Tier Two and three Indonesia cities to grow 5x in next 5 years: Alpha JWC Ventures

By Digital News Asia April 6, 2021

- Tier two and three cities to outpace the growth of tier one cities

- Tier two, three city GDP shares to increase by 3% to 5%

TIER TWO and their three Indonesian cities will be key contributors to Indonesia’s digital economy by 2025, a study by Alpha JWC Ventures and Kearney finds.

TIER TWO and their three Indonesian cities will be key contributors to Indonesia’s digital economy by 2025, a study by Alpha JWC Ventures and Kearney finds.

The study, titled "Unlocking the Next Wave Of Digital Growth: Beyond Metropolitan Indonesia", found that tier two and three Indonesian cities such as Denpasar and Magelang will grow by five times in the next five years, riding on the back of startups specialising in e-commerce, lending and e-payments.

Alpha JWC, an Indonesian early-stage venture capital firm, expects increasing importance of tier two and three cities as they outpace the growth of tier one cities and increase the share of national GDP by 3 to 5% (US$46 to US$77 billion) by 2030.

The report, which was released in collaboration with global management consulting firm Kearney and jointly written with partners Credit Suisse, Amazon Web Services, and Xiaomi Indonesia, outlines Indonesia’s digital economy trajectory for 2021 while amplifying the value proposition that the next wave of startup and investment growth will be driven by non-metropolitan tier two and three cities, beyond the shadow of Java and Jakarta's sphere of influence.

It began by noting that the digital economy requires a new tiering system. The report introduces a new tiering system based on expenditure per capita, population size, internet penetration, provincial GDP growth, and population density.

From 514 cities, 15 cities are categorised as Metropolitan/ Tier 1 (Greater Jakarta area, Bandung, and Surabaya), 76 as Rising Urbanites/ Tier 2 (e.g. Semarang, Makassar, Denpasar), 101 as Slow Adopters/ Tier 3 (e.g. Magelang, Prabumulih, Bangli), and the other 322 as Rigid Watchers/ Tier 4 (e.g. Jepara regency, Jayapura regency).

Growing faster

According to the report, non-metropolitan areas are growing faster and increasing in economic importance than Jakarta due to the Indonesian government efforts on economic diversification and infrastructure.

There will be a more equitable distribution of economic activities between Jakarta and other regions, the study noted. Jakarta’s proportion of Indonesia’s GDP will decrease by 5 to 6% by 2030. Tier two and three cities will be more prominent economically, increasing the GDP share by 3 to 5%.

The study cited Covid-19 as a catalyst for accelerated digital adoption, democratising technology and making it an integral part of millions of Indonesians. Thus, investors and startups with vested interests in Indonesia’s digital economy will see their interests grow three to four times by 2025. Tier two and three cities are just starting to adopt digital habits that tier one cities adopted five years ago.

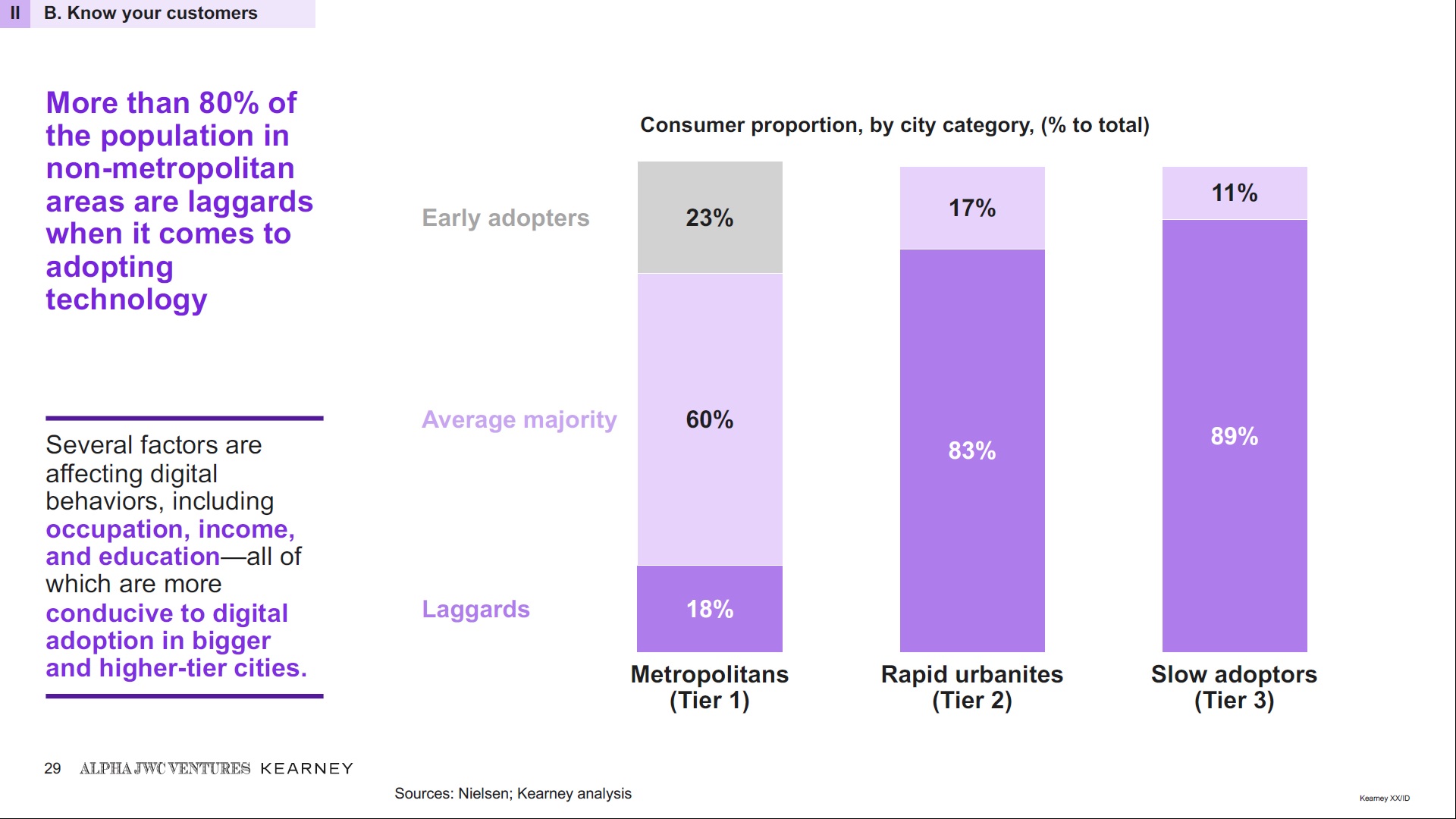

However, the study also found that the majority of consumers in tier two and three cities are still largely unfamiliar with digital solutions, resulting in regional imbalance of digital behaviour.

Consumers in Java are more concerned with ease of use, price, promotion and items availability. Non-Java consumers have more practical concerns, such as security, ease of use and shipment being the main barriers.

These findings, the study noted, suggest that convenience is more important in Java, where digital habits are more widespread and prevalent.

2020 was nonetheless a challenging year for Indonesia, with Covid-19 impacting vital economic sectors. Despite the pandemic, it also saw significant digital investments as funding doubled to US$4.4 billion, from US$ 2.1 billion in 2019.

While many sectors have been negatively affected by Covid-19, the report said that it has created a strong tailwind for Indonesia's digital economy. The next five years will be a familiarisation period where significant education needs to happen to elevate digital adoption with Jakarta and other regional tier one cities.

Still room for growth

"In the past decade, we have witnessed Indonesia's digital economy grow into one of Asia's hotspots," said Chandra Tjan, co-founder and general partner at Alpha JWC Ventures (pic, right).

"In the past decade, we have witnessed Indonesia's digital economy grow into one of Asia's hotspots," said Chandra Tjan, co-founder and general partner at Alpha JWC Ventures (pic, right).

"Despite the outstanding growth, Indonesia is still mostly untouched as most startups are based in the Greater Jakarta area, with most digital solutions heavily concentrated on this region, leaving areas beyond Java behind.

“Our research shows that sectors such as e-commerce, e-payments and lending are close to mass adoption, growing 27-46% CAGR toward 2025 as 40 to 50% of the population in tier two and three cities start partaking in the activities, up 10% from 2020. Based on that observation above, we expect that three unicorns will emerge from e-commerce and lending on the back of growth of these cities,” he continued.

Shirley Santoso, president director and a partner at Kearney, added that the past five years have seen a lot of progress on Indonesia’s regulatory and ecosystem front.

“However, our research reveals that much remains to be done. In the coming five years, we believe key imperatives in infrastructure, talent, consumer education and access to capital will have to be fulfilled to enable the Indonesian digital ecosystem to flourish to become one of the world’s most vibrant ecosystems,” she said.

Jefrey Joe, co-founder and general partner at Alpha JWC Ventures, said that in order to maximise Indonesia’s potential, the involvement from industry players, investors and the government is needed to continue Alpha JWC Ventures’ endeavours in backing local champions.

“We welcome feedback and discussions with potential partners and stakeholders to participate in the next wave of growth in Indonesia's digital economy,” he concluded.

Alpha JWC’s other primary focus for 2021 will be to grow its network of limited partners for its upcoming third fund while concurrently supporting its portfolio companies with financial and value-adding support.

Related Stories :