The TPP and Malaysian IT firms

By Bernard Sia September 4, 2013

- How would the TPP, or any lowering of foreign trade borders, impact Malaysian IT firms?

- Not all foreign IT firms come with the intent of selling their wares to the biggest paymasters

FROM July 15-24 2013, Malaysia played host to the 18th round of the Trans-Pacific Partnership talks in Kota Kinabalu, Sabah – a delectable city with great seafood and one of the most pristine diving spots in Malaysia.

FROM July 15-24 2013, Malaysia played host to the 18th round of the Trans-Pacific Partnership talks in Kota Kinabalu, Sabah – a delectable city with great seafood and one of the most pristine diving spots in Malaysia.

A backdrop of protests however had ensued in Parliament on July 16 from a number of NGOs (non-governmental organisations), as well as outside the venue while the talks were going on.

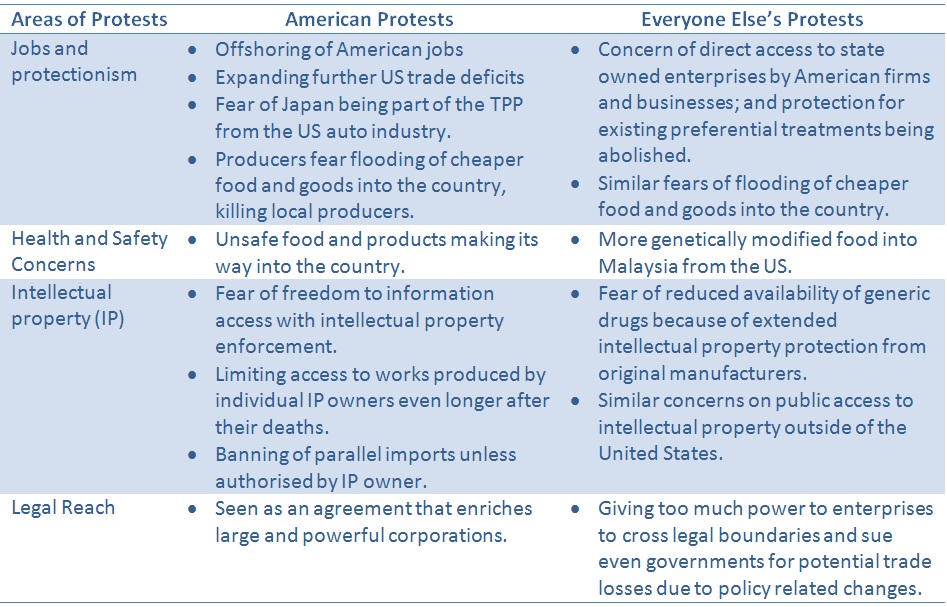

The TPP echoes NAFTA (the North American Free Trade Agreement) and some even lambast the potential outcome of the TPP talks, describing them as “NAFTA on steroids.” TPP protests have taken place in many of the member countries involved, including even some parts of the United States, the country that is spearheading the talks.

Here’s a quick checklist (and contrast) of the major areas that folks are protesting about:

Malaysia’s powers-that-be, government-backed agencies and even industry bodies such as the National ICT Association of Malaysia (Pikom), beg to differ. In fact, Pikom president Shaifubahrim Saleh sees great opportunities in the TPP, while Malaysia’s Minister of Trade and Industry Mustapa Mohamed has made TPP negotiations a top priority, above Asia’s Regional Comprehensive Economic Partnership (RCEP).

Despite all the protests, and in particular secrecy, surrounding the negotiations, I doubt that there are any real secrets with trade talks. With almighty Google handy, all we need to do is to go through the existing US foreign trade agreements and undoubtedly, crucial negotiating points will be repeated, reinforced or reduced, depending on the negotiators.

But enough with the preamble. The question at hand is: How would the TPP, or any lowering of foreign trade borders for that matter, impact Malaysian IT (information technology) firms?

Well, it depends.

This is because the level of preferential treatments and market protectionism varies with every country’s legal and social balancing framework, as well as the selective enforcement of these frameworks by sector.

In Malaysia for example, protectionist frameworks are stronger in oil and gas as well as the auto industry, while the financial sector has slowly lowered boundaries with the second financial liberation plan in full swing, allowing for more foreign banking presence and increasing the number of allowable branches for existing foreign banks.

Within the IT industry, Malaysia’s New Economic Policy has spurred the existence of a number of IT firms such as Mesiniaga. ‘Mesiniaga,’ a direct translation of ‘Business Machines,’ was the sole distributor of IBM products in Malaysia as the company was excised from a department in IBM, before ties were amicably severed in the mid-2000s – sort of a growing up after having achieved the required capabilities to swim in open waters.

Today, most large government-linked Malaysian organisations – i.e. entities with massive funds and complexity such as Petronas, Maybank, CIMB Bank and others – have long done away with preferential treatments, especially with regards to IT solutions, and openly hold tenders that multinationals as well as locals participate in.

The bottom line, as far as these organisations are concerned, is the ability for IT firms to competitively execute well, and carry through their objectives of acquiring the IT solutions and services from the market.

Market leading and successful Malaysian firms understand exceedingly well the competitive global waters that they need to traverse, and the danger of denial by being continuously dependent on handouts.

Market leading and successful Malaysian firms understand exceedingly well the competitive global waters that they need to traverse, and the danger of denial by being continuously dependent on handouts.

Instead of addressing this from a siege mentality standpoint, perhaps the argument has to be rephrased.

The lowering of trade barriers cuts both ways. Despite the foreign influx of labour and products, it also provides opportunity to gain further access into trade members’ markets.

To add, not all foreign IT firms that set foot onto Malaysian shores come with the intent of selling their wares to the biggest paymasters. Some are here to tap on local talents and organisational intellectual property assets, and this depends greatly on the comparative advantages of the respective nation’s IT ecosystem.

You have what we need and Malaysia has IT products and services that you need.

With IT, I happen to believe that the market is borderless to begin with. It did not stop Indian firms like TCS, Mahendra-Satyam, Wipro and others from making a global impact, nor did anything prevent Acer, Asus and Lenovo from becoming leading global PC brands. Not to forget the giants in Samsung and LG Electronics slugging it out with Apple and Nokia, as well as hammering home the final nail in BlackBerry’s coffin.

At the risk of being curt, should Malaysian IT firms continue to subsist solely on protectionism and government contracts, they will inevitably fail. Large global Malaysian businesses have shown ambitions far greater than suckling from the bosom of the Government, and IT firms need to support, catalyse and augment those ambitions.

As such, Malaysian IT firms need to commit investments into creating consistent high quality differentiated capabilities and technical research, or risk being pummelled by foreign competitors that possess far greater grit; as they have not only survived, but grow ever stronger having been trialled by the fires of global competition.

Major shareholders in listed Malaysian IT firms have to use their influence and advice firms to plough back profits and invest in people development and intellectual property, versus wiping away crucially required funds through unrealistically high dividend pay-outs.

Malaysia cannot wait for the global economy to correct itself and thus improve the nation’s current accounts situation, and therefore the national economy – because a country becomes truly prosperous when it possesses globally in-demand high-value export-ready products and services.

Malaysian IT firms are part of that economic value equation.

To wit, Malaysian IT firms have to move forward towards the TPP by being the global best in their fields; the nation cannot suffer anything less.

Bernard Sia is head of strategy at Mesiniaga Alliances Sdn Bhd. His opinions here do not necessarily reflect the views of Mesiniaga.

Previous Instalments:

Questions from IT grads … and some answers

Making sense of big data

The right to brand

Choke-holding performance with process controls

For more technology news and the latest updates, follow @dnewsasia on Twitter or Like us on Facebook.