Hugosave raises US$4 million in pre-series A funding

By Digital News Asia July 14, 2022

- Funding round brings total fund raise to date to US$10.5 mil

- 1982 Ventures, Woodside Holdings Investment Management participated

Singapore-based wealthcare and savings app Hugosave announced that it has successfully completed its US$4 million (RM17.7 million) pre-Series A funding round, bringing the total amount of funds raised to US$10.5 million (RM46.5 million).

Singapore-based wealthcare and savings app Hugosave announced that it has successfully completed its US$4 million (RM17.7 million) pre-Series A funding round, bringing the total amount of funds raised to US$10.5 million (RM46.5 million).

In a statement, the fintech startup said the majority of its funding was provided by current shareholders, including 1982 Ventures and Woodside Holdings Investment Management, and several existing corporate venture investors.

It said the funds will be used to accelerate Hugosave’s presence in the region, increase its breadth of offerings and improve its user’s journey.

Herston Powers, co-founder and managing partner of 1982 Ventures, said Hugosave is growing rapidly and demonstrating that fintech startups can fill the gap in the digital wealth management space with their unique solutions.

“Its easy-to-use platform and strong product offering to users as they spend, save and invest, makes Hugosave particularly exciting to the next generation of investors”, he said.

Meanwhile, chief executive officer and co-founder, David Fergusson claimed that in the past two-and-a-half years, the startup has created a product, built a team, received licenses, gained customer traction, built a state-of-the-art data capture and analysis process, and built partnerships.

“This fundraising is another major milestone,” he said.

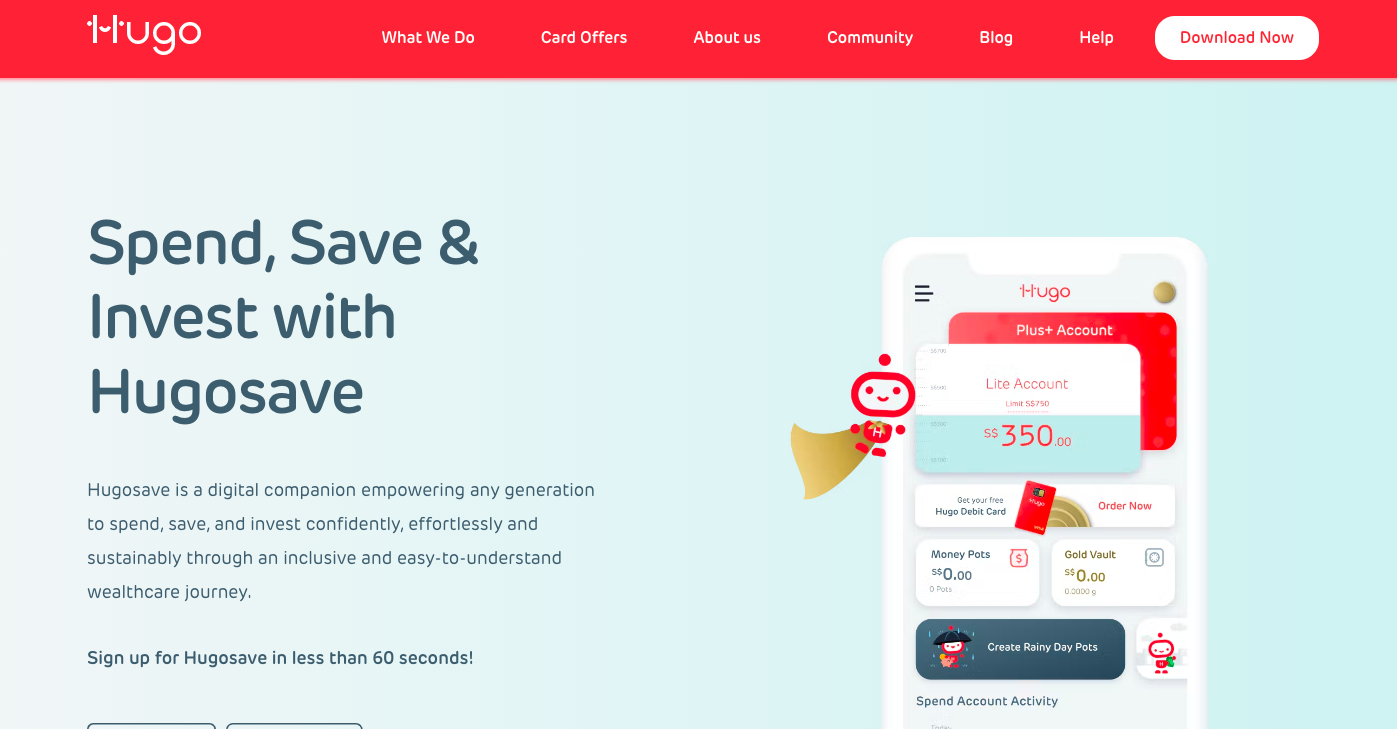

Founded in December 2019, Hugosave aimed at making financial fitness attainable to everyone through its patented 'wealthcare' concept.

Since the launch of its app in July 2021, Hugosave claimed to have increased the financial fitness of over 40,000 users, as they develop healthy habits by spending smarter, saving more, and investing diligently.

Chief product officer, Braham Djidjelli, Hugosave said “Hugosave is a wealthcare and savings app built for the open banking era.

“Our modular architecture is a truly open platform, allowing us to build partnerships with anyone looking for an embedded finance solution.

“Combined with our behavioural engine, this gives us the ability to create exciting and highly personalised financial journeys for our users,” he said.

To make the savings journey seamless and automated, Hugosave allows users to save while they spend through roundups and enjoy partner offers while avoiding unnecessary fees.

These savings can then be preserved and grown through safer investment options such as gold, it said.

“When it comes to investing, many don't know where to start. We want to help people develop sustainable healthy financial habits by creating a super easy and enjoyable investing journey, with a focus on education and user-centric activities,” said Ben Davies, chief operating officer of Hugosave.

Related Stories :