Fintech momentum has only grown during Covid-19, and is set to accelerate

By Tan Jee Yee May 5, 2021

- Fintech platforms saw spike in investors and investments

- Collaboration, including e-wallet integration, public-private partnerships, is the future

FINTECH has become a boon for investors looking for alternative means to diversify their assets – something that was gleamed from the recent Top in Tech Talk titled “Fintech: The Growing Digital Momentum.” The virtual panel, which featured the founders of Malaysia’s top fintech entities, found that the “digital momentum” has snowballed tremendously over the past year.

Take microLEAP, for instance. The Securities Commission-regulated peer-to-peer (P2P) financing platform, which is the first in Malaysia to offer both Islamic and conventional investment notes, saw a huge spike in terms of investors, or people lending on the platform.

The reason, as microLEAP founder Tunku Danny Nasaifuddin Mudzaffar puts it, is due to lower returns of investment (ROI) from more conventional investments. For one, the Malaysian central bank made four OPR (overnight policy rate) cuts last year, slashing interest rates from 3% to 1.75%.

“People are looking for yield,” Tunku Danny says. And yield is something that can be found on microLEAP’s platform, which he says provides returns of between 10% to 15% per annum, on both their conventional and Syariah-compliant investment notes.

This, and the fact that investors are heavily pushing for Syariah-compliant investment notes, grew the amount microLEAP was able to disburse. In April 2020, the platform only managed to disburse US$14,602 (RM60,000). By April 2021, that amount has increased to US$486,758 (RM2 million).

[RM1 = US$0.243]

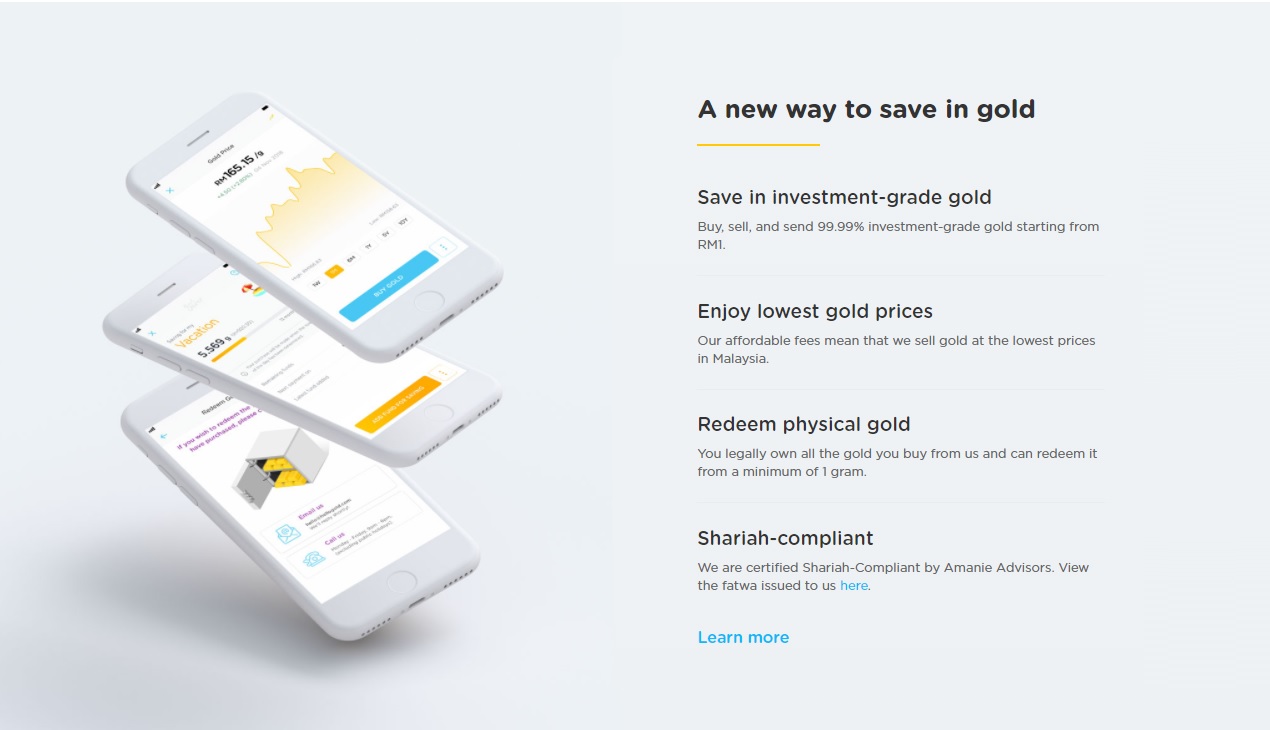

Fintech savings platform HelloGold, which allows users to invest in gold for as low as RM1, similarly experienced growth during the pandemic. Cofounder Ridwan Abdullah says that they were lucky.

“When the pandemic first hit, there was a lot of uncertainty in the market. We found that a lot of people had a higher propensity to save, and people started saving a lot more in gold,” he explains. In the last 12 months, HelloGold has onboarded between 20,000 to 30,000 new customers.

“In the last four months, we have done better than the previous four years,” he says. It certainly helps that the price of gold, as Ridwan puts it, “went on a run during the pandemic.”

For fintech platform Payfo, which is a startup owned by PNMB (Percetakan Nasional Malaysia Bhd), the pandemic had proven challenging. But it did expedite and push for digitalisation within Payfo and, as a whole, the PNMB group, says Payfo CEO Ezwan Annuar.

“We did bring forward some milestones. One good thing from the pandemic is that it expedited the cooperation between banks and Payfo. Things have been improving in the past few months, and banks are now more open with us,” he said.

Right now, Payfo is working with insurance companies, banks and even equity croudfunding players to create an ecosystem via Payfo’s joint app. More important, Payfo is onboarding employees within the PNMB group into their platform, especially into their Joy product, an e-commerce and rewards program.

For Payfo, the over 100,000 staff under PNMB is a captive market that they can capitalise – onboarding these workers mean attracting their peers and family members as users as well. The market and database is then a selling point to attract merchants to Payfo.

The startup plans to expand the market to the public by this year.

Regulatory strengths

Fintech players in Malaysia being allowed to thrive is the result of well-planted seeds, at least in the regulatory space. Both Tunku Danny and Ridwan agree that the Securities Commission (SC) of Malaysia, as well as the Malaysian Central Bank, manage to strike a balance between allowing fintech players to innovate while protecting investors.

Tunku Danny points out how the lack of regulations in China surrounding P2P lending led to a “Wild West” industry that caused an influx unregulated P2P lenders, leading to people losing a lot of money. Today, China has all but clamped down on P2P financing.

The SC, on the other hand, limited the number of P2P financing operators, and conducted due diligence in ensuring the operators remain fit for the license.

The SC, on the other hand, limited the number of P2P financing operators, and conducted due diligence in ensuring the operators remain fit for the license.

“In terms of stifling creativity, I think the SC is very pro-business and pro-innovation,” Tunku Danny says, adding that they are happy to be regulated under the SC.

Ezwan Annuar added that the Malaysian Central Bank (BNM) is “very proactive” in engaging with fintech players. PayFo has been in conversation with central banks in Singapore and Qatar – in an apple-to-apple comparison, Ezwan says that BNM is more proactive at letting fintech players thrive.

Collaboration the way forward

All three fintech players concur that collaboration is the way forward for the fintech industry. microLEAP last year partnered with the Malaysian Technology Development Corporation (MTDC) as their Islamic P2P financing partner.

Under it, MTDC would fill up 30% of any investment note for tech companies seeking alternative financing, while the remaining 70% would be raised by investors on microLEAP’s platform.

“This kind of public-private partnership is the way going forward – tying up with big government-linked entities like MTDC is the kind of how we are growing our investor base,” Tunku Danny says.

HelloGold on the other hand is looking on integrating their services with e-wallet providers, essentially allowing e-wallet users to invest in gold within their platforms.

HelloGold on the other hand is looking on integrating their services with e-wallet providers, essentially allowing e-wallet users to invest in gold within their platforms.

“We think that e-wallets have done an awesome job at onboarding and acquiring customers, and acquiring merchants. What we think is that, they are the probably the best distributors for us,” Ridwan notes.

HelloGold is learning from their mistakes. When they first entered the Thai market with no partners, it was a “relatively painful experience.”

“So we have shifted the mindset about two years ago, where we would only work with partners, and we will become the back of house for products like this,” Ridwan says, adding that they’re hoping to announce these partnerships sometime this year.

For Payfo, their entire fintech products ecosystem is to facilitate cooperation. According to Ezwan, they are currently working on a project with a local bank to bring their backend into Payfo’s Joy platform. Payfo can then serve as their distribution and online marketing arm, while their users can utilise Joy for loan applications. The situation, as they say, is win-win.

Tunku Danny believes that more players are coming into the fintech space, with big technology companies shifting into “techfin” entities (with a focus on tech first, finance after). It’s not a concern – according to the SC, there is an RM80 billion funding gap for small businesses in Malaysia, a pie he feels is big enough “for all the players to play”. He believes that, in time, we’ll witness more aggregation, with bigger players buying a lot of the smaller ones.

“For small startups like us, it’s all about the collaboration. We want to collaborate with the e-wallet players, the money lenders as well. We’re trying to serve the same set of people. The pie is big enough, and we can work together to help people get the financing they need,” he says.

Related Stories :