score, which an AI-driven algorithm compares against the industry average. It uses hard data to rank companies against critical drivers of innovation: Financial Fundamentals; Investors’ Expectations of Future Growth; Employee Diversity; Research & Development; Early Results of Innovation; Business Diversity; and Cash and Debts.

Overall, the 2021 Future Readiness Indicator finds:

- Unlike their industry peers, future-ready companies move aggressively from exploring new capabilities to actively exploiting them. This is what distinguishes companies that scale from those that don't.

- Digitising is essential to future-readiness, though the concept has different meanings in different industries. Top sportswear brands involve comprehensive behind-the-scenes automation of their entire supply chain. For luxury brands, digitising means using advanced data analytics to shape relationships with their high-end customers. For the top financial services companies, it means AI-driven applications and APIs. And for EV-makers like Tesla, it means automated system upgrades and the ability to rewrite software on the fly.

- Companies must settle upon a single, clear, shared perspective to make tough, critical decisions and target resources to gain financial returns from innovation. The top payment companies boldly moved away from plastic cards and adjusted their business models to utilise AI-driven payment systems; top-ranking automakers move at previously unimagined speed to electrify their entire industry; and top fashion/retail brands took advantage of their consistent internal perspectives to rewire their systems top-to-bottom, survive the pandemic, and earn financial returns on investment.

- Today’s future-ready company forms mutually beneficial collaborations with competitors. When companies lack the talent or technology they need, executives of top-ranking companies are confident and curious enough to learn from their competitors. Mastercard and Visa have been willing to open their infrastructures to Google, Paypal, and other tech companies. Automakers without software expertise collaborate with electronics designers from the gaming, entertainment, and programming sectors.

- A big part of successful reinvention is drawing on knowledge from other sectors. Toyota took lessons from the tech sector to survive the microchip supply chain disruption. Automakers like Tesla, Mercedes, and especially NIO learn from luxury retail brands as they design and market their high-end all-electric autos.

Industry-specific breakdown of the Future Readiness Indicator 2021:

Fashion & Retail

The indicator analyses 16 fashion & retail companies based on US$3.2 billion (RM13.52 billion) to US$44.5 billion (RM188.07 billion)revenue and ranks against data from 2018 to 2020. For the Fashion Industry, the research measures against the following criteria: financial fundamentals, investors’ expectations of future growth, employee diversity, cash and debt, business productivity/diversity, early results of innovation, and brand value.

For Fashion & Retail, in particular, the research also considers the strength of e-commerce, presence in mobile apps, live-streaming, omnichannel, direct-to-consumer engagement, the volume of Google search presence, ability to personalise offerings, and the extent to which consumers consider the companies to be environmentally sustainable.

Sportswear brands Lululemon and Nike ranked first and second, followed by luxury brands Hermes, Burberry, Kering, and LVMH.

Before Covid-19, the top-ranking sportswear brands had already rewired their core operations from top to bottom, allowing them to instantly make markdown and promotion decisions and move inventory across countries. It’s how Nike can customise sneakers at scale profitably. Lower-ranking brands like Under Armour, H&M, and Hanesbrands, who took the shortcut of laying new digital tools on top of existing operations, struggled through the pandemic and will have difficulty competing in the coming years.

The research reveals that luxury brands aren't nearly as dependent as sportswear brands on behind-the-scenes digitisation. LVMH and Burberry, respectively low-ranking and high-ranking in digital savviness, are the two fashion/retail brands that rank highest in positive sentiment. Instead of supply chain digitisation, high-ranking luxury brands depend on data analytics to better understand their customers and market scarcity and exclusivity.

Automotive

The Indicator ranks 18 top automakers based on US$6.2 billion to US$291.9 billion revenue and ranks against data from 2010 to 2020. It measures financial fundamentals, investors’ expectations of future growth, business diversity, cash and debt, employee diversity, research and development, and early results of innovation efforts for the automotive industry.

[RM1 = US$0.236]

Four traditional automakers - Toyota, BMW, Ford, and Hyundai - hold the second through fifth positions, but non-traditional automaker Tesla quickly captured the top spot. The research reveals that most traditional automakers, despite mechanical expertise, share conservative views and are relatively unsuited to address vehicle electrification, connectivity, and autonomous driving. During the chip shortage, they found themselves in uncharted territory. But the second-ranking automaker, Toyota, had prepared itself by stockpiling chips, and Toyota avoided the worst of the disruption and reclaimed the title of world's largest automaker.

The real sector star is Tesla. During the chip shortage, Tesla's expertise in programming allowed it to rewrite its firmware, continue production, and sell a record number of vehicles. By definition, Tesla was future-ready before they ever built their first car.

Two Chinese EV-only automakers, BYD and NIO, share their origins with Tesla in software. Yet NIO did not even appear on the list until 2019, and as recently as 2016, BYD ranked 18th. Their 2021 rankings –13th for NIO and 14th for BYD – suggest that these two companies are poised to survive future crises and achieve continuous growth.

Financial Services

The Indicator examines the top 23 retail banks, insurance companies, and payment companies, based on US$10 billion to US$122.1 billion revenue and ranks against data from 2015 to 2020. It measures the following criteria: financial fundamentals, investors’ expectation of future growth, employee diversity, cash and debt, business productivity, early results of innovation, and openness to new ideas.

High-ranking financial services brands used the pandemic to shift operations from in-person retail to AI-driven applications. They reaped the benefits as the sector generated its all-time highest revenue.

Traditional payment companies Mastercard and Visa led the rankings, followed by Ant Group, Square, and Paypal.

Mastercard and Visa lacked the expertise and capabilities to outrun the fintech giants, so they adopted the concept of frenemies; that is, they collaborated with their rising competition by creating easy-to-adopt application programming interfaces (APIs) to allow access to PayPal, Square, and even Coinbase (with its Visa cryptocurrency debit card). Opening their systems to the broader digital ecosystem allows Mastercard and Visa to learn from disruptors and apply what they learn to their organisations.

The research reveals that the highest-ranking financial services brands are more aggressive than their peers in exploring and exploiting new technologies, their openness to collaboration, and their conviction that they must continue to prepare for disruption. In fact, they are already IT companies that happen to be in the financial industry.

Technology

The research includes 28 top technology companies across semiconductors, software, and hardware, selected by US$3.7 billion to US$218.9 billion revenue and ranks against data from 2018 to 2021. The research measures against the following criteria: financial fundamentals, investors’ expectations of future growth, business diversity, cash and debt, employee diversity, research and development, and early results of innovation efforts.

The five top-ranking tech companies - Google, Amazon, Microsoft, Facebook, and US-based semiconductor company AMD - all have an entrepreneurial orientation, willingness to branch out from their core businesses, ability to scale up quickly, and a shared inner vision of the future.

The research suggests that high-ranking technology companies’ flexible organizational structures enabled them to make quick, tough decisions when the pandemic struck. Consumer-oriented companies like Amazon, Facebook, Netflix, and Alibaba ramped up quickly to meet their customers’ demand for home delivery services and personal electronics. In contrast, B2B-focused tech companies like Microsoft and Salesforce offered new products to enable work at a distance.

ESG

Companies within the four industries under examination devote an annual US$20 billion to environmental, social, and corporate governance (ESG) spending, but in the absence of universal reporting standards and third-party verification, companies’ self-reporting on ESG spending is difficult to compare.

The research’s algorithm uses textual analysis to overcome this difficulty. Today’s informed consumers expect companies to be a force for good globally, but the research shows that ESG spending alone won’t improve a company’s image. Companies need to develop ESG goals directly related to their underlying business strategy.

While ESG spending rarely makes a significant contribution to a company’s reputation, the research does show that ESG efforts correlate strongly with other future-readiness activities, such as exploiting new initiatives and being willing to commit resources to improved ways of doing business.

Follow the Future Readiness Indicator on LinkedIn, Twitter, Facebook, Instagram. Watch videos on YouTube