Asia’s mobile-enabled transformation needs regulatory support: GSMA

By Digital News Asia June 28, 2013

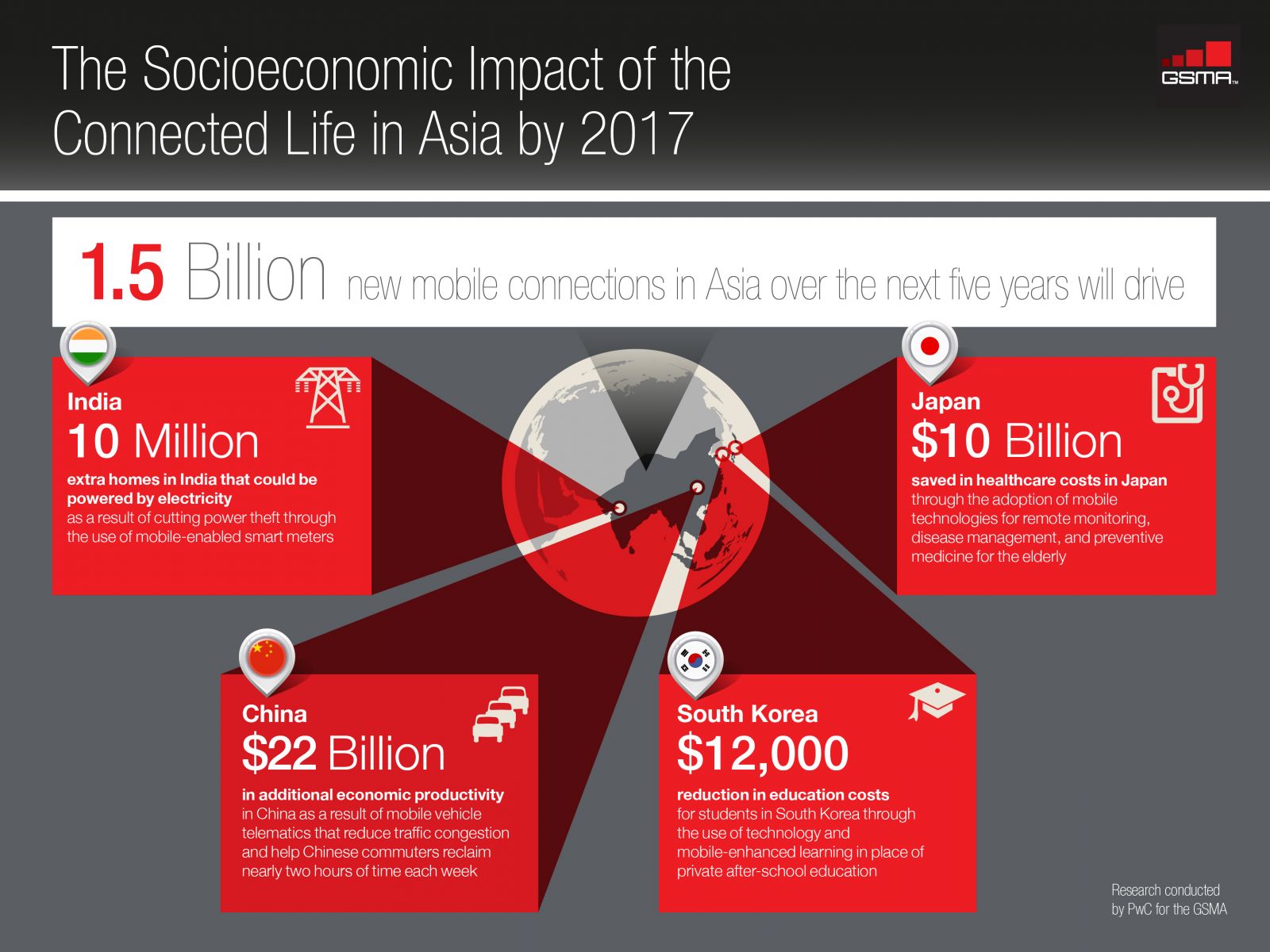

- 1.5 billion new mobile connections are expected in Asia Pacific by 2017

- Region to account for almost half of the predicted global total of 3.9 billion

ASIA'S position at the forefront of mobile innovation is secured, but in order to fully leverage its transformative potential, regulatory frameworks and taxation policies are needed, said the GSM Association (GSMA).

ASIA'S position at the forefront of mobile innovation is secured, but in order to fully leverage its transformative potential, regulatory frameworks and taxation policies are needed, said the GSM Association (GSMA).

Two recent reports released by the association, Mobile Economy: Asia Pacific 2013 and Connected Life that was developed in partnership with PricewaterhouseCoopers (PwC), highlight the immense impact of mobile in the region.

According to the Mobile Economy report, the number of unique mobile subscribers in Asia Pacific reached 1.5 billion at the end of 2012, and another 1.5 billion new mobile connections are expected by 2017.

Asia’s mobile population will account for almost half of the predicted global total of 3.9 billion.

"Mobile is already having a profound impact across all Asia Pacific countries, with spectacular growth in service penetration, driven by investment in infrastructure and continued innovation in devices and services,” said Anne Bouverot, GSMA director general.

As of the end of 2012, the mobile industry had invested US$80 billion in mobile infrastructure, generated US$1 trillion in gross domestic product (GDP) for Asia Pacific economies and contributing US$100 billion to public funding.

With access to vital spectrum resources and regulatory policy focused on driving further investment for the period through to 2020, the mobile industry could contribute an additional US$2.3 trillion to GDP and a further US$200 billion to public funding.

The mobile ecosystem in Asia Pacific is undergoing a rapid transformation with traditional telecoms providers expanding their business models and new players quickly emerging to compete for customers with innovative new services.

Key trends highlighted by the report include:

- Strong growth of data as voice traffic slows down across the Asia Pacific region, while data usage has grown at a Compound Annual Growth Rate (CAGR) of nearly 142% from 2010 to 2012. 3G and 4G connections will grow 17% every year over the next five years;

- Greater affordability of mobile services. The average monthly cost of mobile services across the region is falling by 5% per year, decreasing from US$28.80 in 2005 to US$19.70 in 2012;

- Entry of non-traditional players, including the emergence of entrepreneurial startups in areas such as mobile advertising and online video sites; and

- Increased socio-economic impact through collaborative platforms and mobile-enabled services such as payments, education and information services.

According to the GSMA, this transformation is creating countless business opportunities in both developed and developing economies and accelerating the availability of mobile-enabled services.

In developed economies, which already boast high subscriber penetration rates, there is a need for cohesive regulation to encourage the growth of connected services such as smart cities and m-Health.

For developing countries, there is a continuing need for regulation that encourages long-term investment in network rollout and upgrades to improve access to basic services.

The association is calling for changes that will further enable citizens throughout the region to reap the benefits of mobile. Consistent and fair long-term regulatory frameworks and taxation policies are needed to incentivise, not restrict, investment in mobile and spur regional economic growth and welfare improvement, the GSMA argued.

For example, the Universal Service Obligation Framework (USOF) should be revisited to ensure that goals and levies are aligned to drive the availability of mobile services in areas not yet fully connected by mobile.

The timely availability of spectrum will also be critical in enabling the mobile industry to extend, upgrade and deliver new services, it added.

Regional governments should be led by the International Telecommunication Union (ITU) standards on the bands and amounts of spectrum made available to mobile operators as they seek to upgrade networks to 3G or 4G services, the GSMA said.

The drive towards band harmonisation, in line with the Asia Pacific Telecommunity (APT) band plan, is a critical part of this process, as up to 30% of the benefits of the switch from analogue to digital TV broadcasts depend on harmonisation of the 700MHz band across the region.

“We are now at the dawn of a far greater growth opportunity and we urge regional governments and regulators to support mobile operators in meeting that full potential. Making the right decisions around regulatory frameworks and spectrum availability will encourage the mobile industry to continue investing in expanding and upgrading services across the region,” said Bouverot.

Research conducted for the PwC-GSMA Connected Life report revealed the transformative impact that connected devices and machine-to-machine (M2M) communications will have on the automotive, education, health and smart city sectors in Asia over the next five years (click image above to enlarge).

“The pervasive nature of connected devices is already transforming the way that people in the region live their lives,” said Michael O’Hara, chief marketing officer at the GSMA.

He added that over the next five years, Asia will experience an accelerated growth in connected cars, buildings, medical monitors and a whole range of connected consumer electronics and household appliances.

The report went on to highlight how adoption of mobile technologies could positively impact different sectors.

For example, the introduction of mobile-enabled vehicle telematics could significantly reduce traffic by reporting critical data such as location, driving speed and direction. Reducing congestion is a key challenge.

In 2012, Beijing experienced a traffic jam that spanned over 100 kilometres and lasted more than 10 days and the average urban commute in the biggest Chinese cities is already around 80 minutes per day.

Time saved by reducing traffic through mobile services will help Chinese commuters reclaim nearly two hours of their time every week and add as much as US$22 billion of economic productivity.

Installing mobile-enabled smart meters in India could save enough electricity to power more than 10 million homes by 2017. The country loses 24% of the electricity it generates every year, costing its economy more than US$17 billion, with power theft accounting for around half of these losses. Mobile-enabled smart meters provide the wireless connectivity that allows utilities to detect and record theft.

“However, continued collaboration between mobile operators and key players in vertical sectors is vital in further driving the disruptive and pioneering mobile services that will improve the lives of people in the region,” O’Hara added.

Bouverot added that mobile is already a significant engine for growth and welfare improvement throughout the Asia Pacific region. Now there is a clear opportunity for mobile to further transform lives, create new businesses and drive additional economic growth.

“If regulators are focused on creating environments that encourage further investment, from both traditional and new mobile players, then this opportunity is well within the reach of all countries with the region, regardless of their level of economic development,” she said.

To read the “Mobile Economy: Asia Pacific 2013” report, click here.

To read the “Connected Life: The next five years in Asia” report, click here.

Related Stories:

Brunei, Indonesia, Malaysia and Singapore to align with 700 MHz plan

UK-funded GSMA initiative to leverage mobile tech to aid underserved communities

For more technology news and the latest updates, follow @dnewsasia on Twitter or Like us on Facebook.