Indonesian startup investment hits US$3bil in 2017: Google – AT Kearney

By Yunnie Marzuki September 20, 2017

- Seventy-three percent of the investments are in seed or early stage funding

- In 2017 95% of the total investment value in Indonesian startups came from China

INVESTOR confidence in Indonesia’s startup market is rising with investment growing 68 times over the past five years to reach US$1.4 billion in 2016 and jumping to US$3 billion in the first eight months of 2017.

The “Indonesia Venture Capital Outlook 2017” was carried out by by Google and global management consulting firm, AT Kearney, between May and August 2017.

“Due to the massive growth, the value of startup investments in Indonesia may surpass the nation’s oil and gas investment which was US$5 billion in 2016,” said AT Kearney partner Alessandro Gazzini at a press conference.

Based on both a comprehensive analysis of the VC landscape and investment flows, as well as a broad range of interviews with over 25 local and foreign VCs, the study seeks to understand investor outlook and priorities in Indonesia and is the first in what is expected to become an annual publication.

According to the report, most of the investments are still in the seed or early stage funding. There was a total of 53 investment deals, 43% of which were seed funding and 30% Series A.

Late-stage investments, however, generate most of the value as 43% of the US$3 billion investment value was generated from Series C or later funding.

In 2017 95% of the total investment value in Indonesian startups came from China, with only 6% coming from other investors.

China’s Tencent invested in US$1.2 billion in Go-Jek, Alibaba Group invested US$1.1 billion in Tokopedia and JD.com invested US$500 million in Traveloka.

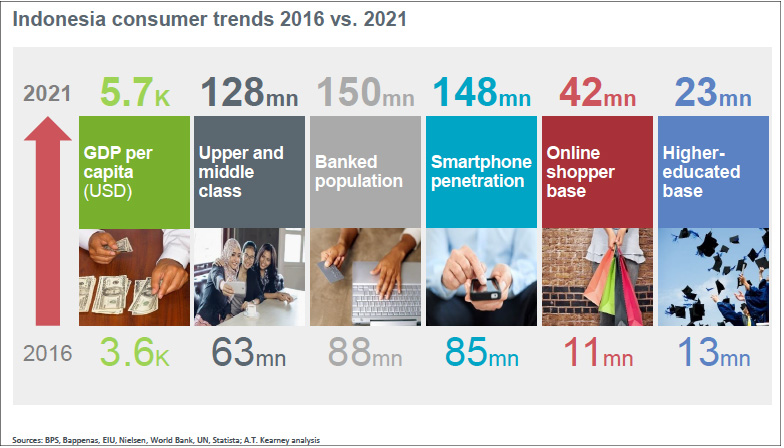

Venture capitalists (VCs) remain extremely bullish on Indonesia as an investment opportunity, given the country’s growing economy, emerging middle class and massive population of digitally savvy young people.

According to the report, 21% of local investors are likely to decrease investments, while 21% will maintain their investments and 57% will increase them.

On the contrary, only 20% of foreign investors said they were likely to decrease investments with 80% saying they were likely to increase them.

East Ventures managing partner Willson Cuaca says that local investors may decrease investments in startup because of a lack of role models.

“They have not seen any successful local investors, while everybody from China is already successful. This is what we called small winning when we want to build strong and big sustainable companies. It is okay to make small investment and have a quick win as it will create a different kind of signal.”

e-commerce and transportation come out top

The report shows that e-commerce and transportation heavily dominate startup investment in Indonesia.

Fifty-eight percent of total investments from 2012 to August 2017 was in e-commerce, followed by 38% in transportation.

It is anticipated that fintech and healthcare will emerge as top investment categories in the next few years as 67% of respondents voted for fintech and 25% for healthcare.

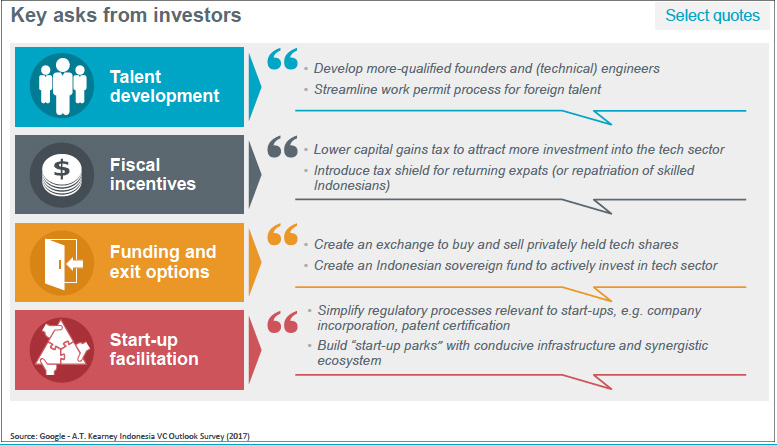

The report also highlighted four key focus areas to accelerate the growth of the Indonesian startup ecosystem, namely, talent development, fiscal incentives, funding or exit options and startup facilitation.

Sequoia Capital principal Abheek Anand says that there is a need to have “smart” entrepreneurs as startup founders. “The culture of taking risks needs to be there. It is okay to fail,” he says.

"We were blown away by how enthusiastic the VCs were and how incredibly bullish they are on Indonesia. The potential for growth is incredible but so is the need for engineers.

“This is not about incremental change. There needs to be a massive push to create more talent if these startups are going to be able to scale and meet demand," says Gazzini.

Government can play a strong role, as evident from mature markets,” the report finds.

“Future investment in start-ups is highly dependent on investor confidence in the market, so it is crucial to understand how investors view the Indonesian market, in both the near and long term.”

According to the report, a first for Indonesia, global investment values continued to soar over the last five years, though deal flow has stabilised and shifted to later stages (Series C and later stages) as VCs focus more on path to profitability versus topline growth.

Although the United States remains the world's start-up hub, Asia is growing the fastest on the back of China, India and Southeast Asia (SEA) investments. Drill down further and it’s clear that investment values in SEA are growing faster than anywhere else in Asia, with Singapore and Indonesia leading the pack.

By taking a deep look into the Indonesian start-up investment environment, this study provides a window into the investor mindset and suggests how business leaders and policymakers can implement improvements that will ultimately strengthen VC confidence and attract both local and foreign investment for many years to come.

Related Stories:

Week in Review: Indonesian (startup) Dream gains momentum, new believers

Unicorns: Not quite mythical, but a rarity in South-East Asia

China’s angels swooping down on Indonesia’s startup space

For more technology news and the latest updates, follow us on Facebook,Twitter or LinkedIn.