Tune Talk confident of being profitable by year-end

By Karamjit Singh April 11, 2013

- Starting to look beyond Malaysia and at the Asean market

- Will ride on AirAsia’s regional footprint to achieve goal

HIS company is already the leading Mobile Virtual Network Operator (MVNO) in town, claiming 700,000 active subscribers as of end-February 2013, with an ARPU (average revenue per user) of between US$10 to US$13 a month and with RM200 million (US$65.9 million) in revenue for 2012.

HIS company is already the leading Mobile Virtual Network Operator (MVNO) in town, claiming 700,000 active subscribers as of end-February 2013, with an ARPU (average revenue per user) of between US$10 to US$13 a month and with RM200 million (US$65.9 million) in revenue for 2012.

But that did not stop a concerned Jason Lo (pic), Tune Talk Sdn Bhd chief executive officer, from writing to industry regulator the Malaysian Communications and Multimedia Commission (MCMC) urging it to stop issuing licenses for new MVNO players.

His rationale? “The incumbent Big Three had about 20 years to form what is quite clearly a loose oligopoly today. I think it is sensible to afford the MVNOs a gestation period too.”

Lo notes that some MVNOs have squandered the opportunity given, through a combination of the wrong business model and poor execution, and are not in the market anymore.

“This puts all MVNOs in a bad light as it affects our brand, with consumers thinking why bother with MVNOs when they are not reliable. This reinforces the position of the Big Three,” says the former singer who also ran his own record label and events promotion company besides being involved in football with MyTeam.

His request however was rejected by the MCMC. Still, Tune Talk seems to have a lot going for itself, with Lo targeting to hit an audacious five million active subscribers by end-2015.

While conceding this was “partly imposed” by shareholder Tony Fernandes, the founder of budget carrier AirAsia, Lo himself likes stretch targets, with his immediate target being to hit one million active subscribers by the end of this year and to become profitable.

His confidence stems from the belief that Tune Talk has now turned the corner in its battle to gain market acceptance. “It typically takes between three to five years for a brand to mature, with the paradigm shift for us in customers’ minds happening sometime last year.”

Having turned this corner, he feels that customers will inevitably recognize Tune Talk as providing the cheapest rates in town, “and then we will start to take off.”

Helping them take off will be a slew of promotions starting with a money-back guarantee the company ran after Chinese New Year earlier this year.

“We are the only pre-paid service to offer consumers a money-back offer if we did not save them money after they switched over,” he says. “No one else dares do this but we are very confident we will save you up to 50% of your bill.”

The campaign saw Tune Talk record a jump of a few hundred per cent in its port-in number – that is, those who switch from one telco to another without changing their mobile number.

But Tune Talk is not just relying on cheap rates. Showing Digital News Asia (DNA) a study done by the MCMC, Tune Talk came up first in four of the five categories, including customer service.

“That shows that MVNOs are not just about cost but can compete in quality of services too,” says Lo.

Eye on Asean

But Tune Talk has a bigger target in mind that lies beyond Malaysia. Lo has said in the past that as an MVNO, it needs to tap the synergies of being in the powerful Tune Group of companies which has interests ranging from insurance and hotels to, of course, air travel.

Indeed AirAsia is the key to its success or, to be specific, the airlines’ Asean footprint.

With roaming charges scaring everyone off from using their SIM in another country and being a source of great frustration among mobile users, Tune Talk’s 1 SIM will probably be well received in Asean.

Tune Talk’s 1 SIM will automatically detect when a user is in another country where there is a Tune Talk presence and will switch the user to a local number.

It has not been easy though. “Roaming is incredibly complicated and very tough technically. It has been a long and tough journey for us to tackle this 1 SIM challenge as there are so many factors at play here, from signalling and carrier negotiations to billing and support … but we are getting there,” says Lo.

It has not been easy though. “Roaming is incredibly complicated and very tough technically. It has been a long and tough journey for us to tackle this 1 SIM challenge as there are so many factors at play here, from signalling and carrier negotiations to billing and support … but we are getting there,” says Lo.

“It has always been in our plans to launch a single SIM for the Asean market but we needed to be strong and established in Malaysia first,” he points out.

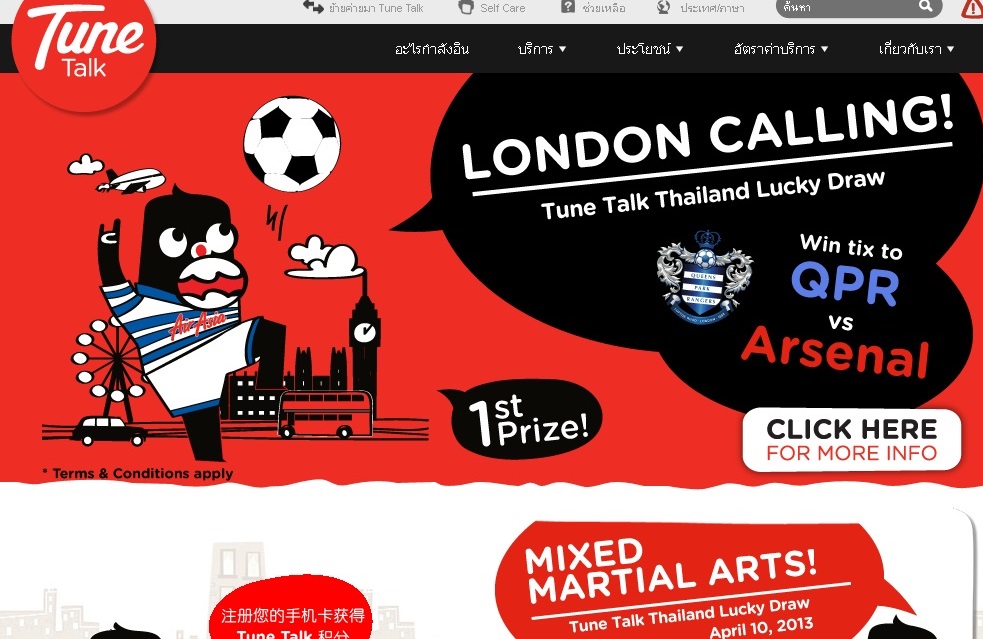

With that looking a distinct possibility, Tune Talk has already started on its Asean strategy with Tune Talk Thailand launching in February in partnership with TOT of Thailand on its 3G network.

Indonesia and the Philippines are next. A partnership is already in place in the Philippines, with the final details being worked out before it launches there.

Related Story:

Ninetology unveils budget phone, banks on youth to spur growth

For more technology news and the latest updates, follow @dnewsasia on Twitter or Like us on Facebook.