Malaysian Telcos’ Q3 2016 report card: Who’s the winner?

By Goh Thean Eu November 29, 2016

- Maxis managed to regain its prepaid momentum, closing in on Digi

- Celcom spent the most on capex so far this year, despite the challenges it faced

LATE last week, regional telecommunications company Axiata Group Bhd announced its third quarter financial results. It was a much-awaited announcement as it provides industry observers a glimpse of how the mobile telecommunications industry has been shaping up this year.

As always, there were some numbers that were within expectations, and some that were surprising. More importantly, some of the key metrics may be suggesting that it will be a very tight race in the fourth quarter – with the possibility of a change in market leadership.

Here’s a look at how these telcos performed head-to-head (-to-head) in some of the key metrics:

Who has the most customers?

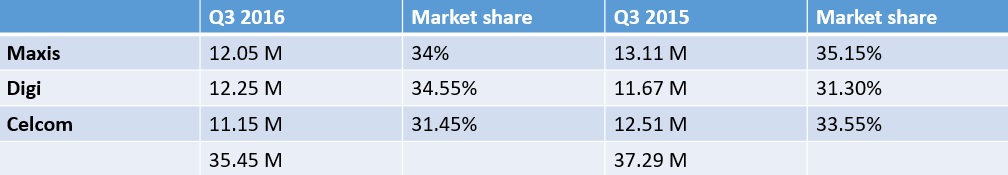

Total customer base

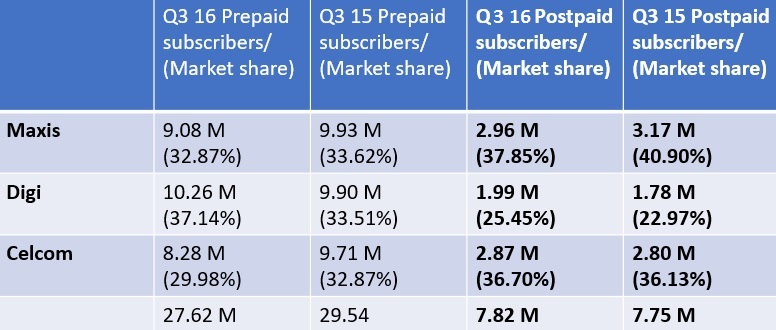

Prepaid and postpaid customer base

Just like the previous quarter, Digi.Com Bhd – once the smallest player among the incumbents – continues to hold the pole position in the overall subscriber base market share with a narrow lead of 34.55% share. (The lead was even narrower for Digi in Q1 – when it had 33.6% market share against Maxis’ 33.5% share)

Digi managed secure its leadership position mainly thanks to its ability to grow both its prepaid and postpaid customer base at a time when its rivals are struggling to do so. Over the past 12 months, its prepaid customer base grew by 360,000, and postpaid customers expanded by 210,000.

While Digi managed to grow its postpaid base, it is still unable to get close to Maxis. Maxis ended the third quarter as the “Postpaid King” with more than 2.96 million postpaid customers, about 970,000 customers more than Digi. [Correction: An earlier version said that Maxis had about 97,000 more postpaid customers than Digi. The error has been amended]

Next page: But, who makes more money?