Malaysia’s ICT outlook: Cloud disappointment, 4G lag

By A. Asohan November 14, 2014

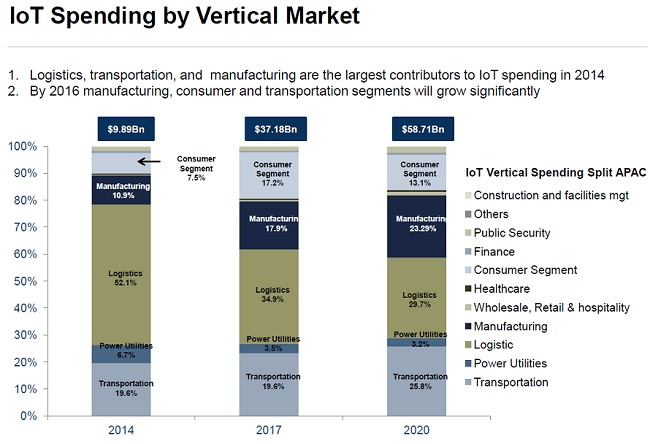

- Malaysia expected to be one of the biggest IoT markets in APAC

- 4G adoption rate at only 3%; population coverage only 20%

.JPG)

These apparent inconsistencies also comes from the fact that Malaysia is a hard economy to categorise – advanced in some areas, but very much a developing market in others, said Andrew Milroy (pic), senior vice president of the ICT Practice at research and analyst firm Frost & Sullivan.

Spending on information technology (IT) hit about US$9 billion in 2014, comprising US$5.5 billion on hardware, US$1 billion on software and US$2.5 billion on services. IT spend is expected to register a compound annual growth rate CAGR) of 9.5% from 2013-2017.

“That’s a very healthy growth rate, by the way,” Milroy told a group of journalists and industry players at Frost & Sullivan’s ICT Outlook for Malaysia briefing in Kuala Lumpur on Nov 13.

IT spending across hardware, software and services is expected to grow rapidly at 10%, 8% and 9.1% respectively.

“Malaysia is also the only country in Asia Pacific where the proportion of hardware spending still outstrips spending on software and services, but we expect that to change as organisations consolidate their hardware,” he said.

One of the major drivers has been the Malaysian Government and its various initiatives to encourage the adoption of ICT, including the Digital Malaysia programme that seeks to transform the nation into a fully developed ‘digital economy’ by 2020.

However, one of the grey spots in IT has been cloud adoption. “If you look at all the numbers that we, and even others, were expecting, Malaysia’s adoption of cloud technology is nowhere near what we predicted a couple of years ago,” said Milroy.

“Adoption of free cloud services has been healthy, but the use of paid cloud services is not where we would have expected,” he said.

“It’s a mystery to us,” he added when asked why this was so. “It could be because of security concerns.”

Still, Frost & Sullivan is confident that this too would change. Malaysia’s cloud market was worth an estimated US$98.7 million in 2014 and will reach US$221.9 million in 2017, growing at a CAGR of 32.6% from 2013-2017, the research firm predicted.

This growth is being enabled by the Government’s incentives to enable small and medium businesses (SMBs) to opt for cloud services.

The Government is also the largest spender for cloud services, followed by the telecommunications and IT sector, manufacturing, education and BFSI (banking and financial services industry) sectors.

On the Business Applications as a Service (BAaaS) front, Malaysia is also witnessing robust growth with an expected CAGR of 33.2% between 2012 and 2018, according to Frost & Sullivan.

One unusually bright spot for Malaysia has been the Internet of Things (IoT). Malaysia is one of the fastest growing IoT markets in Asean and Asia Pacific as a whole, with an estimated spending of US$70 million in 2014, estimated to reach US$447 million by 2017, growing at a CAGR of 111.5% from 2013-2017.

Frost & Sullivan defines ‘IoT spending’ as revenue from hardware, software and professional services that are directly attributable to IoT solutions and services.

Milroy said there are several factors driving the adoption of IoT in the region, such as government efforts to improve competitiveness in their economies and city planners' efforts to address social demographic challenges in their cities.

The increase in low-cost sensors and improved communication infrastructure in the region, coupled with the ready availability of cost effective compute and storage (cloud computing), will also help drive IoT development and adoption.

“The coming together of all these technologies is creating a platform for IoT,” said Milroy. “It’s truly going to be transformational.”

Frost & Sullivan estimates big data and analytics spending was US$101.7 million in 2014 and will reach US$196 million in 2017, with a CAGR of 30.6% from 2013-2017. Software spending is expected to grow much more quickly than hardware spending.

Mobile mayhem

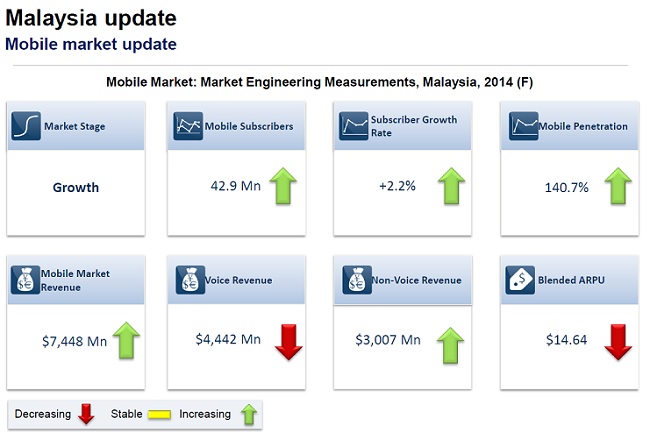

It’s certainly turning out to be a ‘Year of Battles’ for the Malaysian mobile industry, with voice revenue growing at a snail’s pace, and while data revenues are growing, they are doing so at a much higher cost to the operators.

The Malaysian mobile penetration rate is currently 140.7%, and subscriptions grew 2.2% to reach 42.9 million subscribers.

Total revenue was US$7.45 billion in 2014, driven by data and value added services. Non-voice ARPU (average revenue per user) is expected to grow by 2% to US$5.9 billion; however it will not be able to compensate for the 2.4% decline in voice ARPU, Frost & Sullivan said.

Growth in non-voice revenue was boosted by the increase in smartphone penetration, and attractive data plans and bundled offers, according to Ajay Sunder, vice president of the Telecoms Practice at Frost & Sullivan Asia Pacific.

“The availability of affordable smartphones and attractive bundled offers from the mobile network operators (MNOs) are expected to drive smartphone penetration in Malaysia from 38% in 2013 to 48% by the end of 2014,” he added.

To drive data service adoption, service providers are enticing subscriptions by offering unique propositions. For example, DiGi is offering mobile Internet add-ons for social apps, while U Mobile offers unlimited YouTube and Tonton videos for free, Frost & Sullivan noted.

“However, 4G adoption is currently under 3%, as service coverage is restricted to select locations, and the service providers are offering no significant value proposition,” Ajay said.

“The premium pricing, coupled with the lack of population coverage, is convincing consumers to stick with their 3G services – they’re seeing no real benefit to switching to 4G,” he added.

He said 4G population coverage is currently at only about 20%, noting that 4G adoption in Singapore is about 15%, with a population coverage of about 80%.

“But that’s like comparing apples with oranges – it’s always easier to roll out population coverage in a small country like Singapore,” Ajay said.

There has also been a slight shake-up in terms of subscriptions between the top three mobile operators in Malaysia, with Celcom gaining at the expense of Maxis.

Top three trends

“The top three trends that mobile operators will have to face are digital-driven devices, the rise of the digital consumer and the decline in revenue per unit of data – even if data revenue as a whole is growing,” said Ajay.

There is increasing use of a second or even a third device, driven by falling prices and increasing new brands like Xiaomi. All these devices are increasingly data driven and are pushing an exponential growth in data and accelerating the voice to data usage transition, according to Frost & Sullivan.

“Vendors that are able support the seamless sharing of content and applications across multi devices will have an advantage,” said Ajay (pic).

“Vendors that are able support the seamless sharing of content and applications across multi devices will have an advantage,” said Ajay (pic).

Although the growth in data is leading to an increase in ARPU for operators, revenue per incremental MB is falling, he noted. This is further complicated by the increased operator capital expenditure (capex) being incurred due to accelerating data volumes.

Asia Pacific users have shown high involvement in most of the social media platforms with Facebook topping the charts in most of the countries. In 2014, 68% of people in Malaysia were Internet users; out of which, 95% were Facebook users.

“It’s changed the chicken-and-egg situation – people are now getting on the Internet only because they want to get on their Facebook,” said Ajay.

Service providers are increasingly looking at social media platforms as an important tool in their overall promotion and marketing campaigns but do not have a clear strategy, according to Frost & Sullivan.

Operators are looking to establish themselves in the OTT (over-the-top) space and innovate at a pace that can match the incumbents. Tie-ups with social media partners would provide mobile operators with accessibility to increased target base for value added services, the firm added.

Related Stories:

US$64bil potential for IoE in Malaysia: Cisco

Malaysia to craft national IoT blueprint

Cloud use in SEA facing 'rogue cloud' challenge: Symantec

Mobile players must evolve to stay relevant: Frost

Utusan to explore IoE opportunities, in MoU with Cisco

For more technology news and the latest updates, follow @dnewsasia on Twitter or Like us on Facebook.