Twimbit: APAC telco revenues grew at 8.1% to US$132 bil in Q1 2023 with Dialog Axiata a standout

By Digital News Asia July 24, 2023

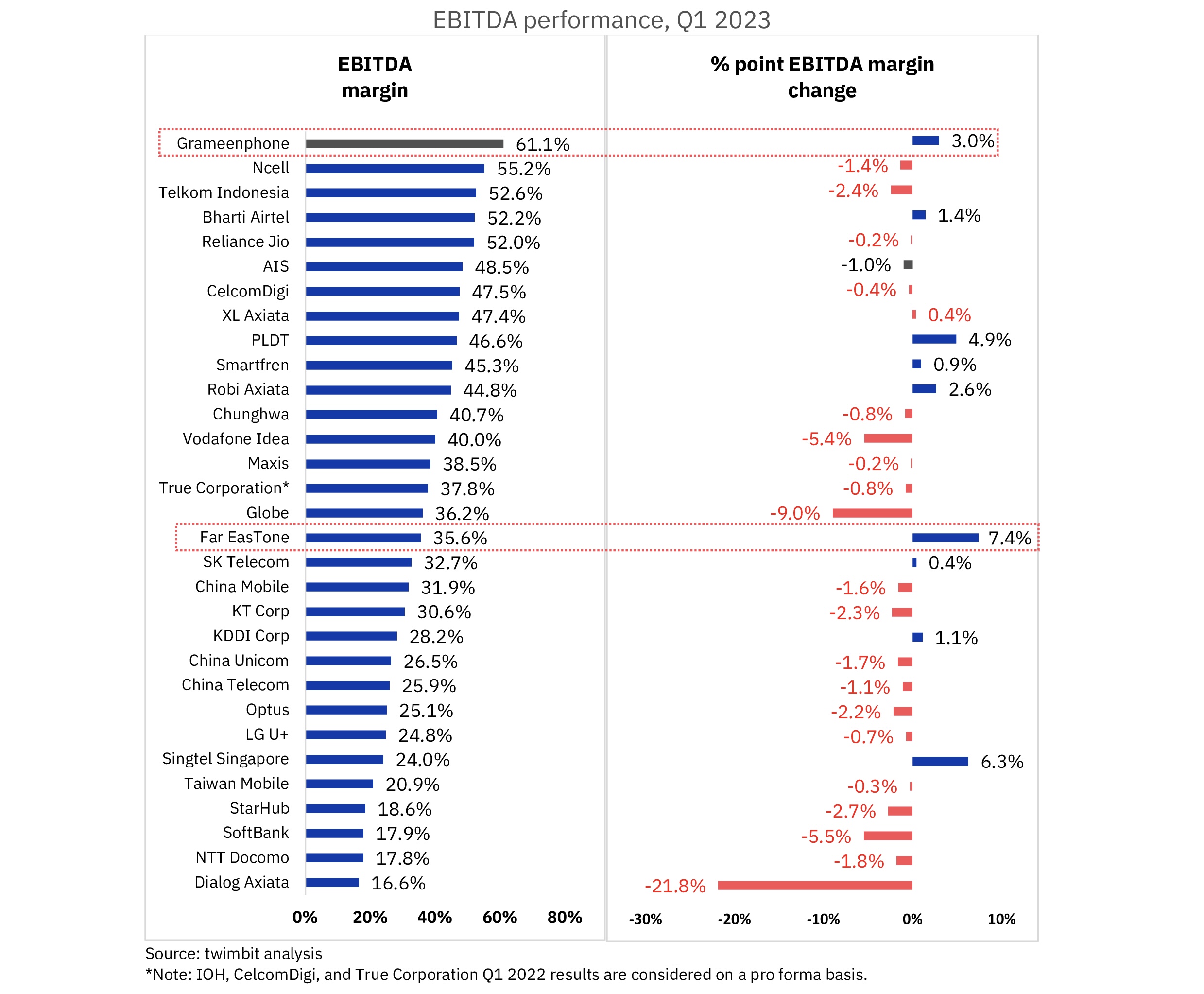

- The aggregate EBITDA margin declined from 33.8% to 29.5%

- Dialog Axiata emerged with an exceptional annual growth rate of 31%

Twimbit, a Singapore based Asian research and advisory firm, recently released a report on Asia Pacific telcos in Q1 2023 that dives into the growth trajectory of telcos recording positive revenue growth during this period.

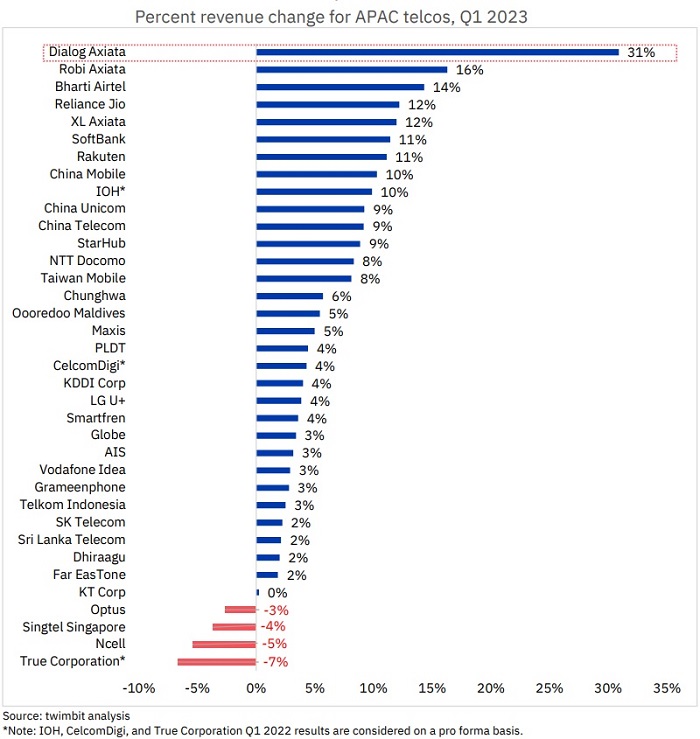

According to the report, 32 out of the 36 telcos displayed positive year-on-year revenue growth where Dialog Axiata emerged with an exceptional annual growth rate of 31% (table at end of article).

Meanwhile, tariff adjustments have driven the continued revenue growth in India’s telecom sector, especially for Bharti Airtel and Reliance Jio. They recorded revenue growth of 14% and 12%, respectively. The leading telcos in India are eyeing another round of adjustments as investments in 5G will likely place increased pressure on profitability in the coming years.

Telcos across the region reported a decline in average EBITDA margin from 33.8% to 29.5% in Q1 2023. According to the Twimbit benchmark, Grameenphone recorded the highest EBITDA margin of 61.1%.

In contrast, Dialog Axiata’s revenue growth has not been enough to offset the impact on profitability, with the telco seeing its lowest EBITDA margin. It decreased from 38.4% in Q1 2022 to 16.6% in Q1 2023.

“The higher direct and network costs from double-digit inflation have significantly impacted its EBITDA,” said Siddhant Ranjan, Research Analyst at Twimbit.

Asia Pacific (APAC) telcos aggregate a substantial 17.3% of total revenues as capex in Q1 2023. This quarter also marks a shift with mature markets, such as China, Japan and South Korea, who have all registered a decrease in overall capex due to peak 5G penetration.

“Only China Telecom has continued to increase capex investments, with aspirations to be the region’s market leader in 5G. Its new focus has led to developing use cases for industrial digitalization,” said Siddhant. The telco recently recorded a capex of US$4.55 billion (RM20.84 billion) in Q1 2023, an annual growth of 56%.

In comparison, he noted the Indian government continued to emphasize 5G deployment, aiming for widespread availability nationwide by December 2023. Bharti Airtel increased its capex by 110% totalling US$1.08 billion (RM4.95 billion) in Q1 2023.

“Q1 2023 marks a notable shift, with 5G being the primary focal point for the telcos’ investments in India,” added Siddhant. “As the telco industry continues to evolve, the push for 5G has become more apparent both on a commercial and enterprise level.”

The full report can be found at Twimbit.

Related Stories :