With takeover done, IBM aims to bolster its cloud business amidst challenges

By Edwin Yapp September 27, 2019

- IBM leverages on Red Hat’s container innovation in hope of boosting cloud biz

- Analysts argue path to success isn’t a walk in the park, citing various reasons

WITH the approval of IBM Corp’s US$34 billion acquisition of Red Hat Inc on July 9 by government regulators, Big Blue’s ambition to ramp up its cloud computing offerings just got better and bolder, according to its top technical executive in Asia.

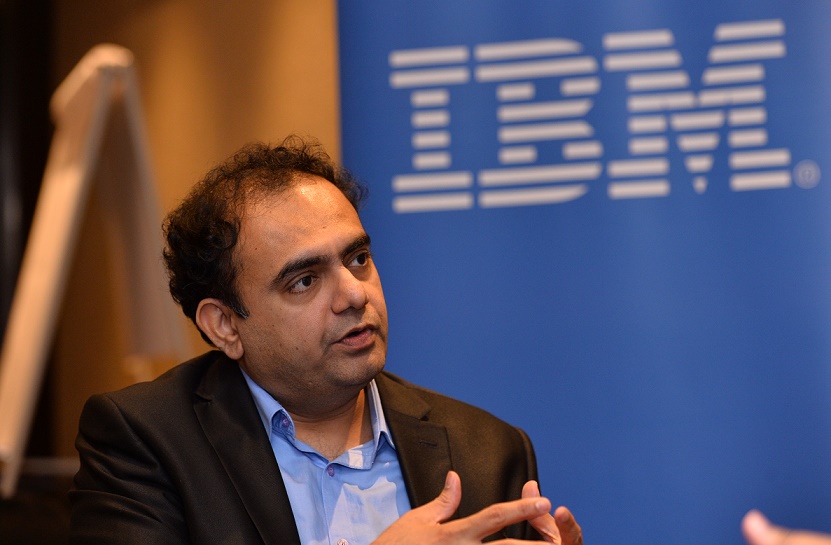

Speaking in an exclusive interview with Digital News Asia (DNA), IBM Asia Pacific chief technology officer Prashant Pradhan (pic) said IBM needs to ensure that it has an open, hybrid, multi-cloud strategy so that it can serve large enterprises that are not already on the cloud.

“If you look at Red Hat, a lot of the technologies that go into hybrid cloud including enterprise grade Linux, OpenShift, come from Red Hat,” he told DNA. “So it made a lot of sense that the enterprise-hardened variants of those open technologies should be part of our [IBM’s] portfolio so that we'll be in a much better position to serve our customers with hybrid cloud.”

On Oct 29, 2018, Big Blue surprised the world by coughing up US$34 billion to acquire Red Hat, approximately US$190 per share in cash, a 63% premium to its closing share price on Oct 26.

READ ALSO: From Red to Blue: Analysts’ views on IBM-Red Hat takeover

Prashant said to understand the rationale behind IBM’s takeover of Red Hat, one has to realise the importance of hybrid cloud to today’s enterprises. Claiming that only about 20% of the world’s enterprise workloads are on the cloud, Prashant stressed that there is still a lot of room to onboard the other 80% onto the cloud.

“The answer to this is [in the] hybrid cloud because cloud is about getting the data and workloads to work in the right environment, be it private or public or both,” he explained. “And if you look at what technologies are creating the foundations that go into hybrid cloud, it is open source,” he said, noting that the synergies between the two companies is what made the deal happen.

As an indication as to how committed IBM is to Red Hat’s acquisition, the company has bet its future on using Red Hat’s container technology OpenShift. A mere three weeks after the acquisition was completed, IBM announced that it has transformed its software portfolio – over 100 software products in all – to be cloud native, and is now optimised to run on OpenShift.

Containers are a lightweight alternative to – and are touted as being more efficient than – full virtualisation. The aim of containers is to allow developers to write software more quickly and to be more agile in deployment over multi-cloud environments. They are also much more portable and lightweight compared to virtual machines.

Known as Cloud Paks, IBM claimed that enterprises can now build mission-critical applications once and run them on all leading public clouds, including Amazon Web Services, Microsoft Azure, Google Cloud Platform, Alibaba cloud and IBM Cloud and even on private clouds, the company said in a statement.

IBM said Cloud Paks will be delivered as pre-integrated solutions and the IBM-certified and containerised software will provide a common operating model and common set of services – including identity management, security, monitoring and logging – and are designed to improve visibility and control across clouds together with a unified and intuitive dashboard.

Prashant said from IBM's perspective, the computing giant wants to move as many of its clients onto an open, hybrid and multi-cloud strategy. Practically, this means the deployment of enterprise-grade software that is based on open standards, and that is according to specifications that clients choose, he added.

"If it's a digital front end, then it may be deployed in a public cloud. If it's core banking services, data and artificial intelligence services then perhaps its can be on a private cloud.

"This move [Cloud Paks] is a significant enhancement to [our cloud strategy since] our ability to scale this concept depends on having the right platform. That's why we've taken all our own software portfolio, refactored it to run on OpenShift, and this becomes the common standard through which we will offer our services."

Will things change for Red Hat?

.jpg)

When IBM's Rometty first made this announcement last year, she had then said the Red Hat takeover was a "game-changer" as it changes everything about the cloud market.

“IBM would become the world’s No 1 hybrid cloud provider, offering companies the only open cloud solution that will unlock the full value of the cloud for their businesses.”

Initially, there were fears that IBM will overrun the Raleigh, North Carolina-based open source culture as it has always been dubbed as a “Switzerland” of the IT world – to be technology agnostic. Some analysts even argued that Big Blue doesn’t have a mixed track record, at best, with previous mergers and acquisitions.

On May 7, DNA reported from Red Hat's annual Summit that IBM’s largest acquisition to date will not change the nature of how Red Hat will operate.

READ ALSO: Red Hat will remain independent: IBM CEO

That said, the assurance by Rometty was still needed these past few months as the initial fears about changes afoot in Red Hat still persisted, even after the deal was approved by regulators.

When asked how the two companies would differentiate themselves from each other, Prashant echoed his CEO’s views, noting that the two companies will continue running independently of each other. He added that IBM is already seeing fruits from the takeover through the birth of Cloud Paks.

"Red Hat is the pre-eminent enterprise open source software provider and we have benefited from refactoring our software portfolio to give clients the option to move their mission critical workloads to the cloud, something they may have been hesitant to do in the past."

Prashant also argued that IBM pledges not to interfere with Red Hat’s approach to how it has always done business but instead will contribute by expanding its scope and reach, by giving the company greater access to many more markets because of IBM's enterprise pedigree.

He said IBM has a significant presence in the field where Red Hat can benefit from its technical sales and business sales in a bid to bolster its enterprise reach. Additionally, Prashant pointed out that Red Hat isn't fundamentally a services company although it may have some consultancy in certain niche areas.

"Red Hat doesn’t engage in large system integration implementations, support and maintenance," he claimed. "This is where IBM's global technology and global business services come in, as we will support Red Hat in this way."

Prashant added that IBM and Red Hat will engage in joint account planning in order to find synergies when going to market.

“Our ‘Synergy’ programme involves go-to-market channel, account and technology planning,” he said. “The aim is to look holistically and incrementally [into our planning] so that we can add value to our approach to market.”

Analysts weigh in

Several analysts noted that the path to IBM’s success with Red Hat isn’t free from hurdles.

Independent technology strategist Shaun Connolly argued in an op-ed on VentureBeat that the combination of Red Hat OpenShift is dependent on Red Hat Enterprise Linux (RHEL) CoreOS for its Kubernetes capabilities.

Connolly believes that the tight coupling of OpenShift with RHEL effectively means it is competing head-to-head with the container services from Amazon (ECS/EKS), Azure (AKS), and Google (GKE).

Rather than enabling the rich value of OpenShift to ride atop any of these cloud container services, this full stack approach from IBM (and now Red Hat) with diminished choice is a two-decade step backwards for today’s developers, he argued. This is are closer than ever to being able to develop and deploy modern applications anywhere they choose, he added.

“IBM/Red Hat appears to want to prescribe a monolithic stack of Red Hat products from top to bottom, all the way down to the operating system.

“Forcing OpenShift users to use Red Hat’s Linux stack is a strategy to protect revenue… This is a tectonic shift for IBM/Red Hat to navigate in their quest to be a credible cloud market contender. They will need the developer community on their side if they are to succeed.”

In a television interview, Bloomberg Intelligence analyst Anurag Rana believes that it will take another year or so before IBM can realise the benefits of their synergies, and bolster IBM’s top line growth for 2021.

On competition with other cloud players such as AWS, Microsoft Azure and Google Cloud Rana said, “IBM used to compete with these players but with Red Hat, IBM is kind of neutral and this will help customers move their workloads wherever they want.”

Rana said as long as Red Hat remains independent from IBM, it’ll actually help IBM’s customers who may want to put their workloads with other cloud players.

So in the long run, this will help IBM will generate more revenue by selling more software and services to these clients, he said.

“For independence [to work], Red Hat sales team should not go and tell customers that it can help customers move to the cloud but that they must shift it IBM Cloud,” he stressed, which would then be counterproductive.

On whether independence can be achieved, Rana was uncertain, noting that this has never been done before.

“But almost everything we have heard from press releases and the CEO [Rometty] points to the fact that this is the direction they are taking because if they don’t, it’s going to be very hard for them to be a good player in the cloud.”

Meanwhile, Tom Petrocelli, research fellow for Amalgam Insights told enterprise news portal ZDNet that there is still a valid concern that IBM will ruin Red Hat through a mix of internal politics and meddling.

“The short-term effect on that will be on hiring and customer retention,” he argued. “Red Hat customers are a loyal bunch, but many are already looking at a plan B. Employees are nervous but holding on. Both groups are primed for flight. One wrong move by IBM and a lot of customers and employees will bolt."

Related Stories :