Rakuten Trade to offer contra trading to investors

By Digital News Asia June 4, 2018

- Contra trading will be launched on June 4, 2018

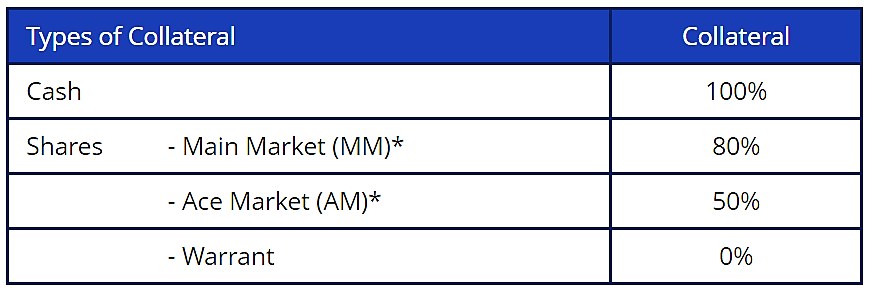

- Offers share collateral value that differs depending on the type of collateral

%20with%20Rakuten%20Securities%2C%20Inc%20president%20Yuji%20Kusunoki.jpg)

RAKUTEN Trade Sdn Bhd will introduce its second product – contra trading on June 4, 2018. The contra trading facility will offer investors a trading limit of three or five times the value of cash and/or collateralised shares.

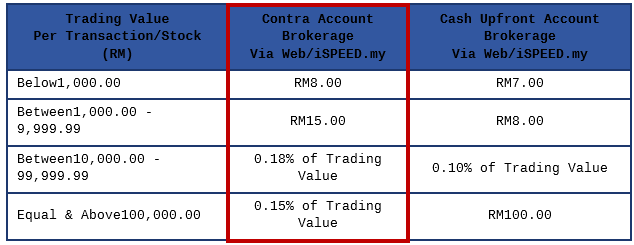

According to Rakuten Trade managing director Kaoru Arai, “Trading on the Malaysian equity market has never been more seamless and more efficient. In true Rakuten style, we are enhancing the trading experience for our investors by providing a platform that is different and more advantageous than what is currently being offered. Our contra trading complements the existing cash upfront facility as it gives additional leverage of up to five times to our clients, higher than what is currently offered, yet at low brokerage rates that are the lowest in town.

“We are confident that this will hold appeal for our fast growing digitally-savvy investors as the premise of the new platform was designed based on their feedback and with our clients in mind. After all, the voice of our clients is a very important component in the continuing growth of the organisation.”

The launch comes as Rakuten Trade, the country’s first completely digital equities broker, just turned one.

The Rakuten Trade contra trading account offers share collateral value that differs depending on the type of collateral.

In line with the launch of its contra trading facility, Rakuten Trade also announced its Two Is Better Than One Campaign that offers cost efficiencies to investors.

Clients who open both a cash upfront & contra trading account will receive a rebate of RM10. Upon successful execution of their first trade, clients will receive 2,000 Rakuten Trade points.

Rakuten Trade is the result of a joint venture between Kenanga Investment Bank Bhd and Rakuten Securities, Inc in Japan; part of Rakuten Group, a global innovation leader headquartered in Tokyo.

Related Stories:

Rakuten Trade celebrates first anniversary

Helping grow Malaysia’s fintech ecosystem

Kenanga Investors launches its first AI powered fund