Richer data needed on venture capital scene in Malaysia

By Karamjit Singh June 4, 2015

- MVCA chairman feels 2015 will be exciting year for investing

- Malaysia needs to do better job at telling its investing story

MALAYSIAN Venture Capital & Private Equity Association (MVCA) chairman Amin Shafie (pic above) feels that 2015 is shaping up to be a very exciting year for investing.

“I was referred to a company a while back and when I spoke to the entrepreneur, he was already in negotiations with two investors,” he tells Digital News Asia (DNA) in a conversation in Kuala Lumpur.

In his capacity as a partner at QuestMark Capital Management, a venture capital firm, Amin was probably disappointed. But put on his MVCA hat and this is actually great news.

“It tells me that if I am not there to make a deal, there are others who will pick it up. And this really means that we ourselves (venture capitalists or VCs) had better pick up our game,” he says, partly referring to the fact that a fair number of Malaysian companies are getting funded by VCs from abroad, especially those based in Singapore.

And with some of the funds in Singapore having repatriation clauses, it can mean that Malaysia then ‘loses’ a company to its southern neighbour, as the main holding company or its regional base is a Singapore-incorporated entity.

Amin accepts that this is the current reality and adds, “You cannot blame the entrepreneurs or investors, but how are we going to talk about our own track record?”

In this case, Malaysia’s track record is evident in the annual report issued by the Securities Commission of Malaysia (SC), where three pages are devoted to the venture capital sector in the 2014 edition.

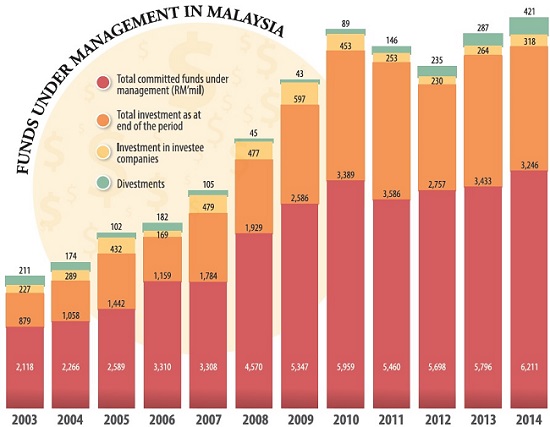

Commenting on the overall report, Amin notes that almost all the data points are higher than in 2013, with perhaps the total investment amount being slightly lower than in 2013. This just means that the drawdown has not been done yet.

Meanwhile, divestments are at RM421 million (US$114 million) in 2014, the highest since such data was kept in 2003. [RM1 = US$0.27]

Total investment for the year stood at RM318 million, a 20.5% increase from RM264 million in 2013. A total of 74 investee companies received VC funding as compared with 56 investee companies in 2013.

[Edited: A chart has been removed from this article.]

While there is a lot of data there in terms of numbers, Amin says the challenge is about “adding a lot more quality and turning the data into the right kind of information.”

For instance, how many investments were made by each of the 112 members of the MVCA? How many members are active, and how many have become dormant?

Who is investing in Malaysian companies going regional, versus those investing in specific investment vehicles in Asean countries?

How much of the investment goes into startups, and at which stage? What kind of investments go into life sciences companies?

“There is really no cross-section analysis at the moment,” Amin acknowledges.

This information however is important as when Malaysian VC and management companies go out to raise money for their funds, interested investors will ask questions that need more refined answers than are currently available in the SC annual report.

And while he says the SC has acknowledged that it can do a lot more with the data, Amin also admits that the MVCA has to shoulder some responsibility as well. “The SC is playing its role as regulator. We should be going to them to ask for more specific information about the sector.”

While he says that a lot could be done, and should be done, the good news is that “it will be done.”

Both the SC and MVCA have been engaging on this very matter and as a result, next year’s report on the sector will be much richer, with Amin confident that the VC industry will be able to share all kinds of cross-referenced information with potential investors.

“These are interesting times for the VC sector, especially with Asean opening up. The question however for us is, ‘Are we moving fast enough?’ ”

Related Stories:

Week in Review: A shift is happening

Disrupt: ‘It’s hard to raise money in Malaysia’

Malaysian VCs invested US$80mil in 2013

For more technology news and the latest updates, follow us on Twitter, LinkedIn or Like us on Facebook.