2018 Malaysian ICT job market grows tepid; slowest salary growth in a decade

By Tan Jee Yee May 30, 2019

- Salaries are expected to grow by a smaller quantum in 2019, at 3.8%

- Declining growth, salaries likely due to economy, and government recalibration

.jpg)

THE latest ICT Job Market Outlook in Malaysia report – published anually by the National ICT Association of Malaysia (Pikom) in collaboration with job portal JobStreet – brought with it a sense of gloom.

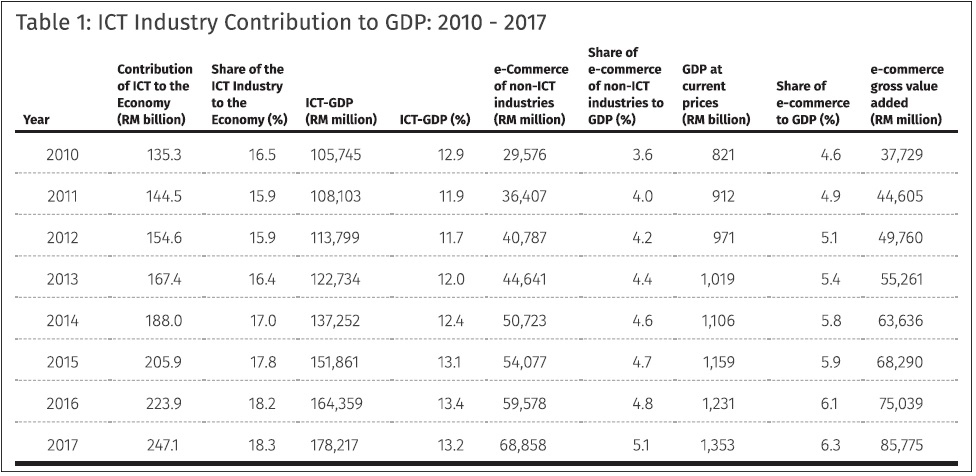

The report found that while the ICT industry continues to grow in size and contribution to the economy, the pace of its growth is slower than the desired rate. The share of national gross domestic product (GDP) by the industry increased by only 0.1 percentage point to 18.3% in 2017, from 18.2% in 2016.

It’s certainly not fast enough to hit 20% of GDP by 2020 – the report noted that the 11th Malaysia Plan envisioned a growth rate of at least 17% per annum from 2016 to 2020 in order for the industry’s GDP contribution to reach the 20% milestone.

Pikom’s projection now pegs the 20% goal as achievable in 2022, given this rate of growth.

It is, at the very least, worth noting that the country’s economic growth is conservative at the moment – 4.7%, as the report noted. During the report’s launch – the 12th issue now – Pikom chairman Ganesh Kumar Bangah said:

“With last year’s political upheaval and significant changes across all industries coupled with global trade’s persistent uncertainties, Pikom foresees a moderate improvement in 2019 with most projections by domestic and international agencies falling within the 4.3% to 4.8% range.

Yet it’s not the curtain call of doom yet. The report indicated that the slowdown may be arrested with the latest moves to develop Malaysia into a digital nation, with the advent of 5G, Industry4WRD, smart manufacturing, IoT, cloud computing and AI.

“On the positive side, we expect an economic rebound in the second half of 2020,” stressed Ganesh.

Slow growth of salaries

The tepid growth of the ICT industry is also reflected in its salaries. During the report’s presentation, Pikom’s organising chair of the Research & Publication Committee Woon Tai Hai said that salaries in the ICT industry grew at the slowest pace this decade, with the overall average monthly salary in 2018 only 4% higher than the previous year and significantly below the average annual growth rate (AAGR) of 6.7% over the nine-year period of 2009 – 2018.

Salaries are expected to grow by a smaller quantum in 2019, at 3.8%.

“While demand for ICT jobs remains healthy, employers seem to be more discerning in their employment choices. Job providers in 2018 appeared to be more conservative in their remuneration and at the same time more demanding in terms of experience and specific skill sets,” he says.

He added that the declining growth trends of both salaries and job openings is likely a response to the recalibration of the economy following the change in government in 2018, resulting in employers taking on a more cautious and wait-and-see attitude.

There are some surprises however. The report found that the Financial Services/Securities/Insurance industry cluster fell from its top position in 2017 to drop out of the five highest paying industries bracket for ICT professionals in 2018.

The reason for this, the report notes, is the much lower number of jobs advertised for this industry segments (473 openings) throughout the year.

Poll position is instead taken up by the Call Centre/IT-Enabled Services/BPO cluster, followed by the “usual suspects” of Computer/IT (Hardware), Banking and Telecommunications. New on the list is the Manufacturing/Production industry.

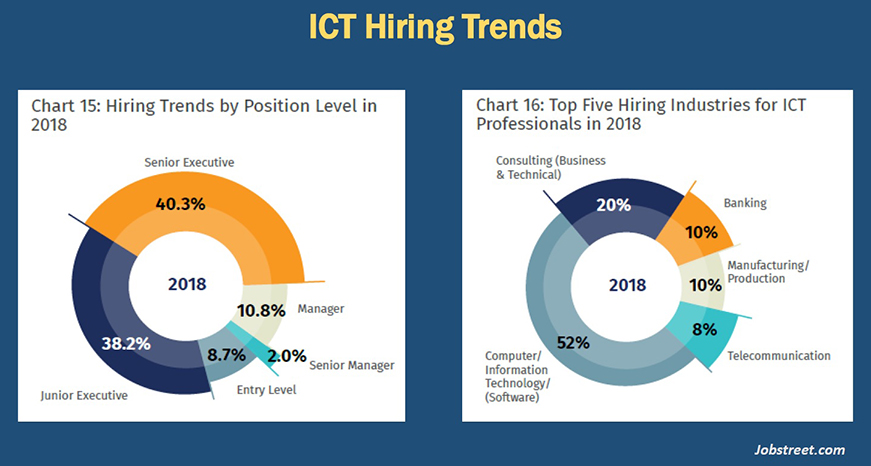

The Computer/Information Technology (Software) cluster is the highest among the top five hiring industries for ICT professionals, at 52% of the pie.

A salary gap to bridge

Woon highlighted that there is a widening gap between entry level professionals and those in higher positions, which is a cause for concern as it has the potential to draw away interest in ICT-related careers and education.

In the report, the ratio between the average monthly salaries of the senior manager and entry levels was 6.66 in 2018 compared to the year before. For last year, the report found that the average entry level salary stood at RM3,080 monthly, while senior managers raked in an average of RM20,521 each month.

Low starting salaries, Woon points out, may worsen the long-standing issue of brain drain with local talents opting for the higher wages and more favourable currency exchange rates in regional markets like Thailand, Singapore, China and Australia.

Average monthly salaries for entry level ICT professionals (with less than a year of experience) is increasing at a lower rate, too – 4.1% to RM3,080 in 2018 against the year-on-year growth of 5% in the previous year. Ditto for junior executive salary growths, which was noted to be at a slower pace.

On average, junior executives in the industry took home RM4,458 per month in 2018, which is 4.7% more than in 2017. It falls below the AAGR (average annual growth rate) of 5.3% in the 2009 – 2018 period.

Senior executives, on the other hand, increased at a faster rate of 5.8% as compared to the year-on-year increase of 4.9% in 2017. This, the report notes, is the highest growth rate for a position of this level since 2015. Senior executivess in the industry took home an average of RM7,469 in 2018.

Notably, senior ICT managers recorded the highest growth rate in salaries – growing by 7.2% to breach the RM20,000 milestone. In 2017, salaries in this position level grew 5.6%. That’s quite a significant leap.

It’s worth noting that senior executives were the most sought after in 2018, with 40.3% among all positions from entry level to senior managers.

Pikom expects the Malaysian economy to turn around by mid-2020, when the government’s newly-introduced initiatives in the digital space bear fruit.

“There is definitely light at the end of this tunnel, and the encouraging news is that many of our economic indicators such as employment, domestic investment, inflation, interest rates and exports are still healthy. However, we must not rest on our laurels as global factors are beyond our control,” says Ganesh.

Related Stories :