Bitcoin mining: China's loss is Malaysia's gain (and TNB's loss)

By Dzof Azmi July 27, 2021

- Shutdown of Chinese miners means Bitcoin block mining is now 30% easier.

- 2021 Cambridge uni study pegs Malaysia as 6th ranked country in mining

A steamroller may be an unusual weapon of choice in the fight against high-tech criminals, but it's what the police in Miri used recently to destroy 1,069 bitcoin servers valued at US$1.3 million (RM5.4 million). The same fate probably awaits another 44 cryptocurrency mining machines worth US$53,200 (RM225,000) discovered last month in an abandoned shack in an oil plantation on the edge of the town.

Bitcoin mining itself is not illegal, but stealing electricity is. The flattened PCs were assets seized by authorities between February and April this year in raids conducted by the Miri police together with Sarawak Energy Bhd.

Sometimes these operations are discovered in a dramatic fashion, as when an unoccupied shophouse in Miri caught fire last February, and authorities recovered charred remains of cryptocurrency mining servers in the debris.

These enforcement operations hint at the scale of the problem in Malaysia, and it is anticipated to only worsen in the near future, as profits in Bitcoin mining begin to rise again, in part due to crackdowns on Bitcoin miners in mainland China.

According to Tenaga Nasional Berhad (TNB), Malaysia's largest electricity utility, since 2018 when there were 610 cases, theft of electricity involving Bitcoin mining surged by 300%, to 2,465 cases in 2020. For 2021, TNB has already detected 1,359 cases up to June of this year.

In response to this, TNB with the cooperation of the Energy Commission (EC), the Royal Malaysian Police and local councils have conducted 92 joint raids from January to June 2021.

Bitcoin mining itself is not illegal, but stealing electricity is a criminal offence under the Electricity Supply Act 1990, carrying a penalty of up to RM100,000 and up to ten years in jail if found guilty. In addition, perpetrators can also be charged for theft or mischief under Section 379 and Section 427 of the Penal Code.

[RM1 = US$0.237]

However, the losses are significant. Johor TNB estimates that they have suffered RM90 million worth of losses in 2020 due to bitcoin mining activities. Meanwhile, in March, Melaka policy uncovered a bitcoin currency mining syndicate responsible for RM9 million worth of losses since February 2019.As of July 2021, TNB has filed civil suits against 268 premises involved in power theft, and 142 individuals have been apprehended in the process.

China's loss is Malaysia's gain

Over the last year, there has been a dramatic rise in the price of Bitcoin, from about US$6,000 in April 2020, to a high of US$63,000 twelve months later. Since then, the price has dropped to US$35,000, credited to a crackdown by authorities on cryptocurrency miners in China.

As China was the biggest crypto miner in the world (accounting for 65% of the Bitcoin hash rate production by some estimates), this crackdown has seen the hash rate drop significantly over the last few weeks, resulting in a slowdown of transactions (the hash rate is a measure of how much work is being done to generate Bitcoin).

But Bitcoin's algorithm automatically recalibrates the computation power needed to validate its tokens to balance miner productivity. The resulting recalculation has made it 30% less difficult for blocks to be mined, which in turn raised profits for the miners on the network. Effectively, with Chinese miners out of commission, it has made it easier for everybody else to make a slice of the pie.

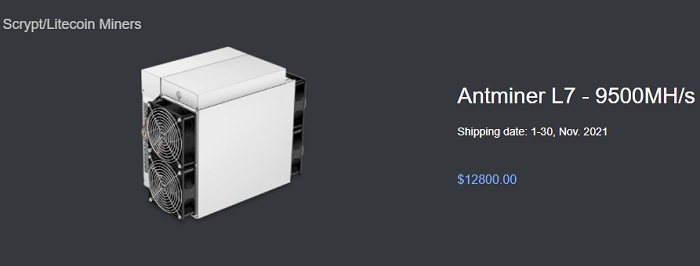

Not surprising that global demand for specialised computers able to mine the process has surged as people look to cash in. According to Bitmain Technology Holding Company, a China based fabless semiconductor company, the machines take months to reach buyers due to a backlog and cost thousands of US dollars. An order placed today will only be shipped out in Nov.

Meanwhile, Malaysians have displayed a very healthy appetite for mining. "We are top 5 according to a Cambridge study for the Bitcoin charts and this does not include the many miners mining other Alt coins as well," says Harpreet Singh (pic), Blocklime founder and chief executive officer.

Meanwhile, Malaysians have displayed a very healthy appetite for mining. "We are top 5 according to a Cambridge study for the Bitcoin charts and this does not include the many miners mining other Alt coins as well," says Harpreet Singh (pic), Blocklime founder and chief executive officer.

He is referring to the study done by the Cambridge Centre for Alternative Finance in the University of Cambridge which in April 2021 estimated Malaysia as the sixth highest country in terms of average of monthly share of total Bitcoin hash rate.

"It's a little hard to tell how many of them are actually legal, since we don't have a way of identifying them," says Harpreet, "(However) illegal mining is very profitable."

By DNA’s rough calculations, if Malaysia's share of 3.4% in April still holds true today, Malaysian miners would be generating about US$1 million worth of Bitcoin per day.

He says that criminals will often buy second hand or older mining machines, and mine what they can using those inefficient machines. "Since they are stealing the electricity, after they have covered the cost of the hardware, it's pure profit."

"Most perpetrators of these illegal connections usually operate in newly opened commercial or industrial areas or areas that see very few footfall to avoid detection as bitcoin mining equipment can be noisy," said a TNB source.

Harpreet adds, "They often hire illegal immigrants to take care of these facilities to make it difficult to trace back who the actual mastermind behind it is."

Opportunity for regulation

Although stealing electricity is most definitely a crime, trading in cryptocurrency is regulated by Malaysia's Securities Commission, and mining cryptocurrency is not illegal. However, Harpreet believes the authorities should take the step up and also regulate mining. "I think we should work towards a win-win situation, by regulating the space and offering incentives to do it legally and safely."

He suggests that perhaps special economic zones can be set aside for mining, where excess electricity can be offered more cheaply, in combination with renewable energy. Regulation will make it easier to identify the players, and promote knowledge sharing between the parties.

"A healthy crypto mining industry will have spillover effects to the chip and board manufacturing industry, electrical power industry, property industry, cryptocurrency and Blockchain industry," he adds.

A spokesman from TNB however was less enthusiastic, focusing on the bad players. "The illegal use of such a large amount of electricity to mine cryptocurrency – whether by tempering meter installation or bypassing the meter – could jeopardise the security and reliability of power supply for the public at large."

Nevertheless, other countries have taken steps to work with miners. For example, Iran issues licenses for cryptocurrency miners and offers cheap electricity, on condition that the cryptocurrency generated is only sold to the central bank. The country originally aimed to raise US$500 million in cryptocurrency this way for the next year, but have recently banned it for four months as the country has been facing major power blackouts.

Malaysia thankfully has no shortage of power but TNB investors will be expecting the utility to do a much better job of clamping down fast on the illegal tapping of its network by the rising crypto miners in Malaysia.

Related Stories :