Tetra Pak Index 2018 projects rapid increase in online grocery market share

By Digital News Asia October 12, 2018

- Developing markets like Indonesia are expected to witness fast increases in online grocery market share between 2016 to 2030.

- Online grocery growth shaped by convenience, sustainability, personalition and technology

Tetra Pak, the world’s leading food processing and packaging solutions company, released the 11th annual edition of the Tetra Pak Index report. With the online grocery segment set to grow at a cumulative annual growth rate of 17.7% worldwide between 2017 to 2022, this year’s report focuses on the rise of online grocery and the opportunities it presents for the food and beverage industry, highlighting the growing importance of smart packaging in creating new business avenues.

According to Kantar’s latest figures for the global fast-moving consumer goods (FMCG) market, online sales grew by 30% in the 12 months to March 2017 — double the figure for the previous year, and compared to just 1.3% growth in all FMCG channels. Going forward, online grocery is expected to continue growing much faster than any other channel, albeit from a fairly modest base — 4.6% share globally.

This comes as brick-and-mortar stores are being reinvented, merging into an omni-channel ecosystem where consumers expect to buy whenever, wherever and however they choose. The trend presents all kinds of innovative possibilities for brands around the world to initiate an online grocery experience for future consumers.

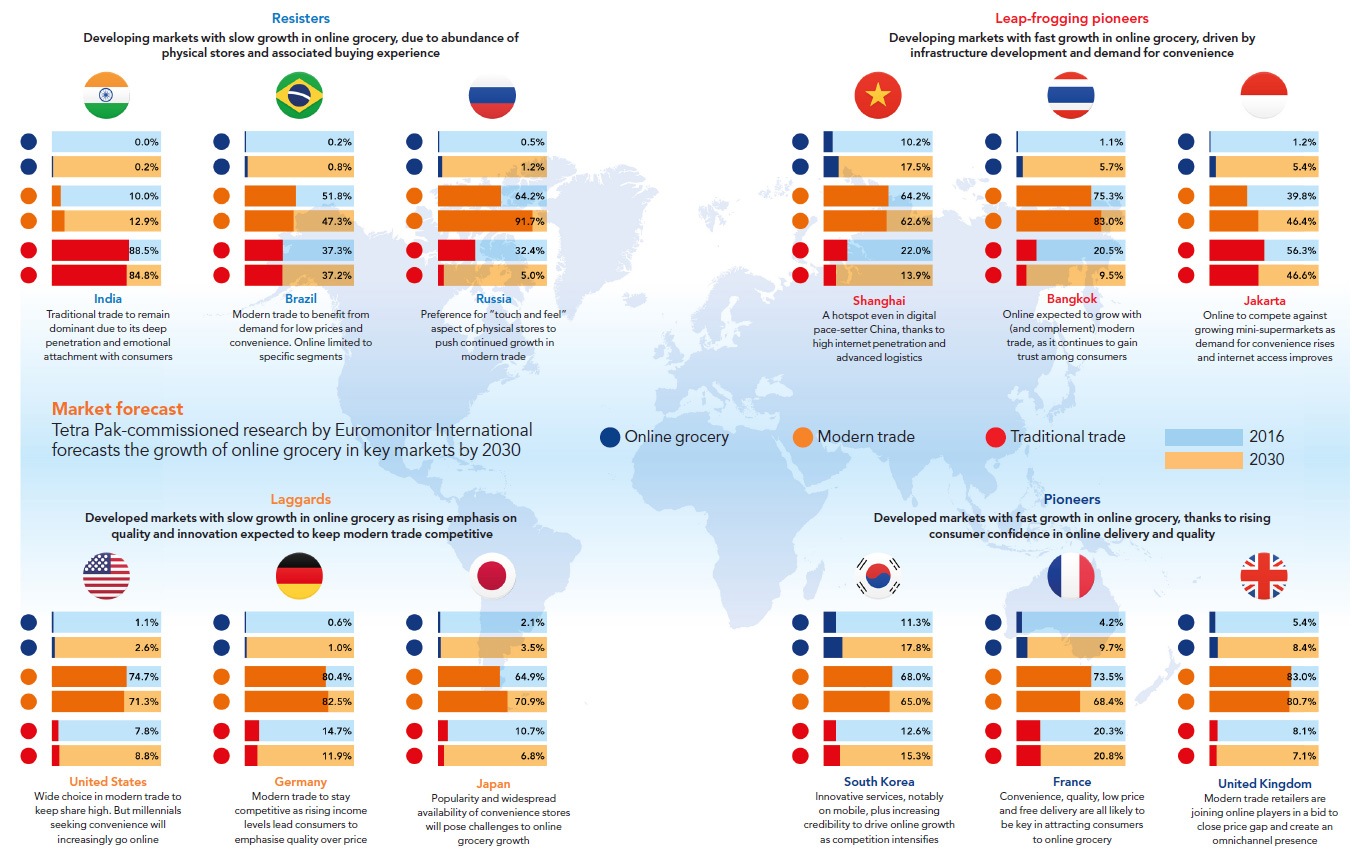

Tetra Pak commissioned Euromonitor International to conduct research to better understand various trends and differences between markets. Key findings include:

There are different ‘Asias’ within Asia

· Shanghai, Bangkok and Jakarta: These developing markets are expected to witness fast increases in online grocery market share between 2016 to 2030, ranging from 4.2 percentage points to 7.3 percentage points, and are categorised as ‘Leap-Frogging Pioneers’. This is driven by infrastructure development, including high internet penetration rates and advanced logistics, as well as the modern consumers’ demand for convenience.

· South Korea: This developed market is classified as a ‘Pioneer’, with its innovative and credible online services, most notably via mobile, and increasing consumer confidence in online delivery. Its online grocery market share is expected to reach 17.8% by 2030, an increase of 6.5 percentage points from 2016.

· Japan: Japan, being a developed market that has an abundance of popular convenience stores, is a ‘Laggard’ in the online grocery market, with a projected market share increase of only 1.4 percentage points — from 2.1% share in 2016 to 3.5% in 2030.

· India: Falling under the ‘Resister’ category, India is projected to show one of the slowest increases in market share of online grocery, with its market share only set to go up by 0.2% by 2030. Traditional trade will remain dominant in this country, primarily due to the already deep penetration of small retail stores, its emotional attachment for the average Indian consumer, as well as the preferred buying experience.

Four trends shaping the growth of online grocery

The Tetra Pak Index 2018 report also brings to light four key trends in the online grocery sector for brands to take note of.

· Convenience: Consumer preference for convenience is driving demand in all geographies and industries, particularly in Asia, as time-crunched shoppers look for new ways to make their lives easier. Key opportunities include easy product replenishment, voice, and convenient packaging.

· Sustainability: Pressure on plastics and awareness of the circular economy will continue to grow, and recycling will become ever more important. Consumers want to know whether brands are 'doing the right thing'.

· Personalisation & Uniqueness: Customisation of products and personalisation in the consumer journey will be important differentiators going forward. This is accelerating the direct-to-consumer trend, and as many as 80% of consumer-packaged goods companies are predicted to migrate to this model by 2025.

· Technology & Performance: Super-fast delivery in as little as 10 minutes is expected by 2025, changing consumer behaviour to buy more frequently and in smaller amounts — adding complexity to the logistics. Supply chains will continue to be transformed by a raft of technologies, notably radio-frequency identification (RFID) and robotics, boosting efficiency and transparency.

The role of smart packaging

Smart packaging technologies are based on unique digital codes that allow each product package to be given a unique identifier, which can include RFID or Quick Response (QR) codes. Consumers can read these codes with their smartphones — linking them to a vast amount of information and opening up exciting possibilities through its inherent traceability and transparency. For example, smart packaging allows each product to be tracked, monitored and interacted with throughout the supply chain, thereby creating new opportunities for more efficient stock management, distribution, automation, and enabling interactive experiences with individual consumers.

“Online grocery shopping is here, and it’s growing fast. It will revolutionise the way food and beverage products are produced, sold, and consumed. However, this proliferating segment will also bring many opportunities for brands to differentiate themselves by providing an elevated customer experience,” said Libby Costin, the Vice President of Marketing at Tetra Pak Asia. “Smart packaging will no doubt play a key role in the new journey. Tetra Pak has been investing in smart packaging since 2016. We truly believe that it will not only help enhance the consumer experience but also drive greater transparency and efficiency for our customers and retailers in the supply chain. We are excited to be the partner to help them explore new avenues, accelerate growth and create new benchmarks in the years ahead.”

Download the Tetra Pak Index report 2018 https://www.tetrapak.com/about/tetra-pak-index

Related Stories:

ICar Asia’s 3Q18 Revenue Grows 51%