APAC consumers have biggest appetite for m-commerce: SAP study

By Digital News Asia November 7, 2013

- APAC consumers using mobile phones for an increasing range of m-commerce services

- Mobile devices becoming key communication and transactions with financial services

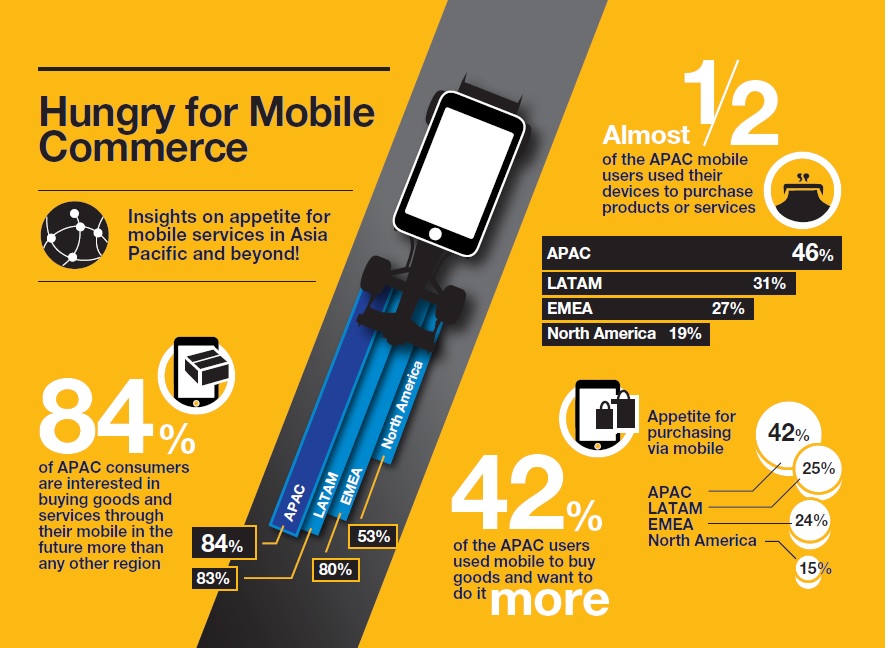

CONSUMERS in Asia Pacific are leading the demand for mobile commerce services globally, with 84% asking for more mobile interactions with banks, telcos, retailers, utilities and other businesses, according to a study by SAP AG.

CONSUMERS in Asia Pacific are leading the demand for mobile commerce services globally, with 84% asking for more mobile interactions with banks, telcos, retailers, utilities and other businesses, according to a study by SAP AG.

Nearly half (42%) of consumers in this region have used their mobile previously to buy goods and wish to make further purchases with their mobile, SAP said in a statement, while nearly half of mobile device users (42%) who have never before used mobile transactions, said they would like to do so in the future.

Overall, the study found that consumers are using their mobile phones for an increasing range of mobile commerce services, including researching products, responding to promotions, customer service inquiries and submitting meter readings to utility companies.

Furthermore, 67% of Asia Pacific users agree that a greater choice of payment methods would encourage them to make a purchase from an organisation or retailer. Seven out of 10 (70%) believe that mobile phones will be more important as a payment method in the future, SAP said.

“Consumers in Asia Pacific lead the world in the demand for mobile commerce and expect even more simplicity and capabilities,” said Anthony McMahon, senior vice president of platform solutions at SAP Asia Pacific Japan.

“There is a tremendous opportunity for organisations to interact and connect more personally with consumers via mobile.

“By unleashing the potential of their mobile device as an all-in-one communication channel, a loyalty card, location-aware personalised offers, a self-service kiosk, plus payments like cash, credit card or web currency, we expect mobile-savvy consumers and companies in Asia Pacific to continue to lead the mobile economy," he said.

Mobile transactions

A total of 3,288 interviews were conducted with adults aged 18+ who own a mobile phone (basic or smartphone) in China, India, Japan and Australia. Respondents completed an online survey in March/ April 2013.

The research conducted by Loudhouse, an independent research agency based in London (click picture to download 125K infographic).

The research conducted by Loudhouse, an independent research agency based in London (click picture to download 125K infographic).

The study shows that consumers in Asia Pacific are now using their mobile phone for more activities beyond making calls and texting:

- Consumers in this region are much more likely than the global average to use their mobile moderately (a few times a week or monthly) for banking (37% vs. 29% global) and buying goods and services (37% vs. 26% global);

- The top purchases via mobile are clothes (49%) and books or e-books (47%); and

- Besides shopping online and in-store, consumers in Asia Pacific are also purchasing via mobile Internet (36%), via a downloadable app (24%) and via SMS (19%).

While embracing the appetite for mobile purchase adoption, it is vital that organisations looking to develop products and services for Asia Pacific are able to balance the desire for ease and convenience with security requirements, SAP said.

- In the study, 54% of users in the region believe that once they gain confidence in mobile security, they will increase their mobile payment activity;

- Assurances about personal data security (57%) and an easy-to-use interface (53%) are the key drivers for increased adoption of mobile transactions and communications in Asia Pacific; and

- Consumers in Asia Pacific expect that with a ‘mobile wallet,’ they would be able to pay a bill (54%), buy goods online (53%) and use it as a means to check their bank balance (52%).

Transforming banking

Consumers in Asia Pacific are embracing the use of mobile devices as a cornerstone for communication and transactions with financial services organisations, SAP said.

Based on the study findings, excluding voice calls, two-thirds of mobile owners in Asia Pacific turn to their mobile devices to pay a bill (versus 55% global), 63% make a bank transfer (vs. 52% global) and 58% set up a new account (vs. 48% global).

The mobile economy is an opportunity for banks to strengthen their position through new products and services to create new revenue streams, attract new deposits, reduce costs, reduce fraud, and increase customer loyalty.

Innovative mobile banking applications and services provide customers the convenience of managing their finances from a mobile device, SAP said.

Transforming retail

Transforming retail

The mobile explosion is transforming the shopping experiences for consumers, making them more informed and demanding, the company added.

There is huge potential for retailers to profit from the growing appetite for mobile purchase adoption in Asia Pacific. The study findings show that retail is a key focus of mobile purchases in the region with attire (49%), books or e-books (47%), entertainment services (44%), and music downloads (42%) all typical purchases.

Users in Asia Pacific are encouraged to buy goods using their mobile phone by lower cost services (29%), coupons (26%) and exclusive offers.

Retailers need to respond to the changing behaviour of the new generation of consumers and empower them through mobile commerce and mobile payment technology, as well as tools to drive loyalty and marketing activities via mobile devices.

Transforming telcos

Today, mobile operators want to acquire and retain customers by offering new value added mobile commerce services, SAP said.

In the study, more than half of users (54%) in Asia Pacific agree that their mobile payment activity will increase when they have more confidence in mobile security, with 40% requiring more confidence in how to use their mobile as a payment method.

As Asia Pacific increasingly becomes a mobile economy, consumers will demand convenient access to transaction channels anytime, anywhere. Mobile operators can help drive the adoption of mobile payment services.

As the study shows, free minutes, texts and Web use (28%), personalised services (24%) and lower cost services (22%) will encourage consumers in Asia Pacific to use their mobile to check usage data for their mobile account.

To learn more, download the full report here or explore the interactive data visualisation website here.

Related Stories:

Electronic payments stimulate economic growth in Malaysia: Visa

Soft Space on a roll, now DiGi on board with CIMB

Newly launched MOLPay-FPX Plan aimed at micro-enterprises

Smartphone shopping trend sweeps Asia Pacific: MasterCard survey

Critical role of operators in using ‘mobile money’ to fight poverty

For more technology news and the latest updates, follow @dnewsasia on Twitter or Like us on Facebook.