UOB launches virtual payment solution to help companies improve productivity and efficiency

By Digital News Asia March 15, 2017

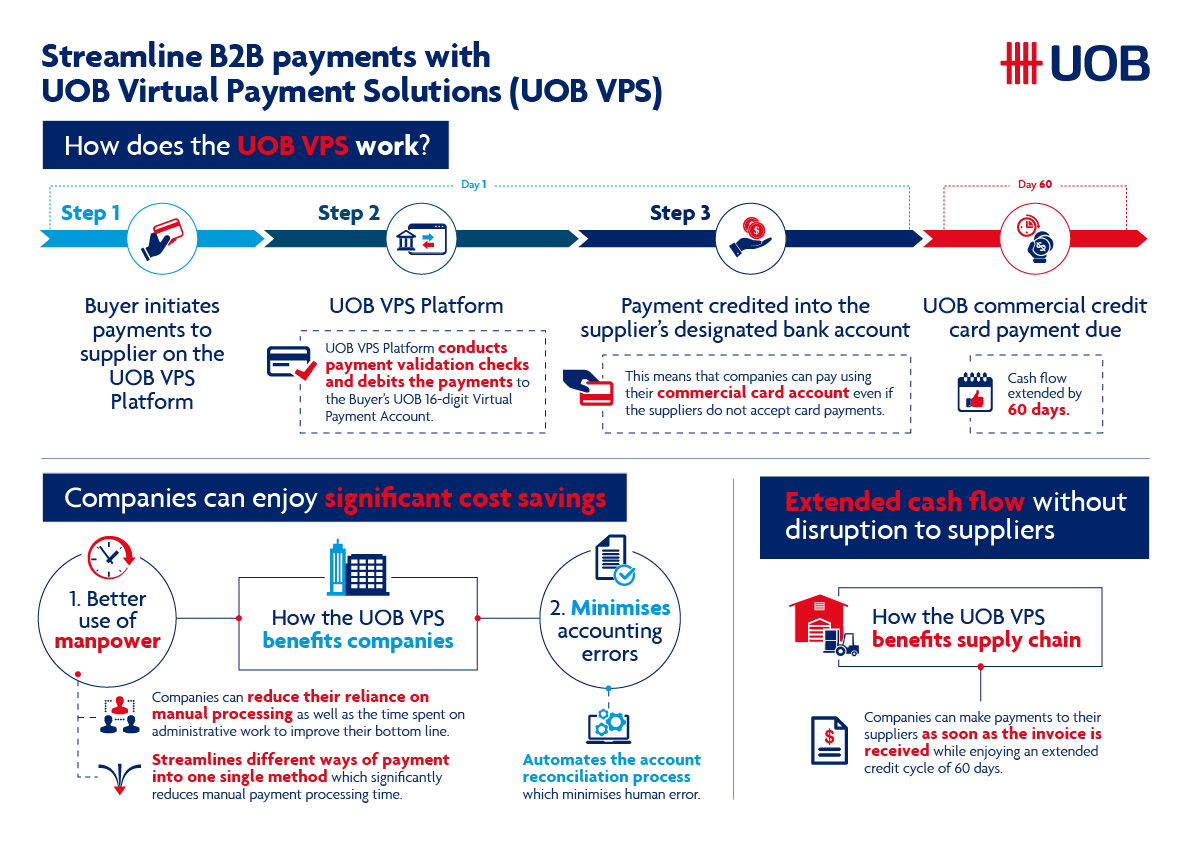

- SME suppliers that don’t use credit cards will quickly receive payments

- Human error is also minimised as the process is now largely automated

UNITED Overseas Bank (UOB) has launched the UOB Virtual Payment Solutions suite, to help companies raise their productivity and manage cost efficiently.

The UOB Virtual Payment Solutions suite enables businesses to pay their vendors and suppliers through a virtual corporate credit card account even if these parties do not accept card payments.

This in turn benefits the entire supply chain as the supplier receives payment immediately and the company making the purchase enjoys interest-free credit to help extend their cash flow for up to 90 days.

As the account reconciliation process for UOB Virtual Payment Solutions is automated, the company would be less reliant on manual processing. It can then redeploy its resources to focus on other areas of business.

UOB Group Commercial Banking managing director and head Eric Tham said that businesses are looking for ways to use technology to increase their profits particularly as they grapple with rising business costs and a tight labour market.

“In the current economic climate, it is important for companies to be even more proactive in managing their cash flow and increasing productivity to ensure their continued growth. That is why we continue to introduce financial technology solutions such as the UOB Virtual Payment Solutions suite to make managing the financial side of their business easier,” Tham said.

Payments made simpler

NEC Asia Pacific is the first company in Southeast Asia to use the UOB Virtual Payment Solutions suite. NEC APAC and 18 of its small and medium enterprise suppliers are using the business-to-business payment solution as part of a pilot.

Through the solution, NEC APAC has improved its processing of payments from up to 60 days to fewer than seven days from when the invoices are received.

NEC APAC finance director Sandra Kwok said, “We have had good feedback from both employees and suppliers on the improvements made through the UOB Virtual Payment Solutions suite. Our ability to pay with a credit card, even when our supplier does not accept this form of payment, has enabled our finance team to reduce the time spent on reconciling payments.

“Human error is also minimised as the process is now largely automated. At the same time, our 18 suppliers, who are all SMEs, benefit as they receive their payments faster. This helps them manage their cash flow more effectively.”

UOB Personal Financial Services Singapore managing director and head Jacquelyn Tan said, “Over the last five years, we have seen close to a 20% increase in the use of payment cards by companies. This is mainly because the companies appreciate the ease of account reconciliation that credit cards bring.

“However, as their SME suppliers generally do not accept credit cards, the companies have had to rely on time-consuming cash and cheques to pay them. Through the UOB Virtual Payment Solutions suite, our corporate customers can pay their SME suppliers as well as reap the benefits of using credit cards.”

Related Stories:

Xero integrates with UOB to benefit Singapore SMEs

UOB to offer Visa tokenisation via its app

UOB Singapore to launch virtual marketplace for SMEs

For more technology news and the latest updates, follow us on Twitter, LinkedIn or Like us on Facebook.