Asia Pacific ICT spending to grow despite headwinds: IDC

By Digital News Asia September 13, 2022

- ICT spending expected to reach US$1.4 trillion by 2026

- Investment in the education expected to grow slower in 2023

According to IDC’s latest release of Worldwide ICT Spending Guide Enterprise and SMB by Industry, the firm forecasts Asia/Pacific’s ICT spending to grow by over 3.8% in 2022.

According to IDC’s latest release of Worldwide ICT Spending Guide Enterprise and SMB by Industry, the firm forecasts Asia/Pacific’s ICT spending to grow by over 3.8% in 2022.

The research firm said this is expected to reach US$1.4 trillion (RM6.2 trillion) by 2026 with a compounded annual growth (CAGR) of 5.2% by the end of 2026.

It said consumer technology spending in Asia/Pacific as been hit, with growth slowing in 1H2022. However, enterprise technology spending, including service providers, remained strong, IDC said.

The firm said the ongoing supply chain constraints, geopolitical tensions, rising inflation, weakening of local currencies against the US dollar, and a resurgence of infections in pockets continue to impede economic recovery post-Covid-19.

Tightening monetary policy to manage rising inflation in the region is driving an increased risk of economic slowdown and poses solid headwinds for ICT spending growth in the next 18 months, it said.

Vinay Gupta, research director, IT Spending Guides at IDC Asia/Pacific, said IT spending in the region has moved from exuberant growth last year to that of strategic growth.

"Technology budgets are stable as of now, however, leaders will place greater scrutiny on technology investments as they represent a much larger share of spend and also to allow them sustainable business growth," he said.

The survey notes that Asia/Pacific is home to a mixed bag of countries.

It highlighted that countries such as Singapore, South Korea, India, Thailand, and Taiwan, are net importers of energy and commodities and are facing the brunt of increased imported inflation due to the weakening of the local currency.

Whereas Indonesia and Australia, which export commodities such as coal, oil, and gas, have benefited from the current situation, it added.

Their inflation results from the increasing demand due to the opening of the economy and supply chain constraints, the survey said.

Overall, few industries are expected to have a slight slowdown in 2022 ICT spending, mainly owing to the global challenges, and expected to grow wearier throughout 2022 until government measures fall into place to keep the economy stable, it added.

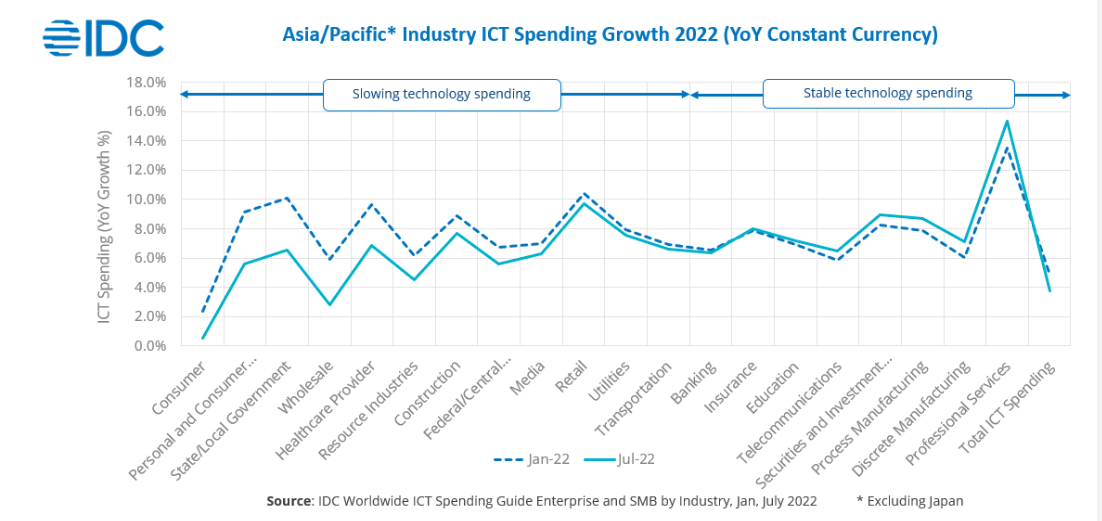

The above chart shows the difference in 2022 technology spending growth between the January and July releases of worldwide ICT spending guide enterprise and SMB by industry.

Consumer-driven sectors such as personal and consumer services, wholesale, construction, and retail have slowed down due to rising inflation or lockdowns to control infection spread, depending upon the geography in question, IDC said.

Industries with lesser dependence on consumer discretionary spending or which provide essential services are showing stable technology investment, it said.

These include banking, insurance, telecommunication, securities, investment, and professional services.

Mario Allen Clement, associate research manager, IT spending guides at IDC Asia/Pacific said, "Enterprises may continue to focus on operational efficiency. However, new initiatives may be stalled."

According to the survey, education is expected to grow slower in 2023 as IT investments may be stalled due to excess and sudden spending in 2021, followed through in 2022.

Wholesale on the other hand is expected to have a higher bounce back as budgets focus on improving omnichannel selling, growing commerce ecosystems, expanding into global markets, inventory transparency, and automation, the research showed.

IDC noted that Large Business (more than 1,000 employees) continue to hold the largest market throughout the forecast and it contributes to almost half of the ICT Spending, excluding the consumer segment.

The Worldwide ICT Spending Guide Enterprise and SMB by Industry is IDC's flagship all-in-one data product capturing IT spending across more than 100 technology categories and 53 countries.

Related Stories :