Much ado over Malaysia’s against the grain 5G approach

By Karamjit Singh December 6, 2021

- Track record of mobile operators delivering 3G, then 4G stands against them

- M’sia executed supply driven high tech infra before with fibre broadband in ‘08

So much has been written and argued about Malaysia’s bold 5G approach via the single wholesale network approach, and will continue to be so at least over the next one year, until the mobile network operators realise that the Malaysian government, irrespective of the political coalition in charge, has fully bought into the advantages of adopting a supply driven approach to 5G.

Here the Malaysian mobile industry’s above average track record at best (many would argue, average) in delivering 3G and then 4G weighs against it. A chart of the top 30 countries in the world on 4G network access by users in 2020, does not list Malaysia. And if you think smaller countries would be on such a list, as coverage would be easier, think again. India, Thailand and Indonesia make the list.

But not to fear, our telcos, and here I mean mobile operators, Celcom Axiata Bhd, Digi Bhd and Maxis Bhd, continue to rake in some of the highest earnings before interest, taxes, depreciation and amortisation (Ebitda) margins in the world. World leaders in something at least.

With 5G promising to deliver the same headline benefits that 3G and 4G promised ie faster, better quality networks that will spur corporate innovation, turbo boost entrepreneurial drive with myriad innovative and disruptive services possible, and highlight the country as having world class digital infrastructure (a hygiene factor for foreign investors), would you want to leave this in the hands of the same culprits?

Oops, players I mean. They who live by the mantra of delivering, not demand driven services but profitable demand services. Sorry all you Malaysians in rural areas desperately seeking data connectivity. Climbing trees helps build muscles. Squating on a rickety bridge improves your sense of balance, sitting by a rural road/path will heighten your sense of alertness to potential danger.

Clearly the last three governments since Pakatan Harapan took over in May 2018 have arrived at the same conclusion – No! The stakes are too high to leave 5G rollout in the hands of our telcos. We cannot rely on them to ensure we have a speedy and comprehensive coverage rollout of world class 5G, one that will not further widen the digital divide in the country.

Speed of rolling out matters, pace of coverage expansion matters and closing the digital divide which is actually an economic divide, are all crucial and matter to the government – no matter who is calling the shots. I bring this up again as those who have dealt with telco resistance to change in the past note that one tactic deployed is to try and delay the change for as long as possible in the hopes that there is a change in approach from the government.

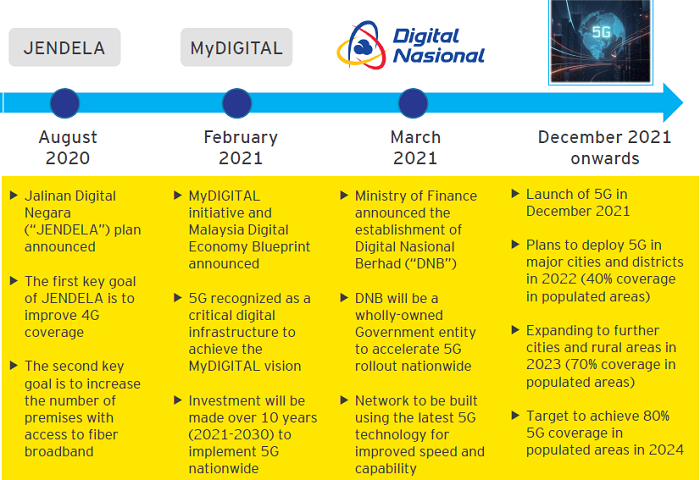

Which is why this has to be a supply driven initiative, meaning we will build it first and wait for demand to catch up. Such a risky proposition, from a corporate standpoint, means that only government can undertake it. Enter Digital Nasional Bhd into the picture when it was announced in March 2021 and led by the no nonsense corporate heavy weight, Ralph Marshall and with a highly respected board of directors, all steeped in telco and corporate experience.

Despite the strong team Ralph has built, predictably it has not been smooth sailing so far and I don’t expect it to. After all, the key mobile operators, and I mean Celcom, Digi, Maxis are staring at the single biggest shift they will have endured in their lifetimes – delivering a telco service, 5G, without owning the spectrum and network and without being able to crow about having the best, the widest, the fastest network.

“They are making an emotional argument, when they claim they can build their own 5G networks quicker or more cost effectively,” notes a former senior telco executive who is still involved in the industry today and describes the telco opposition as predictable. Indeed, industry executives and regulators will tell you that this belief in owning their own network and spectrum as a differentiator is deeply rooted in the DNA of all telco executives. But change is coming.

There are already enough data points and research to debunk this notion that the operators can more efficiently build their own networks. You can read this extensive analysis done by boutique research house, Asia Analytica early on in March. Asia Analytica is owned by Tong Kooi Ong, a leading corporate figure in Malaysia who is a loud voice on the need for the country to embrace digital quicker in order to strengthen its competitiveness. A more recent and comprehensive economy wide analysis was done by EY last month that was commissioned by DNB and available on its website as a pdf download here.

As a journalist covering the tech scene and the progression of the digital economy I was especially interested in the data point that in 2030 alone, 5G technologies will also support almost 148,000 net additional jobs across the economy and lead to a 3% increase in the proportion of high skilled jobs in the economy. That’s a step towards your high income economy.

Been there, done this

In the back and forth about whether this single wholesale network approach is a good idea, it is lost on most people that Malaysia has successfully taken an aggressive supply led approach before when it comes to a critical piece of high tech infrastructure – high speed broadband.

Back in Sept 2008 the Government invested RM2.4 billion into the building of a fibre based high speed broadband network by Telekom Malaysia (TM) which committed RM8.9 billion. The target was to provide fibre broadband access to over 1.3 million premises by 2012. There was huge blowback from industry players, the public and politicians over this.

TM’s then Group CEO Zamzamzairani Isa told me that the reality was that TM would have taken longer to roll out fibre broadband if it was left to demand side economics and it would have prioritised higher economic return areas. Nothing wrong with that. But you can see why the country cannot afford to leave the rollout of 5G to be dictated by the listed telcos only. Btw, today you will be hard pressed to find critics who say that decision taken in 2008 was flawed or has held Malaysia back.

To be sure there are still issues to be worked out between DNB and the telcos, and politicians are worried this could balloon into the next 1MDB. A few weeks ago some politicians from Pakatan Harapan issued a statement expressing their concerns over a number of issues, especially over the decision to give the precious 5G spectrum to DNB for free instead of raking in an estimated RM8 billion to RM10 billion that can be put to good use.

I sent them some follow-up questions (box, right) seeking to understand their concerns better and challenging one of their points raised but till now have not had any clarifications from them which is unfortunate. But I know that DNB has engaged with concerned politicians before and I hope they continue to offer them briefings regularly. Ralph is running operations with a very high degree of transparency and these regular engagements should be part of that process.

Telcos concerned about cost but DNB is listening

The telcos certainly are concerned about how much they have to pay for the wholesale service and have argued that it is costly. But DNB is listening to them and to the regulator, Malaysian Communications and Multimedia Commission (MCMC) and has submitted a new pricing proposal which is for a five year period instead of the initial 10 years.

This is definitely a lot more palatable than being locked in to pricing for a 10 year period with telcos arguing that initial 5G demand will be slow and they want the flexibility to lease 5G services when they see market demand.

This demand in seeking pricing flexibility, which I feel is reasonable, however runs up against the economics DNB is facing as the network operator. “The economics of a wholesale network are not attractive for the first three to five years. DNB has to build or rent infrastructure to provide coverage to populated areas of 40% in 2022, 70% in 2023 and 80% in 2024. But the economics of demand won’t be in its favour for the initial years which means it has to charge a higher price first before bringing it down later,” says a regional consultant. Balanced against this is the need by DNB to make its pricing attractive and adjustable to help the market drive demand.

DNB initially responded to this with its three tier pricing model based on Coverage, Capacity and something called Buffer Capacity but Ahmad Taufek Omar, its Chief Commercial Officer tells me they have dropped the latter option. “Buffer capacity has been removed, post industry consultation. DNB will only charge for excess capacity used beyond the coverage commitment on a pay-per-use basis, on an Additional Capacity rate.” Again proof that DNB is listening to industry feedback.

Meanwhile coverage, according to Taufek is where licensees are required to buy into all the clusters that are rolled out during this time, as part of their commercial arrangements with DNB. This means that as DNB widens its coverage, the telcos have to pay a fee that is the same for all of them. No telco can say they are not interested in say, Batu Gajah, a small city in Perak and therefore will not pay for coverage there.

This means that in Malaysia’s 5G, coverage is no more a differentiator. But differentiation through pricing will come from capacity. Without being specific, Taufek explains, “additional capacity pricing is charged in Gbps units. This is charged monthly on a pay-per-use basis, calculated based on the actual capacity used less minimum coverage commitment capacity.”

Volume discounts will come in here with DNB charging lower rates for higher Gbps units purchased. That operator can then pass on the lower cost to its customers.

But also, just to be clear, DNB is not the final arbiter of pricing. After negotiating with operators on its pricing structure, it has to still be approved by the MCMC, which may feel that there is further room to lower prices. So the fear that DNB can set its own price is not true.

Another key point of contention is that the government will end up funding DNB to the tunes of billions with this plan. Despite the government and DNB consistently maintaining that the 5G network will be funded by the private sector without further government funding beyond an initial RM500 million from Ministry of Finance as working capital and with no guarantees for borrowings that DNB is undertaking, and with the EY report also making this point, scepticism is still high.

I just put this down to the fact that people have very little trust in government and need to be continually reassured. I understand that the 1MDB spectre looms large in people’s minds as well.

Note that DNB announced on 12 Nov that it has secured a working capital financing package of up to RM400 million from Deutsche Bank with RM250 million revolving credit line on an unsecured basis. No government guarantee in sight.

Sure things may change down the road, but I think DNB will get things right and execute its 5G responsibility well, with the telcos coming around once they find an acceptable commercial balance with DNB.

It is absolutely critical that we get our 5G rollout right, and not because we are behind some of our ASEAN neighbours and must catch up, as Communications and Multimedia Minister Annuar Musa vowed to do on a tweet on Sept 27.

Rather, 5G is a critical infrastructure platform for enhanced competitiveness and innovation.

Dzuleira Abu Bakar, CEO of MRANTI, certainly believes so as she leads efforts to rejuvenate TPM into a hub that accelerates the commercialisation of innovation and technology with an Artificial Intelligence Park, introduction of various facilities such as 5G Development Hub, Sustainable Urban Farming Incubation Facility, Biotechnology Incubation Hub and Autonomous Vehicle & Robotics Hub

“In order to achieve this, we will need a strong backbone with 5G infrastructure and data-driven services. Having 5G infrastructure puts us on the fast track.”

Indeed, let’s all work towards getting on that rising tide called 5G - it will lift all boats.