Dompet Kilat rebrands, announces new service offerings

By Digital News Asia April 22, 2021

- Introduces Agro Kilat, Modal Kilat and Gaji Kilat

- Dompet Kilat claims to have over 600K downloads, facilitated 16,000 borrowers

INDONESIAN peer-to-peer (P2P) lending company Dompet Kilat has announced three new service offerings aimed at jumpstarting small and medium enterprises (SMEs) and facilitating growth of underserved Indonesians.

INDONESIAN peer-to-peer (P2P) lending company Dompet Kilat has announced three new service offerings aimed at jumpstarting small and medium enterprises (SMEs) and facilitating growth of underserved Indonesians.

The introduction of the service offerings comes in hand with Dompet Kilat’s latest rebranding exercise, the company said in a statement.

Since its inception in 2016, Dompet Kilat claimed to have over 600,000 user downloads on Google Play Store and has facilitated over 16,000 borrowers.

It said it was also one of the first peer-to-peer lending fintech platforms to be granted a license from Otoritas Jasa Keuangan (OJK), Indonesia's financial service authority.

“We created Dompet Kilat with the sole purpose to provide solutions that fulfil borrowers and lenders financial goals. The pandemic has affected all of us greatly, which is why Dompet Kilat is determined to provide SMEs and Indonesians a fighting chance,” said Sunu Widyatmoko, chief executive officer of Dompet Kilat.

“We've also spot an opportunity for Indonesians to grow businesses in productive sectors, which indirectly influences Dompet Kilat’s introduction of Agro Kilat, Modal Kilat, and Gaji Kilat. The agriculture sector specifically is the second-largest contributor to Indonesia’s economy, recording a 1.75% growth in 2020.”

Sunu added that the company is optimistic about the growth of fintech lending in 2021.

Sunu added that the company is optimistic about the growth of fintech lending in 2021.

“Even in the midst of a pandemic, Indonesia recorded an Rp73 trillion (US$5.16 billion) or 25% growth in funding value with loan requests showing a steady increase late last year. This is a positive sign as growth of SMEs often spurs a nation’s economic growth,” he claimed.

The new offerings

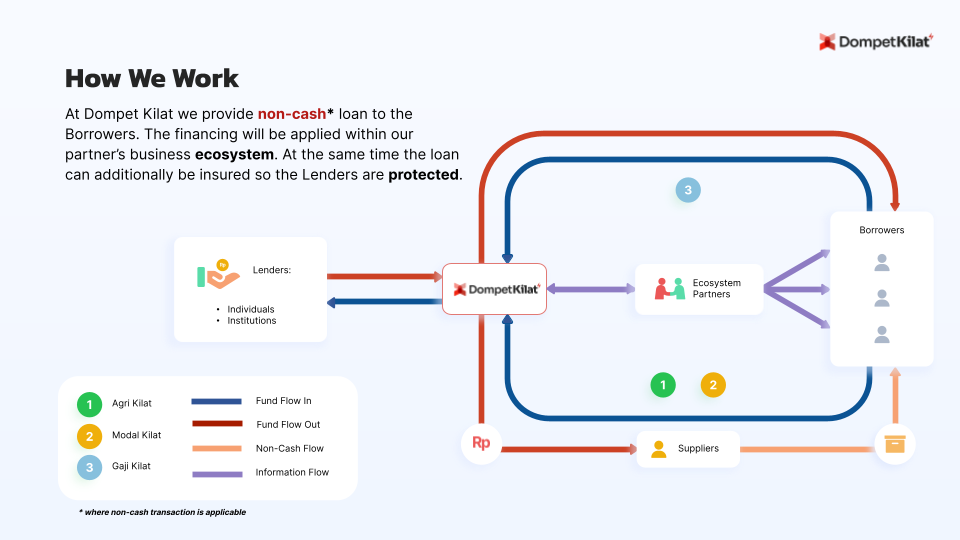

Dompet Kilat's rebranding revolves around the brand’s latest service offerings: Agri Kilat, Modal Kilat and Gaji Kilat.

Agri Kilat, the company said was created as a response to the minimum availability of working capital financing in agriculture businesses such as paddy farming, shrimp farming and chicken farming. The lending model is based on a closed loop ecosystem approach.

Once an ecosystem has passed Dompet Kilat’s risk acceptance parameters, the application process becomes increasingly convenient. The key feature of Agri Kilat’s leading model is that its cash flow matches the financing terms within the business cash cycle, which reduces the risks of back lending, the company said.

Modal Kilat, on the other hand, is a short-term working capital loan. Intended to provide financing facilities to startups in need of funding, Modal Kilat aims to spur new business owners' growth and finance expansion efforts, it said.

Meanwhile, Gaji Kilat, a service that provides employers with the necessary funds to provide employee benefits. Dompet Kilat collaborates with employers and banks for monthly salary deductions to install loan repayments with a fair interest rate.

For more information, visit here.

Related Stories :