Swiss Re study: Increase in digital platforms, Covid-enforced mindset is changing Malaysia’s insurance landscape

By Digital News Asia February 4, 2021

- 67% Malaysians express interest in using online channels for insurance purchase

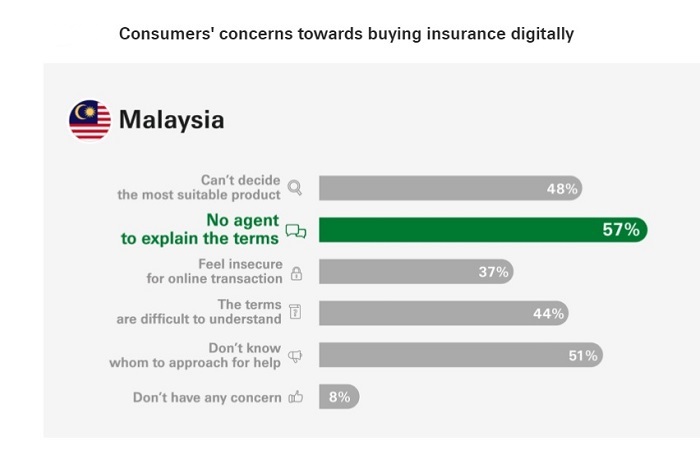

- 57% still prefer help from agent; offline and online hybrid for customer support is vital

Supportive government policies and a Covid-enforced spike in digital activity are pushing consumers and their insurance needs online, according to the latest study by Switzerland-based insurance company Swiss Re.

The study goes on to iterate that growing presence of e-commerce and digital wallet apps presents opportunities for innovative partnerships between insurers and digital platforms to bridge the US$47 billion health protection gap in Malaysia.

The survey finds that many consumers in Malaysia are willing to try new apps, with an increasing usage frequency and transaction amounts over time. Findings indicate that insurance products, when sold through e-payment and e-commerce platforms, stands a higher chance of success in Malaysia.

The Swiss Re Institute study, titled "Going Digital – Insights to Optimise Consumer Appetite for Online Insurance" surveyed 1,800 consumers in India, Indonesia and Malaysia in June 2020 to understand their attitudes toward digital platforms and perceptions of buying insurance online.

The survey also tested their acceptance of selecting and purchasing six life and health insurance products tailored to fit digital platforms. The three Asian economies represent a combined population of over 1.5 billion people, with a burgeoning middle class increasingly dependent on digital to drive their decision making.

Survey respondents were household decision-makers aged between 18 and 65 and had used digital platforms at least once within three to six months prior to being surveyed. These digital platforms include e-commerce apps/ websites, payment/ digital wallet apps, health-tracking apps, connected commuter platforms, among others.

“Health and safety measures intended for curbing the spread of Covid-19 have now driven a clear paradigm shift towards digitalisation in the post-virus era," says Swiss Re’s Client Markets, Life & Health Southeast Asia head Jolene Loh.

"With an increasing number of digital platforms extending their business reach into financial services, insurers need to adapt their business models to become more relevant and responsive to the latest customer needs.”

Digital platforms growing in popularity

The survey results indicate that digital platforms have high penetration rate in Malaysia, with an average of 64% using these channels at least once a week. Among them, e-commerce apps or websites such as Shopee in Malaysia are the most popular, used by 89% of respondents at least once in three months, closely followed by digital payment apps (75%), such as Touch n' Go

There is also a growing trend in seeking insurance information online and buying insurance digitally. Traditional channels, such as agents, brokers or referrals, are still the primary channels for insurance-related information searches in Malaysia. However, 67% of Malaysian respondents expressed interest in using online channels to purchase insurance in future.

Among the different types of digital platforms, Malaysians prefer to purchase insurance products from bank and insurer website or apps the most, driven by their trust as these platforms were rated as most credible. Digital payment and e-commerce apps were considered the next preferred digital insurance purchase channels in the future.

Preferences and support

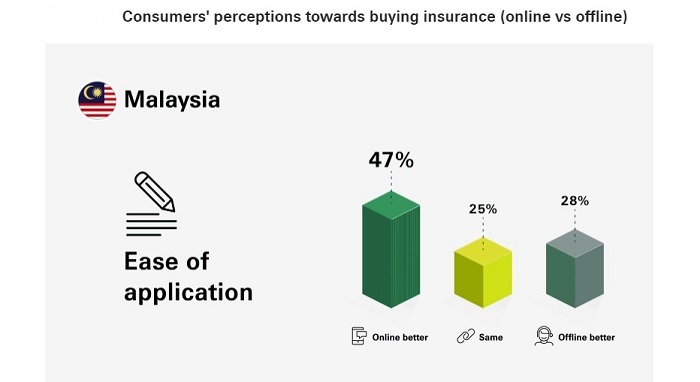

When respondents were asked why they want to purchase insurance digitally, ease of application and getting the best premium rates are the top reasons across all three markets. However, respondents also expressed various concerns when buying insurance online.

57% of Malaysian respondents still preferred to have an agent to help explain the terms while 51% felt that they were uncertain of getting adequate support, especially when they need help.

“Our survey results reveal that while digital insurance is becoming more popular, offline support is still necessary due to the need for guidance and assistance. It is important for insurers to adopt an omni-channel approach to complement online customer journey with personal assistance to address consumer concerns,” says Loh.

The survey tested six hypothetical life and health products to gauge consumer interest in insurance offered through different digital channels. They include medical reimbursement insurance, cancer reimbursement insurance (to cover cancer-related medical expenses), critical illness pay-per-use insurance, cancer insurance (pays a lump sum upon cancer diagnosis), hospitalisation cash – parametric haze/ smog protection and income protection for gig workers.

The results show that critical illness pay-per-use insurance has the highest chance of success for digital distribution in Malaysia, as consumers find its bite-sized transaction amounts palatable. The simpler cancer reimbursement product is also preferred over cancer lump sum insurance, especially in Malaysia.

Opportunities going forward

The survey illustrates potential engagement opportunities between insurers and digital platforms that will benefit the entire insurance value chain and unlock demand from new insurable risk pools.

Partnering and working with digital platforms and ecosystems will give insurers access to millions of consumers that are often under-protected, especially in markets across Southeast Asia. Insurers should leverage data collected from the platforms, such as health tracking apps, for personalised wellness programmes and a more holistic risk assessment by incorporating lifestyle factors like physical activity and sleep.

This could transform life and health insurance, where risks evolve over time and individual behaviours influence health outcomes.

Meanwhile, digital platforms can benefit from business diversification and stronger customer loyalty by offering financial services online. Partnerships across industries can also offer digital platform experience and expertise in different domains at low cost of failure and minimal risk to their mainstream offerings.

Digitalisation unlocks more opportunities for insurers to continually improve the customer experience, starting from digital distribution and predictive underwriting to efficient claims management. At the same time, insurers should personalise their digital offerings to drive uptake.

According to the survey, consumers in Malaysia are more willing to share general information such as age and occupation, and health information, such as height and weight, with insurers. There is a further spike of 20% of respondents willing to share such information should there be a premium discount.

“In 2021, it will be a priority for insurers to carefully calibrate their digital strategies to capitalise on the opportunities offered by digital platforms. Leveraging Swiss Re's underwriting expertise and risk management experience, not only can Malaysian insurers and platform partners learn but also apply their consumer insights to enable more customers to narrow.” Loh concludes.

-END-

Related stories:

Axiata Digital’s Aspirasi sees financing & insurtech as enabler for SME digitisation

Related Stories :