Axiata 3Q net profit falls 7% to RM238.53mil, revenue rises to RM6.2bil

By Digital News Asia November 24, 2017

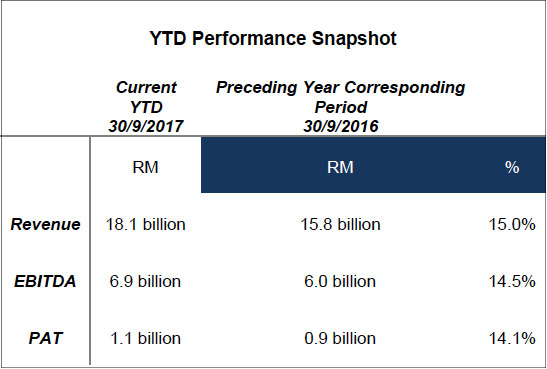

- Total revenue improves 15.0% to RM18.1 billion YTD

- YTD Ebitda up 14.5% to RM6.9 billion with a margin of 38.1%

AXIATA Group Bhd saw third quarter net profit fall 7% to RM238.53 million, from RM256.56 million a year earlier.

Revenue, however, rose on growth in its Malaysia and Indonesia operating units. In a statement to Bursa Malaysia on Nov 23, Axiata said revenue rose to RM6.2 billion in the third quarter ended Sept 30, 2017 (3Q 2017), from RM5.46 billion, on the back of strong growth from Malaysia and Indonesia.

Performance in revenue was fuelled by traction in the data revenue segment, contributing 46.8% of service revenue, as compared to 35.5% in 3Q 2016.

The company's 3Q 2017 profit after tax rose to RM319.07 million, from RM295.75 million. Minority interest was higher at RM80.54 million, against RM39.19 million in 3Q 2016.

During the first nine months of FY17 (9M 2017), Axiata's net profit climbed to RM884.76 million, from RM813.75 million a year earlier. Revenue was higher at RM18.14 billion, versus RM15.78 billion in 9M 2016.

Total year-to-date (YTD) revenue was up 15% to RM18.1 billion from RM15.8 billion in the corresponding period last year.

Revenue growth was mainly driven by the data segment with data revenue contributing 44% of service revenue as compared to 33% in YTD 2016.

An ongoing cost optimisation programme and improved performance by OpCos contributed to a 14.5% increase in Ebitda to RM6.9 billion from RM6 billion for the same period in 2016. The programme achieved a RM960 million in savings and avoidance YTD, exceeding the target of the RM800 million for full year 2017.

YTD PAT improved by 14.1% to RM1.1 billion on the back of EBITDA improvements and forex translation gains.

Quarter-on-quarter (q-o-q) revenue for the group improved 2.4% to reach RM6.2 billion, Ebitda grew 8.9% to RM2.5 billion while PAT was down 33.4% to RM319.1 million, impacted by the losses at Idea and forex.

Asean markets

Celcom Axiata Bhd and PT XL Axiata Tbk continued to show improvements in revenue and Ebitda whilst Smart Axiata Co Ltd maintained its overall performance despite an increase in price competition.

Q-o-q total revenue and service revenue grew 2.1% and 1.9% respectively, ahead of industry performance.

Prepaid revenue improved by 3.7% driven by positive traction from data leading to a higher prepaid average revenue per user (Arpu) for the quarter. Celcom’s postpaid Arpu improved by RM2.

XL’s service revenue grew 5% q-o-q on the back of a 10.9% higher data revenue. Data revenue at XL now outpace the decline in legacy voice revenue.

Ebitda at XL improved 10% q-o-q driven by revenue improvement and focus on cost efficiencies.

While the Cambodia market undergoes a sharp increase in price competition, on YTD basis, Smart maintained its overall performance. Revenue, Ebitda and PAT for Smart grew 9.3%, 9.4% and 8.9%, respectively, while data revenue rose by 35.2%, accounting for 51% of total revenue.

“I am encouraged with the quarter-on-quarter improvements at Celcom, although there is still more work to be done. Likewise, XL has been successfully executing on its transformation strategies and our other mobile OpCos remained on a strong growth course.

“edotco’s sustained performance and drive for operational efficiencies are starting to significantly contribute to the group’s financial performance.

“Furthermore, our group-wide cost optimisation programme had surpassed our full year goal within the first nine months to achieve RM160 million above target and deliver of RM960 million in cost savings and avoidance,” said Axiata president and group chief executive officer Jamaludin Ibrahim (pic, below).

South Asia markets

YTD revenue at Dialog Axiata PLC’s mobile, fixed and pay-TV operations grew 10.7%, 34.6% and 1.2%, respectively.

Overall revenue improved 8.5% on the account of strong data revenue growth as a result of higher data subscribers and data usage.

Ebitda for the quarter grew 15.6% q-o-q backed by cost initiatives.

Robi Axiata Ltd recorded a solid quarterly performance, with q-o-q Ebitda margin improving 6.3 percentage points to 22.2% driven by integration with Airtel.

Robi’s service revenue improved 4.1% q-o-q to outperform the industry. At the same time, subscriber and revenue market share rose to 29.3%, up 0.2 percentage points and 28%, up 0.5 percentage point respectively.

Since launching 4G in June, Ncell Private Ltd offers 4G services in 19 cities in Nepal, driving data revenue growth of 15.4% q-o-q.

YTD data revenue grew by 17.2% to account for 18.3% of total revenue. YTD core revenue and Ebitda grew 7.2% and 18.8% respectively while core Ebitda margin increased by 5.1 percentage points to 52.1% from cost initiatives.

Axiata’s new businesses and associates

edotco Group Sdn Bhd recorded growth from expansion of its portfolio and higher tenancy ratio. YTD basis, edotco accounted for about 6% and 7% of group revenue and Ebitda respectively.

Driven by higher tenancy across all its operating countries and the maiden contribution from its Pakistan operations, edotco recorded revenue growth of almost 10% year-on-year (y-o-y).

Its y-o-y tenancy ratio rose to 1.5x from 1.4x. In August, edotco announce its biggest expansion plan with the proposed acquisition of Deodar Private Limited to obtain approximately 13,000 more towers in Pakistan.

Upon completion, edotco will be the eight largest independent tower company globally with close to 40,000 sites in its total portfolio.

Axiata Digital Services Sdn Bhd with its portfolio digital companies and business units is now focused on a few strategic verticals and monetising its assets. Its digital financial services (DFS) portfolio continues to build its presence and ecosystem and has been improving on its contribution to the group’s core business.

Continued disruption in the Indian mobile industry led to Idea Cellular Ltd registering a negative contribution of RM156.4 million for the quarter while M1 Ltd contributed a profit of RM30 million to the group.

“As we continue to be impacted by the challenges in India, we remain focused on driving improvements at Celcom and XL, and continue with our successes in strong execution in all our other markets.

“We are also very focused on our group-wide cost optimisation initiatives. In terms of growth opportunities, we are growing in all our frontier markets as well as in edotco and our digital businesses.

“Nevertheless, we are cautiously optimistic on our fourth quarter performance given the recent surge in competitive activities in Indonesia and Cambodia, and remain very concerned with the Indian market,” concluded Jamaludin.

Related Stories:

Axiata Group accelerates its digital talent transformation ambitions

Axiata Digital, MDEC collaborate to extend MIFE API Platform

Celcom trying to create a startup culture to regain its mojo

For more technology news and the latest updates, follow us on Facebook, Twitter or LinkedIn.