KPMG study finds Malaysia among leading global manufacturing destinations

By Tan Jee Yee November 4, 2020

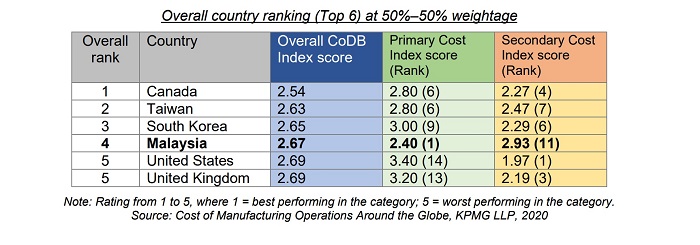

- Ranked 4th among 17 economies in cost of doing business in manufacturing

- Very strong in Primary Costs, but needs to improve labour skills & mindset

Adding to Malaysia’s appeal as a global investment destination, a recent study by KPMG sees Malaysia ranking fourth among 17 economies in an assessment comparing their competitiveness as manufacturing hubs.

This puts Malaysia ahead of countries in the Asian region such as China, Japan, Vietnam and India.

The joint study by KPMG and The Manufacturing Institute in the US, entitled “Cost of Manufacturing Operations around the Globe”, provides a current assessment of how the manufacturing sector in the US compares in competitiveness to its main trading partners.

This study evaluates a total of 23 cost factors that impact the cost of operations (Cost of Doing Business or CoDB) of a business conducting manufacturing operations in the United States relative to sixteen other countries that are leading manufacturing exporters to the US.

These factors include costs that directly impact a firm’s bottom line (Primary Costs) and factors that impact overhead costs and the ability to operate efficiently, typically related to the business environment or ease of doing business (Secondary Costs).

The overall CoDB Index scores are determined at equal weightage of the Primary and Secondary Costs.

The study indicates that Malaysia’s ranking on the CoDB Index results from high scores on the Primary Cost Index, where Malaysia emerged at the top, tied with China, Mexico, and Vietnam. The country had outperformed on three factors: hourly compensation costs, real estate costs and corporate tax rates.

In analysing the results further, by changing the weight of the Primary Costs and Secondary Costs from equal (50%–50%) to 70%–30%, Malaysia would be ranked the number one most cost effective location in the CoDB Index.

“Malaysia continues to be a prime manufacturing hub for investors despite uncertainties in the current landscape. This is especially significant in our new reality, where operational stability and cost containment are central in every company’s long-term business survival,” says Johan Idris, KPMG Malaysia managing partner during a virtual media briefing on the study.

Malaysia: a thriving ecosystem

The study’s findings bide well for Malaysia as a destination for companies looking to expand, reorganise or launch their supply chain. “An immediate effect out of the Covid-19 pandemic has seen companies around the world relooking at their supply chains. A study by McKinsey estimates between 16% to 26% of global exports, worth US$2.9 trillion to US$4.6 trillion, could move to new countries over the next five years if companies reshuffle their supplier networks,” says Johan (pic, left).

The study’s findings bide well for Malaysia as a destination for companies looking to expand, reorganise or launch their supply chain. “An immediate effect out of the Covid-19 pandemic has seen companies around the world relooking at their supply chains. A study by McKinsey estimates between 16% to 26% of global exports, worth US$2.9 trillion to US$4.6 trillion, could move to new countries over the next five years if companies reshuffle their supplier networks,” says Johan (pic, left).

“KPMG’s study proves that we have the factors in place to aid Malaysia in moving up the production value chain. It is by acting with agility and building on our resilience that we are able to maintain our competitive advantage and remain a preferred destination for high quality investments.”

Also participating in the briefing was InvestKL CEO Muhammad Azmi Zulkifli, whose organisation just celebrated the major milestone of successfully attracting 100 global companies to establish their operational HQ to the Greater Kuala Lumpur region. “Malaysia offers a thriving ecosystem for companies looking to locate their operations here. The government is pro-business, our cost of doing business is competitive and we thrive in our Ease of Doing Business ranking.”

Azmi also adds that, “Office rental rates in the capital city for example are the most affordable in APAC according to Knight Frank’s first quarter Asia-Pacific Prime Office Rental Index 2019.”

He further notes that Malaysia is boosted by the country’s access to global markets, world-class connectivity, infrastructure and highly-skilled talent. “Greater Kuala Lumpur pivots towards ‘Industries of the Future’ and there is a strong focus on advance manufacturing and services which aims to push the industry up the value chain towards high-impact, high tech and sustainable activities.”

While acknowledging that transformation during challenging times is vital, he urges companies to seize opportunities through diversification, technological upgrading, creativity and innovation. “We seek to attract and facilitate more investments such as these to support the government's vision of Industry 4.0 and to stimulate the economy further.”

Areas of improvement

While Malaysia may rank high in the Index, there is still much work to be done. As Johan points out, Malaysia is ranked 11th out of 17 when it comes to Secondary Costs, which is associated with things like quality of labour, ease of doing business, infrastructure, and risk and protection.

While this puts Malaysia higher than China, they are also ranked lower than South Korea, Taiwan and Japan.

Responding to questions, Johan says that it’s vital for Malaysia to not only continuously focus on maintaining competitive Primary Costs, but also work on improving their quality of labour, infrastructure and ease of doing business, which all fall under Secondary Costs.

In terms of improving quality of labour, this pertains to upskilling and reskilling employees. Johan stresses that organisations need to prioritise investing in people. “In any organisation, the most important asset is people. You need to give people the right knowledge, tools and skillsets.”

But it’s not just organisations. The government and “everybody”, Johan says, needs to support the talent pool. “Quality isn’t just about the right skill, but also the right mindset. It’s also about wellbeing. You need to ensure that people not only have jobs, but support them during the times of crisis. There are things on the ‘soft side’ and ‘hard side’ of talent that we have to continuously look into, if you want people to come and invest in Malaysia,” he stresses.

Another area of importance is in adopting Industry 4.0 (I4.0), something which Azmi stresses upon. “It’s about moving up the value chain. We must be cognisant of the fact that Malaysia has a limited population and that’s where we need to drive efficiencies. And efficiency gains will come with developments in technology and in innovation.”

Johan says that Malaysia has gotten a good start towards I4.0 adoption, considering the government blueprint. “Everybody understands that it needs to happen.” The Covid-19 pandemic has accelerated traction – Johan says that more companies are approaching KPMG to understand their I4.0 journey and pain points.

He also notes that industry associations are helping companies embrace I4.0, though there’s need to be more coordinated with efforts in helping SMEs towards I4.0.

Under the Ministry of International Trade and Industry (MITI), of which InvestKL is a part of, there is a fund dedicated towards upbringing and identifying the right Malaysian companies for I4.0 assessments, as well as guiding them towards the next step in adoption.

Under the Ministry of International Trade and Industry (MITI), of which InvestKL is a part of, there is a fund dedicated towards upbringing and identifying the right Malaysian companies for I4.0 assessments, as well as guiding them towards the next step in adoption.

There are, in short, a number of activities coordinated across the country in I4.0 assess and support. “What is key to us is that after an assessment, we look at how we can best partner these local companies and SMEs to an MNC (Multinational Corporation). Being part of their global value- or supply-chain will accelerate their journey,” Azmi (pic, left) elaborates.

The ministry is engaging with the required associations for this. Azmi points to the Federation of Malaysian Manufacturers (FMM) as a “close ally” – the association has thousands of members which MITI and its various agencies continuously engage. The goal is to raise the base line of Malaysian manufacturing excellence to bring it closer to the levels global manufacturers in the country operate at while creating a higher quality talent pool in the manufacturing sector. And with Malaysia's strong attraction as a global manufacturing hub, expect more parts of the global supply chain to resettle in Malaysia as well.

Related Stories :