Grocers facing ‘Uberisation,’ says HappyFresh

By Digital News Asia February 3, 2016

- Double-digit growth ahead for Asian online grocery business

- Sadly, market also being driven by traffic congestion and long working hours

INCREASED mobile accessibility and broadband penetration are disrupting the traditional grocery-buying business model, enabling consumers to purchase groceries anywhere, at any time.

This is going to lead to the ‘Uberisation’ of the retail sector, according to Jakarta-headquartered regional online grocer HappyFresh, referring to the US ride-sharing company that is disrupting the public transport industry.

READ ALSO: Growing the online grocery shopping culture in Malaysia

According to the Ericsson Mobility Report: On the Pulse of the Networked Society, mobile penetration in the Asia Pacific region (excluding China and India) reached 110% in the first quarter of 2015, surpassing the global average of 99%, HappyFresh said in a statement.

“We are seeing an ‘uberisation’ of the retail industry in Asia,” said its chief executive officer Markus Bihler.

“The outlook has never been more promising. Opportunities abound in this region with its sophisticated food-loving consumers, growing wealth and rapid urbanisation.

“The continued increase in mobile adoption and broadband penetration has helped boost our online grocery sales,” he added, without giving specifics.

In 2015, HappyFresh secured US$12-million Series A funding led by Vertex Venture, the venture arm of Singapore’s Temasek Holdings; and Sinar Mas Digital Ventures (SMDV), the venture arm of Sinar Mas Group of Indonesia.

“Ordering online for home delivery is gaining in popularity in the region … and we foresee a double-digit growth ahead for the online grocery business,” said Bihler.

The online grocery markets [corrected] in Asia are set to reach S$19 billion (US$13 billion) by 2020, according to the latest forecast by HappyFresh.

In Indonesia, middle- and upper-income consumers will continue to drive the growth of modern, online retailers.

Meanwhile, spending power and credit card penetration are higher in Kuala Lumpur than in Jakarta, and in general people are more used to buying things online in Kuala Lumpur, the company said.

Large supermarkets and hypermarkets are important players in the grocery retail landscape and they will continue to do well and dominate in this region, it added. Many are integrating online delivery service into their business model to make it even easier for tech-savvy, time-crunched consumers.

Other driving forces

The increased popularity of online grocery shopping in Asia has also been fuelled by two social ‘developments’ – traffic congestion and long working hours, HappyFresh said in its statement.

The increased popularity of online grocery shopping in Asia has also been fuelled by two social ‘developments’ – traffic congestion and long working hours, HappyFresh said in its statement.

Three South-East Asian cities (Jakarta, Bangkok and Surabaya) are in the Top 10 cities with the worst traffic congestion globally, according to a survey conducted by Castrol and Tom Tom.

Because of this, few people want to push their way through a crowded supermarket after a long day at work, said HappyFresh.

Secondly, Asian countries also tend to have the longest working hours – they have the highest proportion of people who spend more than 48 hours a week at work. This number is expected to rise as Asia becomes even more affluent, the company said.

“Customers are also becoming very selective when it comes to quality foods. A Nielsen study shows that today’s shoppers are seeking fresh, natural and minimally processed foods with ingredients that help fight disease and promote good health,” said Bihler (pic).

“This presents a tremendous opportunity among niche consumer segments, especially in the healthy eating space, and other categories that may be more difficult to find on in-store shelves.

“As a result, a number of speciality retailers have emerged in the health and wellness space, from national online grocery delivery services with extensive fresh sections to local produce delivery services,” he added.

Buying groceries with one click

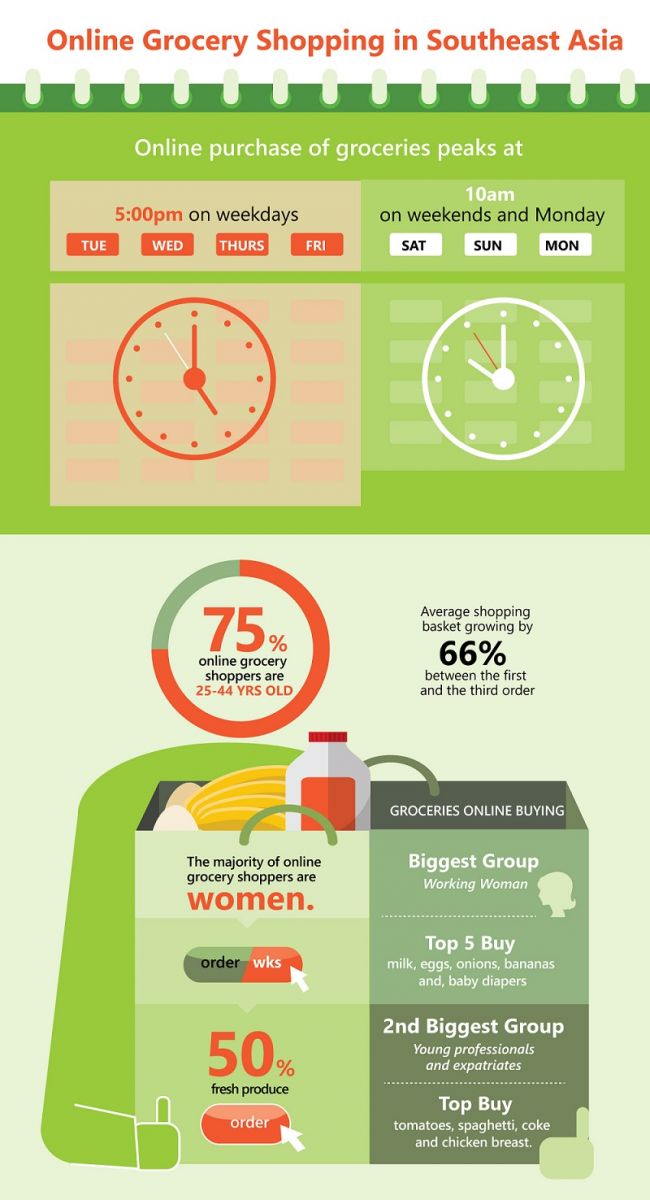

Consumers are embracing technologies that enable them to buy groceries with one click rather than having to walk to bricks-and-mortar stores to get what they need, with the average shopping basket growing by 66% between the first and third order, according to HappyFresh.

Shopping patterns vary from market to market, according to the company’s proprietary survey of shoppers across five countries (click infographic below to enlarge):

- Online purchase of groceries peaks at about 5pm on weekdays and 10am during the weekends and on Monday. This means that customers enjoy shopping toward the end of working hours, or like to get their shopping done during the weekend or early on Monday (so they don’t need to worry about groceries for the rest of the week).

- About 75% of online grocery shoppers are between 25 and 44 years old.

- The majority of online grocery shoppers are women. They place their orders weekly, and fresh produce accounts for 50% of every order.

- Working mothers outnumber all other customers buying groceries online. The top five most ordered items are milk, eggs, onions, bananas and, naturally, baby diapers.

- The second biggest group is young professionals and expatriates, whose top buys are tomatoes, spaghetti, coke and chicken breast.

Related Stories:

Presto Grocer’s regional e-commerce ambition

Jakarta’s HappyFresh raises US$12mil in Series A

RedMart raises US$26.7mil, hires ex-Amazon VP as COO

SAM’s Groceria uses Motorola self-scan tech to improve customer experience

For more technology news and the latest updates, follow us on Twitter, LinkedIn or Like us on Facebook.