Unisys Security Index: Data security concern biggest barrier to consumers embracing digital identity-based services

By Digital News Asia October 26, 2018

- Malaysians are highly aware of data security issues

- Financial service providers need to gain trust to build consumer confidence

Malaysians are more concerned about data security issues – such as identity theft, credit card fraud and internet viruses or hacking – than the physical threats of natural disasters and war or terrorism, and this is impeding consumer take-up of new digital identity-based financial services – according to the 2018 Unisys Security Index.

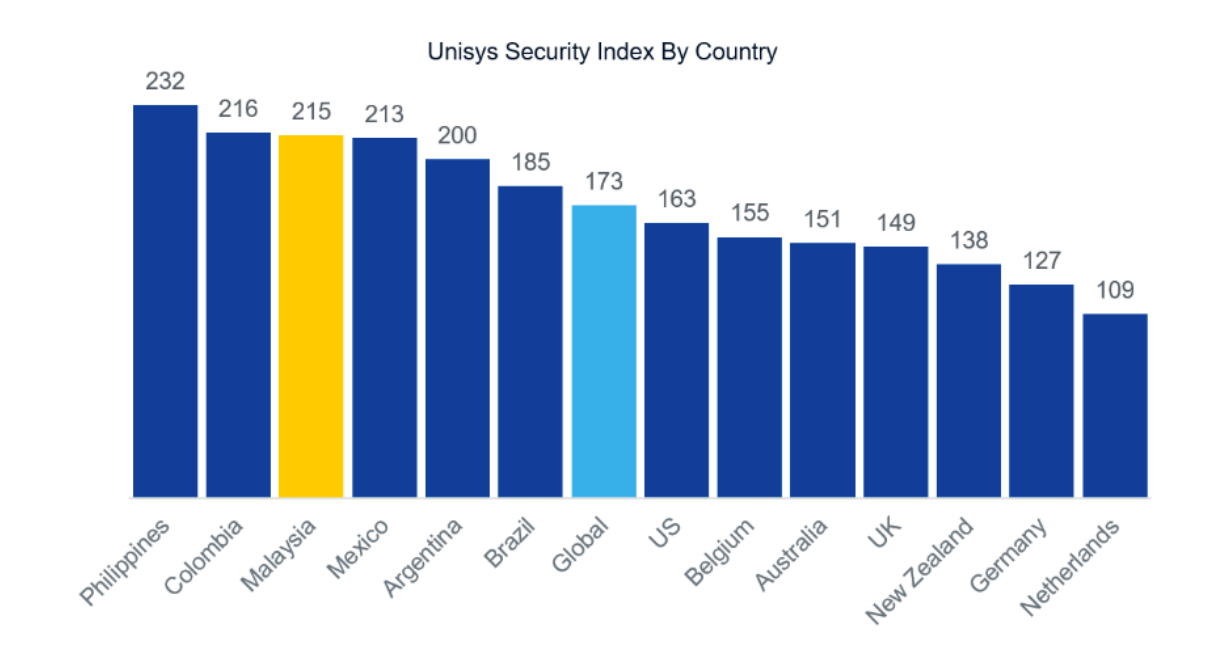

The only recurring snapshot of security concerns conducted globally, the 2018 Unisys Security Index of security concerns of the Malaysian public is 215 out of 300, where 300 represents the highest level of concern. This is unchanged from 2017 and the third highest level of concern of the 13 countries surveyed, behind the Philippines and Colombia. Women are more concerned than men, younger people aged 18-24 years are more concerned those aged over 55 years, and those on low incomes are more concerned than Malaysians on high incomes.

In the decade since the survey was first conducted in Malaysia, the intensity and nature of security concerns has evolved. The overall level of concern has steadily increased from 160 in 2008, driven by growing concern about data security issues, with viruses and hacking seriously concerning 80 percent of Malaysians in 2018 - almost double the number in 2008 (43 percent).

“The high Unisys Security Index for Malaysia reflects the growing awareness of data security issues that are likely to impact consumers directly - from credit card fraud and identity theft to viruses and hacking,” said Ian Selbie, solution director Financial Services, Unisys Asia Pacific.

Top three security concerns for Malaysians in 2018:

• Identity Theft: 86 percent of Malaysians are extremely or very concerned about unauthorised access to, or misuse of, personal information.

• Bank Card Fraud: 86 percent of Malaysians are similarly concerned about other people obtaining or using their credit/debit card details.

• Internet Virus/Hacking: 80 percent of Malaysians are concerned about this issue.

However, security concerns vary by location with a larger proportion of people living on the Peninsula concerned about the data security issues: credit card fraud, viruses/hacking and identity theft; whereas people living in East Malaysia are still more concerned about the physical threats of natural disasters and war or terrorism.

Data security concerns inhibit digital identity adoption

This year’s study also examined how comfortable Malaysians are with using various forms of digital identity to verify a person’s identity to access services online and offline. The majority of Malaysians are comfortable using some form of a digital identity to interact with government organisations, but support falls dramatically for using digital identities to interact with commercial and financial providers.

For example, 64 percent of Malaysian are comfortable using a single user ID and authentication to access multiple government services, but only 48 percent are comfortable using the same approach to access financial services from multiple providers – an offering that will be more common as open banking is rolled out across Asia. Only 36 percent are comfortable saving passwords, payment information and electronic keys onto a phone or wearable device to authorise contactless transactions. Concern about data security was cited as the main reason for not being comfortable with all types of digital identities considered in the survey.

“Malaysians are more open to embracing digital identities to engage with government organisations than with banking or commercial entities. This indicates that Malaysian financial service providers need to gain trust and build consumer confidence in the new types of integrated financial services that will be available in the coming open banking environment. Malaysians are typically digitally inclined, so those providers that show these data security concerns are addressed can use security as a competitive differentiator,” Mr Selbie explained.

For more additional results and information on the 2018 Unisys Security Index and to download a report on the Malaysian survey results, visit www.unisyssecurityindex.com.my.

Related Stories

As APAC embraces digital, consumer trust is in short supply

Sceptical Malaysians don’t believe what they see on social media