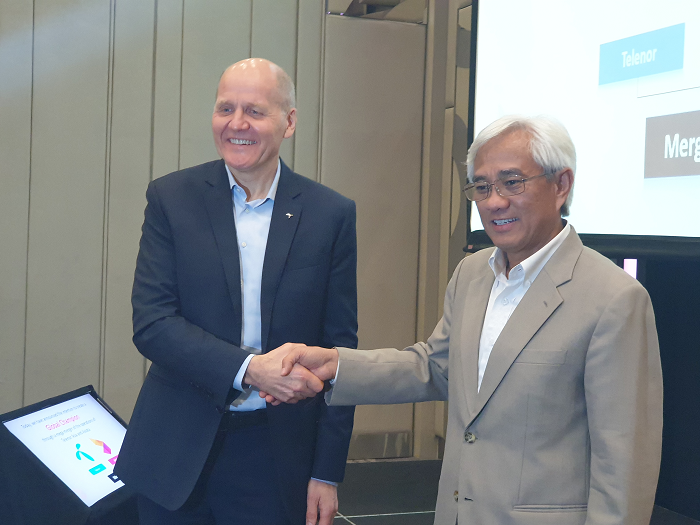

Telco Deep Dive 2019: Axiata-Telenor mega merger called off, fails to hurdle complexities

By Digital News Asia September 6, 2019

- Points to complexities of proposed transaction as getting in way of closing deal

- Acknowledge strategic rationale of merger, do not rule out future deal

After all the excitement and potential to unlock powerful game changing synergies, including becoming the largest telco group in Southeast Asia with expected revenue of US$11.9 billion (RM50 billion) and net profit of US$954 million (RM4 billion), the doubts and concerns have scuttled the deal as Axiata Group Bhd (Axiata) and Telenor ASA (Telenor) have mutually agreed to end discussions regarding a non-cash combination of their telecom and infrastructure assets in Asia (the "Proposed Transaction").

A media statement from Axiata points out that, “due to some complexities involved in the Proposed Transaction, the parties have mutually agreed to end the discussions.”

Acknowledging this, Axiata’s chairman Ghazzali Sheikh Abdul Khalid says, “The Board realizes the strong strategic rationale of the Proposed Transaction and is equally cognizant of the level of complexity of such a deal that extends across nine countries and 14 major entities.”

Since the proposed deal was first announced four months ago, both parties have been working on due diligence and finalising transaction agreements to be completed within the third quarter of 2019. And while that effort has come to naught, both parties still acknowledge the strong strategic rationale of the Proposed Transaction and do not rule out that a future transaction could be possible.

And while there has been plenty of murmurings and speculation, all unconfirmed, about hurdles, ranging from Indonesia’s unhappiness to the EU palm oil ban to headcount, senior leadership and shareholding stake, the Axiata statement stresses that the parties do not intend to provide further comments.

Digital champion aspirations still on track for 2022

Ghazzali also stresses that Axiata’s digital champion ambitions by 2022 remain firmly on track. “Regardless of the expressed synergies of the merger, we are confident that the termination of the Proposed Transaction does not affect the Group in achieving its Digital Champion ambitions,” he says, expressing the Board’s gratitude for the support of the Malaysian Government, Axiata investors and all its employees during this process.

Operating from a position of strength, Axiata expresses confidence in its capacity to leverage opportunities across the consumer, home, enterprise/IoT, digital and towerco businesses as the industry globally moves towards convergence.

Excellent YTD19 results and encouraging FY2019 target

As evidenced in the Group’s YTD 2019 results, Axiata’s “Shifting Gear” focus towards profitable growth and cash generation continues to demonstrate excellent momentum and growing confidence in the Group’s PATAMI outlook. Five out of six operating companies (OpCos) delivered highest profit growth in their respective markets which saw XL and Robi return to profit.

Celcom stabilised with improvements in PATAMI and EBITDA margin as result of its focus on network as well as sales and marketing efficiency. Digital Businesses is well on its way to a path of profitability with ADA expected to be profitable in FY2019.

edotco registered double-digit revenue and EBITDA growth.

The Group also announced it is likely to exceed its 2019 headline KPIs for EBITDA growth and ROIC with ongoing capex efficiency programme likely to deliver capex below guidance of RM6.8 billion for FY2019.

Mid- to long-term strategy to future-proof the Group

Axiata has made a major strategic shift towards Operational Excellence which will result in increased focus on profit and cash while future-proofing the Group with prudent investments in new growth areas of enterprise, home and digital VAS.

This will ensure its resilience in navigating an increasingly competitive business environment. The Group therefore, continues to stay on course, among others, in the execution of its operational excellence initiatives focusing on:

- Business Model Transformation to simplify, digitise & leverage analytics for “smarter” execution

- Network and IT Optimisation to drive capex efficiency through “sweating” existing assets, coupled with more centralisation and standardisation to maximise economies of scale

- Cost Excellence Programme on track to deliver US$1.19 billion (RM5 billion) savings, possibly even more with the above initiatives to prioritise near-term cash/profit & ROIC improvement

Axiata’s president and group chief executive officer Jamaludin Ibrahim said, “Axiata continues to be a growth story and remains one of the largest mobile operators in the region. Today, we are operating from a position of strength, with all eight OpCos performing well and looking cautiously optimistic to meet our 2019 KPIs.”

Moving forward, he highlights that the Group is transforming into, “a digital technology company in what can be described as an increasingly converged global industry, branching out beyond mobile and consumer to home broadband, enterprise, digital and TowerCo.”

Jamaludin also expresses confidence of reaping the benefits of its investments in new growth areas including Enterprise, Home, Digital VAS, Digital Businesses and Infrastructure in the next few years.

“We continue to actively explore possible consolidation and portfolio optimisation opportunities to extract synergies, maximise efficiency and fund future growth areas,” he says.