Emerging market regulators accelerate efforts to develop sustainable finance, strengthen cyber resilience

By Digital News Asia September 24, 2017

- Discussed responses to cyber threats from new innovation, technological sophistication

- Conducted a cyber simulation exercise developed in collaboration with market experts

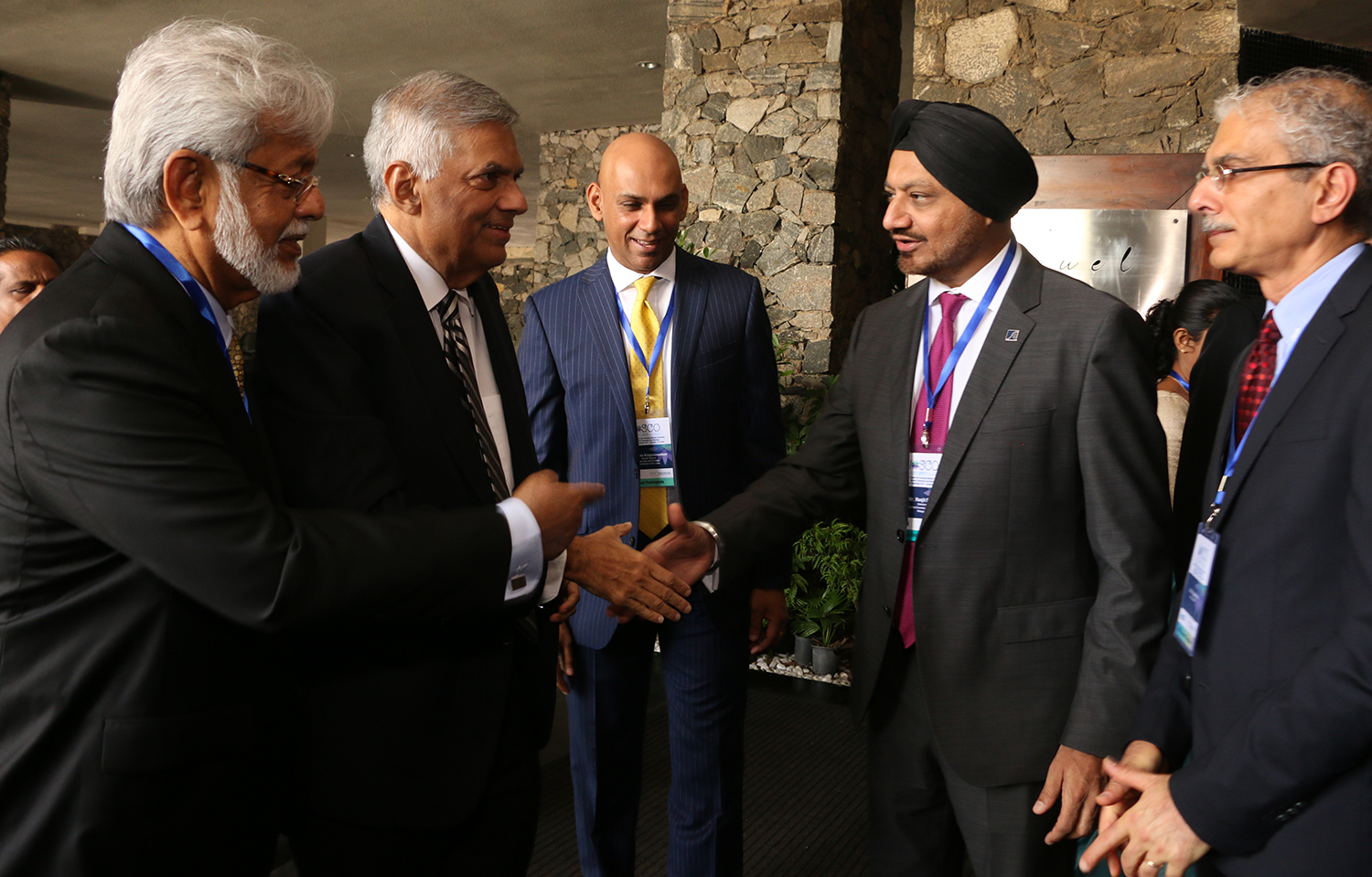

LEADING emerging market regulators met in Colombo, Sri Lanka, at the annual meeting and conference of the IOSCO Growth and Emerging Markets (GEM) Committee, chaired by the chairman of Securities Commission Malaysia (SC), Ranjit Ajit Singh, who is also vice chair of the IOSCO Board.

The GEM Committee annual meeting and conference were preceded by the meeting of the IOSCO Asia-Pacific Regional Committee, which were hosted by the Securities and Exchange Commission of Sri Lanka.

The two-day event attracted more than 300 participants from 50 jurisdictions. The Prime Minister of Sri Lanka, Ranil Wickremasinghe provided the keynote address at the GEM Conference.

Participants discussed measures to address challenges in scaling up sustainable market-based financing, including the role of policy makers, regulators and industry participants in promoting green financing solutions within emerging markets.

The role of international financial institutions in supporting sustainable capital markets was also reviewed.

Ranjit said: “There was agreement among emerging market regulators to accelerate the development of sustainable finance, including the establishment of a task force on sustainable finance”.

These efforts are also aligned with SC’s efforts in advancing Malaysia's position as a leading Islamic finance centre and its value proposition as a centre for sustainable finance, as seen by the recent issuance of the world’s first green sukuk under the SC’s Sustainable and Responsible Investment (SRI) Sukuk framework.

Given the increasing number and sophistication of cyber incidents occurring recently, the GEM Committee also conducted a cyber simulation exercise developed in collaboration with market experts to strengthen regulatory capabilities and preparedness in addressing cyber threats.

Ranjit said: “Greater regulatory cooperation is critical in strengthening resilience and regulatory expertise in relation to cyber threats.”

Key elements discussed included enhancing regulatory mechanisms and protocols in response to cyber threats arising from new innovation and growing technological sophistication across markets.

Also discussed were early warning cyber risk indicators and mechanisms to strengthen the sharing of cyber intelligence and information.

Other substantive areas discussed included key issues and challenges regarding liquidity in emerging capital markets.

The regulators also discussed how fintech is shaping capital markets and the balance between innovation and investor protection, particularly in areas such as cryptocurrencies and initial coin offerings (ICOs).

Related Stories:

Asean affirms importance of closer coordination of cybersecurity efforts in region

Malaysians’ concern about cyber security issues escalates: Unisys Security Index

The ever-evolving world of cyber security

For more technology news and the latest updates, follow us on Facebook,Twitter or LinkedIn.